All-time highs, yes, but be wary of OPEX 👀

Results: BASON up for the week again.

Quick summary:

The 2024 Q1 competition is up & running - click here.

A much more contained and quite boring week, as expected. No big news, markets kept pushing up, continuing the momentum from the week before. Tech is still dominating.

We positioned up on Wed, and captured most of our gains by Friday (after a flat Thu). It ended close to 1.8% for the week. Not a bad follow-up to the +3% post-FOMC week.

CPI inflation came out today, and it’s higher than expected (3.1.% act vs 2.9% exp). In addition to that we have a bunch of manufacturing data on Thursday, and the PPI + consumer sentiment on Friday. Fed speakers throughout the week, and don’t forget, it’s still earning season.

For paid subscribers, a brief interpretation of the CPI report and the upcoming February OPEX (this Friday). An important 2-week period is ahead. We’ll see where it takes us.

The competition

It’s beginning to stabilize up top. The more bullish users seem to be getting their just rewards, kudos! Happy to see precision still stellar for SPX, but very interesting to see it on average even better for DJI and VIX. I guess all that vol compression is helping.

Keep it up everybody! And remember, consistency is key to staying in the top. And good predictions, obviously.

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

After that strong but surprising tech-driven post-FOMC rally, there was really only one way for the markets to go - up. And they have. Markets kept making advances on Mon, Wed, and Fri. The price action was simple. Sustained up moves, followed by some consolidations in between. Still no pullback, and each week we keep pushing into all-time highs.

The BASON captured part of Wed and the Fri move up, pocketing a decent 1.77% for the week. Yeah, it was a boring week, but we’re not complaining!

This week should see much more action (and potentially volatility). First, the CPI today came in higher than expected, at 3.1% versus 2.9% exp. However, the annualized CPI was lower than December (when it was at 3.4%). Still, what matters is the month-on-month change which did not go down, but stayed the same at 0.3%.

Core CPI (all items less food an energy) also stayed stubbornly high, at 3.9% (expectations were 3.7%). The same annualized level as in December. Overall, not a good sign for anyone hoping for cuts in March (or even May?).

In addition to CPI, we get manufacturing indices, retail sales, and jobless claims on Thursday, and we get the PPI inflation and consumer sentiment on Friday.

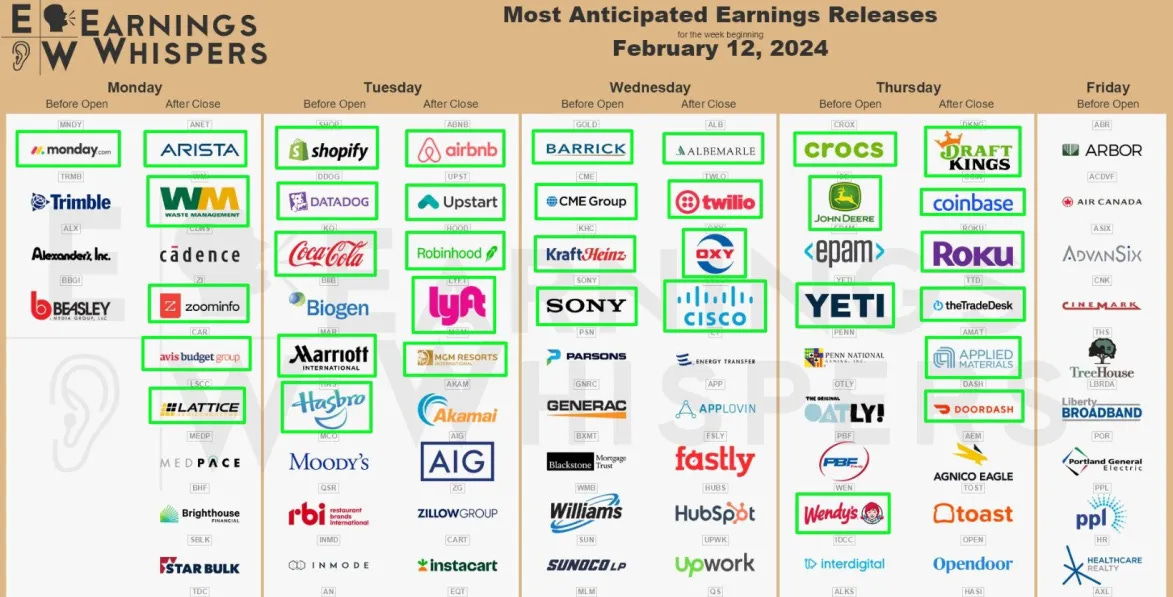

Finally, the earnings are still coming up. Not the companies that will drive the market, but remember, a high Q4 GDP growth makes earnings beats more likely than not.

Enjoy the week!

Update: post-CPI and OPEX guidance

There was no blog on Saturday (I’m preparing a longer piece for this weekend), but I wanted to give you an update on interpreting today’s CPI numbers and discuss the probabilities of a sell-off coming into another options-driven “window of weakness” over the next two weeks.