A new upper pin is given for Q4

Paid subscriber analysis

This week gave us a few interesting trading moments, even though it was in general quite sideways. On Monday, the final day of September and Q3, as everyone was waiting for the JPM collar trade to expire (a massive options position from one JPMorgan hedge fund - see more about it here), markets trended lower, and then the final half an hour saw a strong rally as the new collar position was announced. Then Tuesday opened with a significant decline due to Iran’s attack on Israel that kind of set the tone of the entire week - sideways down.

But for the long run, the collar trade is important, so let’s stick to it a bit more.

On Monday it was significant that SPX pushed through a very strong 5,750 level in the final 30 minutes of trading, as this was exactly the pin for the market given by the JPM collar trade that was set three months earlier (in the final day of Q2). In other words, the collar trade (huge, few billion in notional value) had a call sell at the 5,750 level, so the market was pinned to this level, but did not surpass it - not until the collar was closed an hour before the close on Monday.

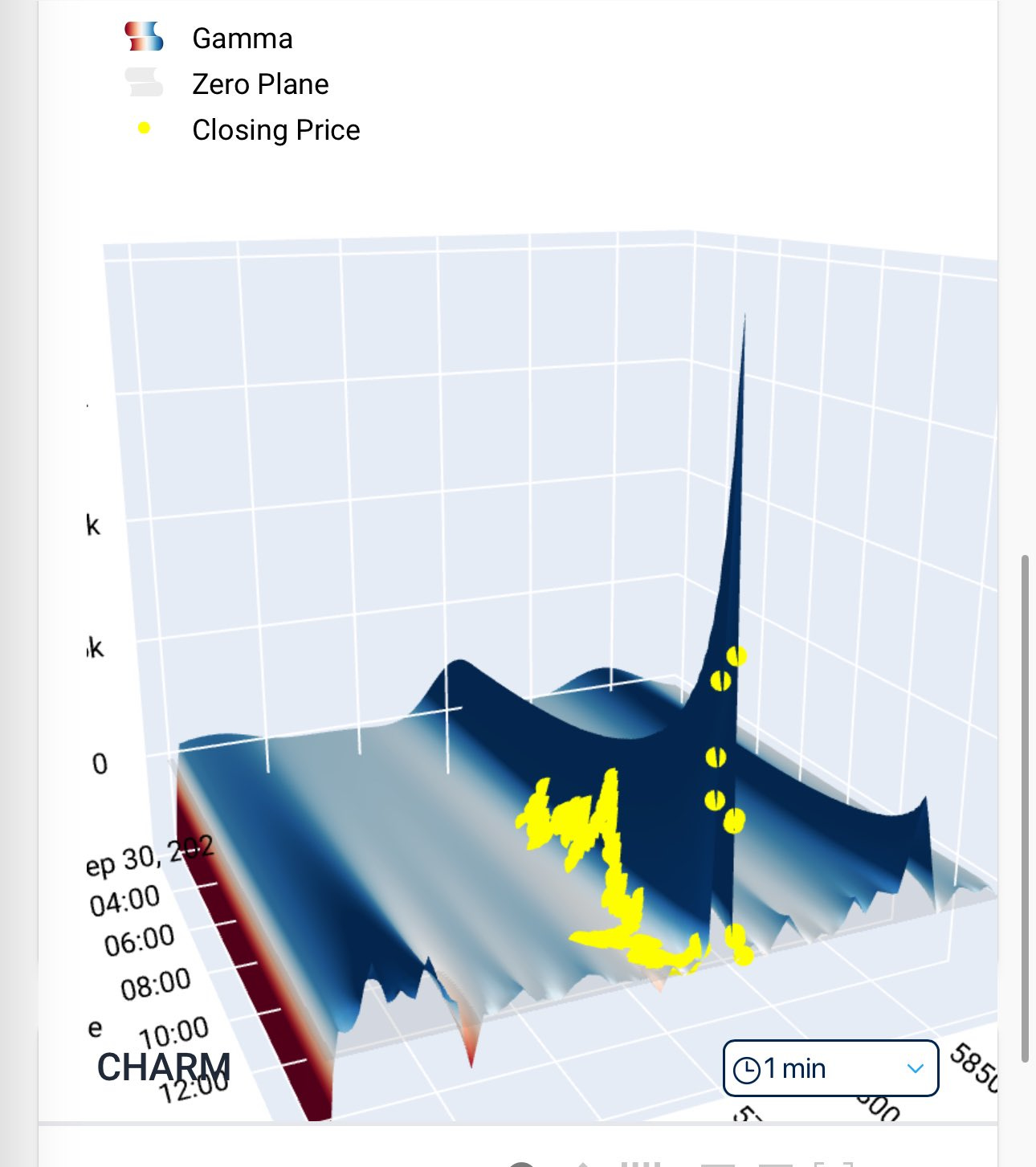

The charts below visualize the price action quite well. As the market was approaching the level - think of it as a major, major supply zone (note the 3D chart below showing extreme gamma around 5,750) - it sold off it, but as soon as the position was closed, it bounced back strongly, from -0.5% to close at 0.4% for the day. This was market makers hedging their books by buying ES (SPX futures) and pushing the whole thing up strongly. In just 30 minutes of trading, a few trillion was pushed around :)

The new collar’s upper value (the call that was sold) is 6,055 (the long put is at 5450, the short put at 4600), so if the market keeps pushing up, expect it to get pinned once again around exactly this upper level by the end of the year. That’s why the SPX 6000 target is quite realistic. If the market continues to push up gradually over the next two months.

Which, according to our estimates, it most likely will.

Especially after the latest job report that came out on Friday. The US economy added more than 250,000 jobs in September, much more than expected, as the unemployment rate fell down back to 4.1%. This reinforces the soft landing narrative and the knee-jerk reaction on Friday was a strong buy. Afterwards we saw some selling and sideways action - most likely as probabilities of a 50bps cut for the next Fed meeting got revised down, but by the end of the day, it rallied back to - 5751. How convenient, eh?