32 weeks of predicting markets: 145% return

The competition for Q2 2022 is already back on!

Dear readers,

thank you all for following us, and a special thank you to all regular competition participants for helping us make our prediction tool, the BASON better. Without your diligent predictions, we would not have built the BASON to where it is today.

The Q1 competition is finished, and we announced the winner of our $2000 prize on Friday:

A huge congrats to him, and a shout-out to all in the top 5: you’ve been great this quarter, keep it up!

The Q2 competition is open today (yes, the second quarter is already here, that went fast!). For those familiar with how this works, we invite you to continue with the new competition in Q2. 13 weeks this time, from April 5th to July 1st:

For those new to the competition, click on the button, log in via your Twitter or Gmail account and give us your prediction on 5 indicators and 2 stocks for the next 13 weeks. Persistence pays off in this game, don’t miss out on too many weeks, cause you lose points that way.

Also, this is a mutually beneficial game. You help us test and improve the BASON, we reward you with weekly option strategies on how to cash in on our predictions. And there’s also the $2000 prize we give out to one winner each quarter.

What’s the chance of your predictions being right? Well, it’s in the title isn’t it :) Have a look at our performance thus far:

BASON performance for the past 9 months

For the past 9 months, we’ve been testing how our unique prediction methodology - the BASON (predicted Trump ‘16, Brexit, Biden ‘20, etc) applies to predicting markets. This is the result:

In total, our portfolio is up 18% in 2022.

S&P is down 6%.

Overall, since we started the survey, we are up 145%.

S&P is up only 8%.

Bull market - BASON makes money.

Bear market - BASON makes money.

Powerful.

In monetary terms, $10,000 invested in the BASON since May ‘21 earned $24,518 by now. The same $10,000 invested in S&P500 would have given you $10,835. It outperformed most asset classes during that time.

Again, powerful.

Judging by last year’s performance, when markets were only going up, and the BASON was mostly predicting up weeks, I was afraid we had an upward bias.

Well, not after the turbulence during the first quarter of 2022. This year’s bear run featured episodes of huge volatility. VIX has been on average 26.5 since January. Typically high volatility reduces our accuracy and our profitability, but the BASON remained robust throughout. It delivered continued value over the 10 weeks of testing during the first quarter of 2022. Where most investors lost money - we gained. Not by going short, but by following the methodology.

This is why our correlation with the market, after 32 weeks of testing, is at 0.17 (!)

We were wrong 6 times, only once did the market make money while we lost (4th quadrant). But we were right 26 times (81.25%) - first and second quadrant. 10 times we made money while S&P lost. Really, really good numbers.

How does the #BASON work?

We ask people where they & their friends think the markets will end up at the end of each week - utilizing the wisdom of crowds - while applying network analysis to control for their groupthink bias. Basically it's a wisdom of crowds survey adjusted for bias using network theory.

You might have guessed that the network theory is the crucial ingredient here. We look for clusters of people based on who they’re friends with or who they follow on social media. We look for hetereogenous groups (more diverse in opinions), and give them higher weights compared to more homogenous groups (typical bubbles).

Here’s a 20-min video explaining the methodology in greater detail:

Why does it work?

These two quotes from Shiller and Keynes might explain the logic of why all this makes sense:

“Psychologists have noted that the human species is unique in the advanced development of its theory of mind - that is, humans’ strong tendency to form a model in their own minds of the activities in others’ minds. We are thinking about what others are thinking, about their individual thoughts.”

Robert J. Shiller, 2019, Narrative Economics, Ch. 6

“People deciding which investments to make are basing their decision on observations of what other investors are thinking or what they are about to do with their investments”

John M. Keynes, 1936, The General Theory of Employment, Interest, and Money, Ch. 12

Keynes famously used the beauty contest experiment to prove that point. You get a prize if you pick out the girl who wins the contest. So you vote not on who you think is the best looking, but who you think that other people will pick as the best looking one. And that one happens to win the contest.

This is exactly the same logic we used in elections (Trump, Brexit, Biden) and that we now use in predicting markets. You prime yourself with one choice, and then correct your own bias (update belief) when thinking of others.

It’s pure Bayesian! And it works!

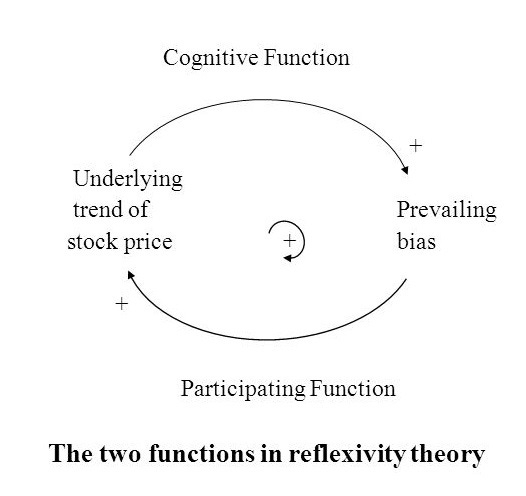

Another hypothesis that can explain BASON’s performance is the theory of reflexivity by Soros. Perma-bulls and perma-bears cancel each other out (homogeneous bubbles). What is left is the “prevailing bias”.

The BASON can be useful in figuring out the weekly signal of the prevailing bias. It does not, in this case, predict the underlying trend (it can, and actually was used to do that as well - e.g. predicting demand recovery during COVID in 2020, but that’s a different topic).

Join the competition to benefit from the BASON!

So when you join our competition keep all this in mind. Put yourself in other peoples’ shoes. Think about where they think the markets will end up.

Thanks for making it this far. If you liked what you saw feel free to subscribe to our newsletter and don’t miss out on our Q2’s competition:

Remember, the key to winning is consistency!

Good luck :)

If it has to do with Sorass: No thanks!