Earnings and macro data week

4 Mag7 earnings, PCE inflation, Q1 GDP, and unemployment - all this week

Quick summary:

The fifth week of the Q2 competition is up & running - click here to join the action.

Markets swung from a 3% drop to a 4% gain last week after Trump eased concerns over tariffs and Fed leadership. We also got a technical breakout above 5,450 and a rare Zweig Breadth Thrust suggesting renewed bullish momentum, but gains were led by a handful of big stocks.

Big earnings and economic data week. First we get Q1 GDP and the PCE index (Fed’s inflation tracker) coming up tomorrow morning, and then after close we get MSFT and META earnings, and on Thu after close we get AMZN and AAPL. Then, as if this wasn’t enough, on Fri morning we get the April unemployment rate and wage data. Should be a fun packed week!

We will review all of these in the Saturday paid section, with an overview of how this might impact the FOMC that’s coming up the week after (May 7th). Plus the usual FOMC scenarios. Don’t miss it!

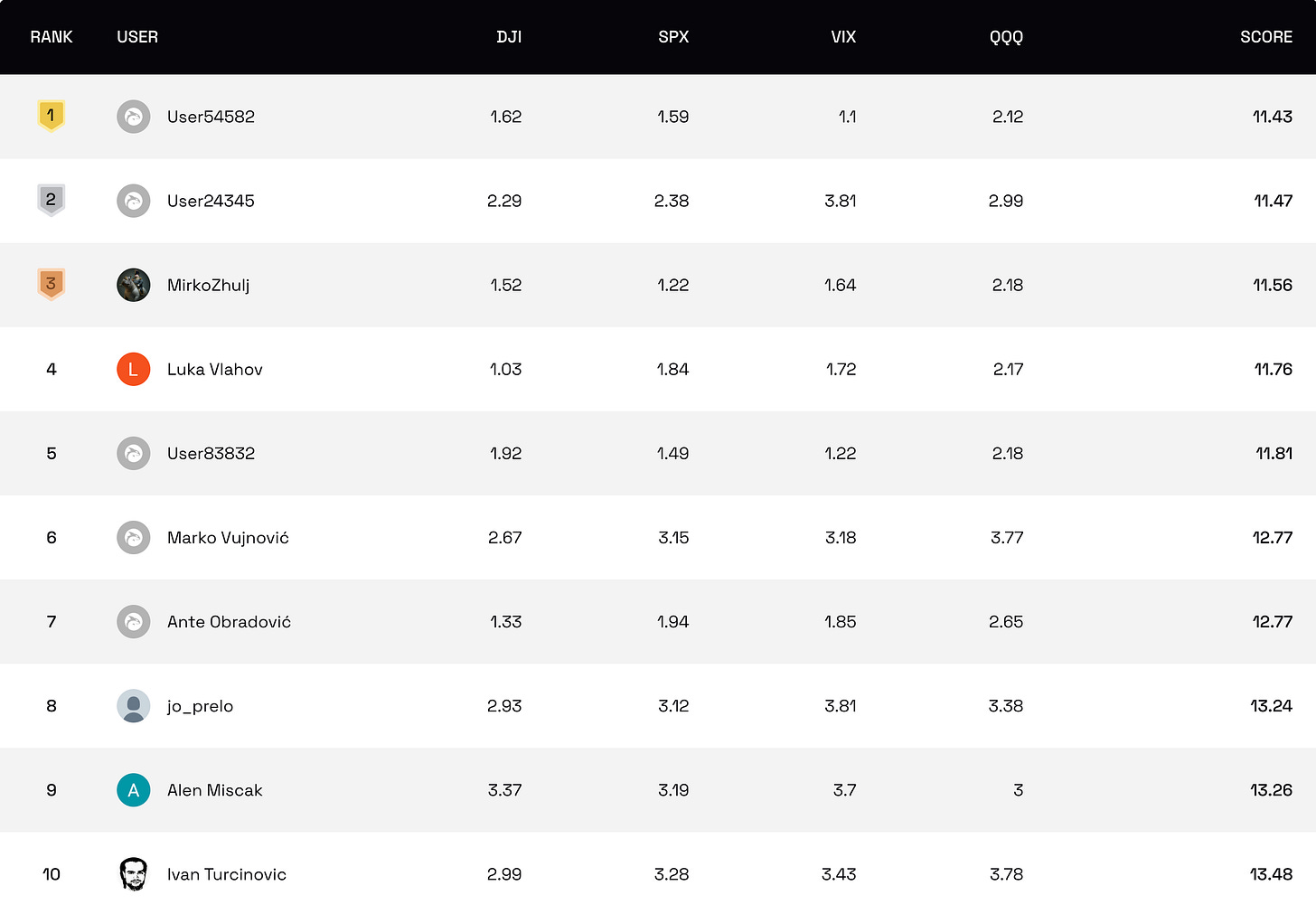

The competition

Last week brought some major swings, both in the markets and on the leaderboard. A few big moves helped shake up the top spots, while much of the field is still finding its footing. With seven weeks left in Q2 and key events like NVDA earnings ahead, this is the perfect time to stay sharp and look for opportunities to break out—or secure your position as we move deeper into the quarter.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

The week opened with a 3% sell-off on Monday as trade talk anxiety and speculation about the Fed rattled everyone. But things quickly reversed after Trump said he had no plans to replace Powell and hinted at making a deal with China instead of raising tariffs. That was enough to send stocks surging from -3% to +4% by Friday, finally breaking through stubborn technical levels—including the much-watched 5,450 mark and even triggering the rare Zweig Breadth Thrust, which often signals the start of a bull run.

Still, it’s not all smooth sailing. The April sell-off showed that bonds and the dollar weren’t the safe havens they used to be—foreign money is leaving US assets altogether, thanks to inflation worries and shifting trade policy. Even though names like Tesla saw earnings disappoint, stocks like TSLA and AAPL soared on hopes for tariff relief.

But most of the move came from just a few of the biggest stocks, not the whole market. With more earnings and the Fed coming up, it’s a good time to stay sharp. This could be the start of something bigger. We have seen it yesterday, where the intraday sell-off was reversed sharply in the final hours of trading, just as we got close to what now seems like decent support. So far, it’s holding.

This week brings a packed schedule of economic data, earnings, and ongoing Fed speculation. We’ll get fresh PCE inflation and Q1 GDP data before open on Wednesday, and then towards the end of the day, Commerce Secretary Lutnick is delivering his updates on trade talks. But most eyes will still be on Mag7 earnings, coming up from MSFT, META, AMZN and AAPL, and many others:

Finally, on Friday, we get the April unemployment rate and all other jobs and wages data. If tariffs made an impact, we should see it in this week’s macro data, first and foremost, and then obviously on earnings data.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.

According to predictions, the data published this week will not be so positive - more and better will probably be the data from MAG7 companies - I assume that they will publish positive results ... and PCE, GDP, unemployment data will certainly "slow down" the growth of stocks this week ... it will be a very, very difficult week - hard fun - it's good that I go away from home for 5 days and disconnect from everything - and leave everything to Vuk and the guys .... hahaha ... thank you for the good results !!