Ahead of earnings and FOMC

Paid subscriber analysis

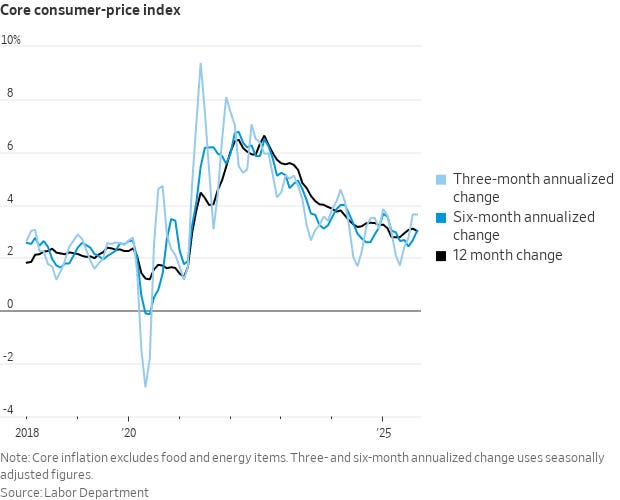

After several weeks of no data from the government due to the still ongoing shutdown (I hope it doesn’t start affecting air traffic!), we got a highly anticipated CPI print yesterday and it came in lower than expected.

Core prices rose 0.23% in September and headline went up 0.31% (expectation was 0.4%), which means that both headline and core CPI are now at 3% (less than expected).

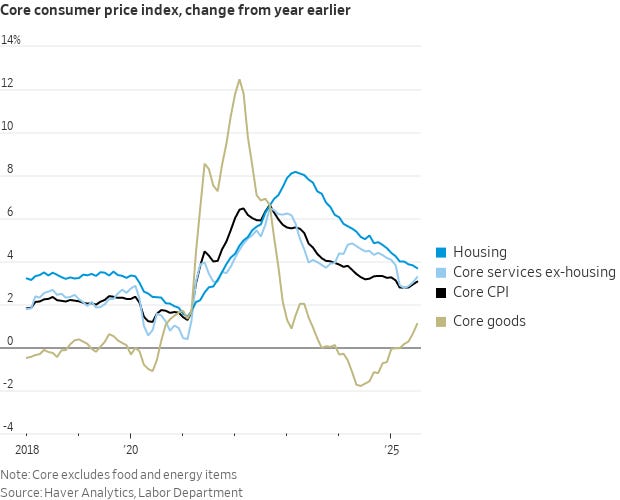

In terms of decomposition, housing and all core services are on a steady declining trend, which is good, but core goods shot up a bit. This could be due to the impact of tariffs, however not nearly as feared. In other words, as all other prices are going down steadily, even the tariff impact did not push inflation up significantly.

The knee-jerk reaction to this was obviously bullish. In anticipation of the FOMC meeting next week the pricing in of 2 cuts is still there, and 2026 rate expectations are still down at 3%.

On a technical level this move was exactly what was needed to push us back into the ATH trend (see chart below) - which we were struggling to pick up over the past 10 days (ever since the Trump China tweet broke the trend on Oct 10th). Bullish🐂.

On that front, Trump is meeting Xi in person before the end of month which is a good sign (Trump typically doesn’t do these things in person unless he can announce he made a great deal). Also bullish🐂. But still careful, as with the two of them, anything can happen.

As we are now back into that bullish trend, I will take the opportunity for some shameless self-promotion.

Last week I mentioned that markets went into extreme fear and that this was typically a good sign to buy. Especially since we saw vol declining - the VIX at 28 last week was clearly unsustainable and a sign of a one-off panic. The current VIX going back to 14/15 (closing yesterday at 16) is much more in line with the current market regime and narrative.

In the paid section last week I mentioned two good trade ideas - long dated SPY or QQQ calls (which both printed this week), and short the VXX or UVXY - which was another good trade this week. If you’re still in the long calls, keep ‘em. November and December rallies are likely coming (more on this in future posts). This was from last week:

Two good trades are possible given this medium term outlook:

(1) long-dated out-the-money SPY (or QQQ) calls (e.g. Mar expiry) which could deliver decent returns during the end-of-year push. We kept talking about these in September, waiting for an October resolution…

(2) shorting structured VIX-related ETFs like VXX and UVXY which have a natural tendency to go down over time due to the futures contango (spot VIX needs to climb significantly above futures VIX and remain elevated for these products to justify high pricing), is always a good idea after spikes like these…

More on the continuation of these trades below, in the paid section.