Data is in. Your move FOMC.

Paid subscriber analysis

This week we got more of the same, in line with what we have been repeating for over a month now: sideways-up markets (on Mon, Tue, Fri, flat on Thu) with a Wednesday break-out rally. Friday’s jobs report was the big surprise, but despite the initial negative reaction, markets still traded sideways for the rest of the day. Why the negative reaction though?

Well, because the US economy added 272,000 jobs in May (expectation was 180,000), and the unemployment rate was only slightly higher, at 4% (up from 3.9% last month). This was a very hot number and, after a brief slowdown in April, it confirms the higher for longer, i.e. no landing narrative: the economy is doing great (check out the GDPNow estimate from below), the labor market is robust, and inflation is sticky. Really no point in cutting rates into a hot economy, is there?

One thing that I’ve noticed is that people keep talking about the reported rise in part-time jobs vs full-time jobs…

“Full-time workers declined by 625,000, while part-time workers increased by 286,000.”

…suggesting this is not a good outlook for the economy. I disagree for one simple reason: part-time work is the new normal post-COVID. Working several jobs online enables people more freedom and bigger earnings. Usually, having more part-time jobs would signal a recessionary vibe, as firms have to cut workers or shift them to part-time employment, thus lowering their overhead costs.

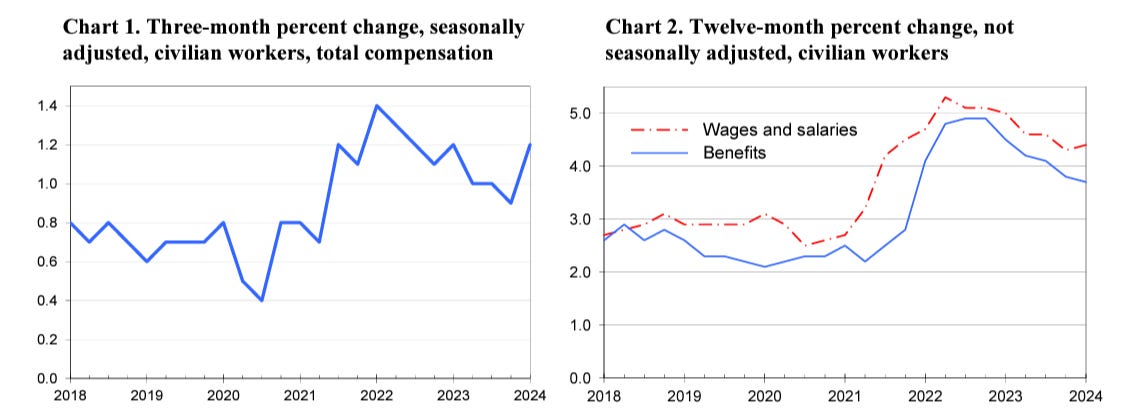

We have a complete opposite today: workers are in high demand, which creates additional push for higher salaries (still growing at 4-5%), and people chose to do more part time jobs as free agents.

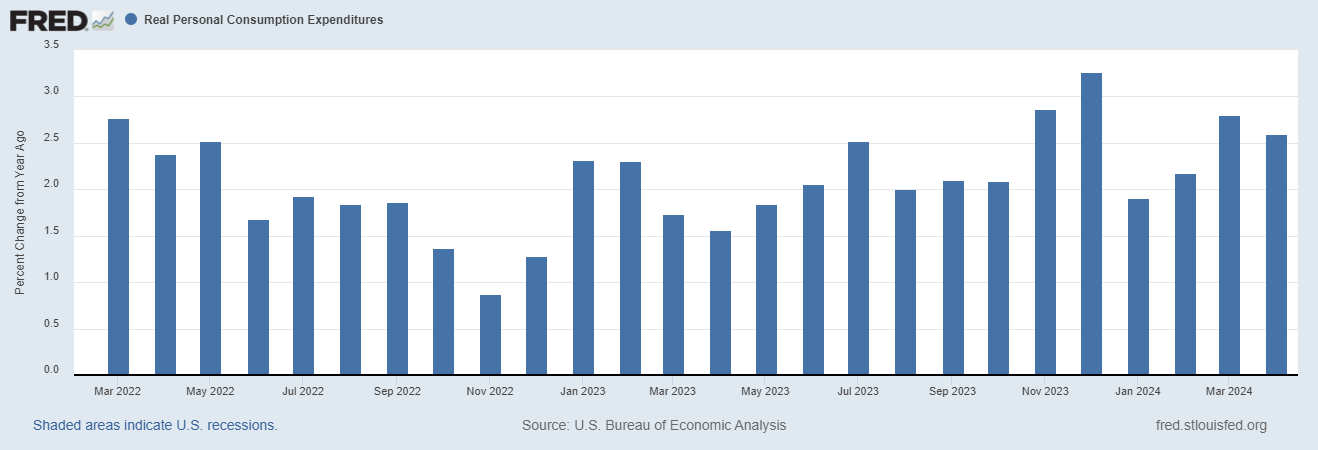

The best proof that the increase in part-time jobs is not recessionary are consumption numbers. If people lost job stability and ended up with lower salaries, we would notice the impact in consumption data. But personal expenditures are still high. They’ve stabilized post-COVID and aren’t showing any signs of decline. Salaries are higher, spending is high. Therefore, be wary when interpreting these numbers. As long as people are doing better, who cares how they’re classified?

FOMC dot-plot expectations

Next week we are probably going to get some medium term clarity. On the same day, Wednesday June 12th, we get the new CPI number (8:30am) and the FOMC meeting (2pm). It’s not just any FOMC meeting - we get an updated Fed dot-plot chart and their expectations on rate cuts.

Last time we got the dot-plot, back in March, expectations were unchanged from December - when the Fed added fuel to the end-of-year rally. The expectations were of three interest rate cuts for 2024. The markets started pricing in 6 cuts, which I immediately declared unrealistic. Obviously it was unrealistic, as it’s June and no cuts have been made.

In March, I personally expected the Fed to curb these expectations, particularly when we were getting data of inflation being stickier than expected, and economic growth in Q1 being high. But the Fed did not budge. They doubled down, the presser was dovish, and markets shot up once more. Rate cut expectations did get adjusted though, and markets have since lowered them even further at the sign of easing in the labor market and lower expected economic growth. But even that was only temporary it seems, as GDPNow estimate for Q2 was back over 3% yesterday.

And rate cut expectations again got repriced down to only one rate cut, where it’s still basically 50-50 on whether the Fed cuts in September, or does it even cut at all before the end of the year:

With this in mind, what can we expect this time from the Fed?

Well, for sure, no change to interest rates in June. But as far as the dot-plot adjustment of future rate cuts, there are three potential scenarios: