On today’s agenda:

What to expect in June and rest of summer?

Data dependency: CPI, unemployment, FOMC

Option flows: step skew, buy protection?

Ending Q2 on a high?

As we end May with the bounce-back from the April correction now fully complete, it’s worth reminding ourselves of what we wrote in our analysis on May 4th, a few days after the May FOMC meeting:

“…in the equity market we can expect more sharp sell-offs followed by strong bounce-back rallies - a jumpy market that might as well be gradually trending up, before some significant correction like this April. There is no clear direction like after July 31s last year (when the medium-term signal was a clear sell), or after November 1st last year (when the medium-term signal was a clear buy). This is not particularly good for our fund, as we strive on strong directional moves, and hate jumpy markets, but that just means we won’t be amplifying our risk exposure for the time being.”

This was spot on. The market was “gradually trending up”, with a few volatility spikes every now and then - you can best see this in the VIX chart for May (VIX is inversely correlated to the SPX, so its gradual decline means that vol is compressed while markets go up gradually, while the few up ticks signify sell-offs, followed by buying the dip as vol keeps going down and markets up):

May was a classic example of volatility compression (VIX went down to 11.7 at its low point earlier last week), but with a few spikes that for all purpose made our life more difficult.

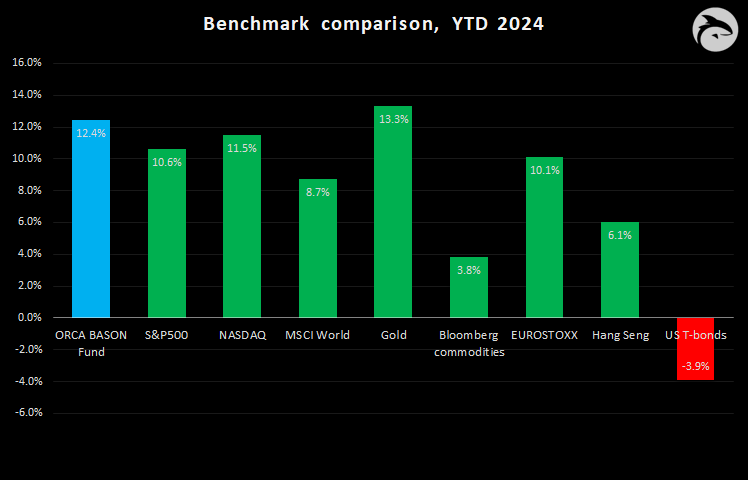

ORCA’s BASON Fund underperformed in May - our first negative month after 9 consecutive positive ones - but we are still up 12.4% YTD, doing better than almost all our benchmarks (gold being the only exception):

After a stellar Q1, we’re flat in Q2. No big deal for us, as the bulk of our return comes from a few stellar weeks every now and then. Statistically, we still have quite a few of those ahead of us this year.

In June and over the summer, we think a similar pattern will continue on equity markets. Our assessment from May 4th still holds. I’d love to have more exciting news for you coming into the final month of Q2, but it’s looking like more of the same.

Here’s the blueprint that helps us navigate this period: