The first out of the two important, high vol weeks has ended. We got 5 Mag7 earnings this week, all of which actually beat estimates and yet the performance of the stocks was somewhat subdued (except for AMZN on Fri and GOOGL on Wed). That’s what happens during windows of weakness, as we have pointed out two weeks ago. The usual supporting flows are just not there, so one needs to be careful as dips are more likely. As are bounce-back rallies, like the one from Friday.

On the macro front, GDP growth is still strong (came in at 2.8%), inflation still low, and labor markets still hot (total jobs did went down on the account of the hurricane, but unemployment remained at a steady 4.1%). Another set of data points confirming a soft landing narrative, still not recessionary.

Now that the preludes have passed, on to the main events: elections on Tuesday, and FOMC on Thursday.

Today we talk about a market playbook for each of these.

Elections: what does a Trump or Harris victory mean for markets?

NOTE: Oraclum is NOT doing election predictions this year. We made our name making really accurate Brexit (2016), Trump (2016), and Biden (2020) predictions in the past, but we are sitting this cycle out for obvious reasons: we are fully focused on our fund.

However, I still do posses a lot of intangible knowledge about the US political system and the mistakes its pollsters make. After all, this used to be our bread and butter not that long ago. So before examining the market reaction, a few words on the state of the race.

The polls are neck and neck. Trump was the clear favorite over Biden (the debate and the assassination attempt all but sealed his victory), but ever since Harris came in, the tides have changed. I talked about a very possible Harris polling bump as soon as she became a candidate. This is a normal reaction to someone new just entering a race. People get excited, want to find out more about her, and she gets a bump in the polls. But after a while the bump evens out and we get a much more uncertain race. This is where we are now.

However, as you may know, polls got it wrong over the past few cycles. To be fair polls aren’t meant to give us predictions. They are only snapshots of voter attitudes over time. The trend is much more important than the latest headline figures. Their biggest issue is the inability to get a representative sample anymore (look up non-response bias), so they have to use models which tend to be wrong more often (models cannot be a substitute for good ol’ statistics). In other words, the polling errors are no longer around the typical 3%. More likely 7-8%. Which doesn’t really help much, but you should take this into account when observing their data.

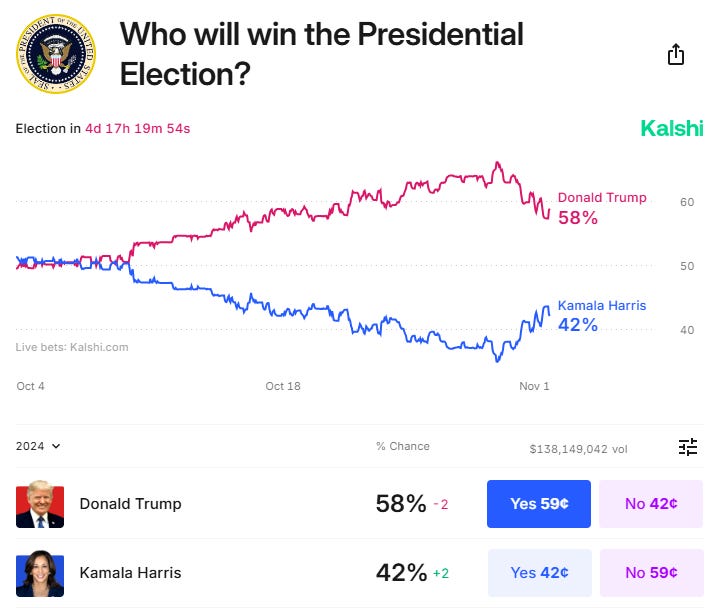

Slightly better than polls and polling aggregators are betting markets. And the biggest one, Kalshi had Trump in front by some margin during October (probability of 65 to 35 was the biggest margin). Although, as of the last week, Harris is picking up in here as well.

It’s a coin toss, alright, and the signal is really really hard to get this time. Makes me even more sorry we’re not doing it this year, given the superiority of our approach in not even needing a representative sample to get these things right. Just like with our market predictions, as all of you are aware of.

Do keep in mind that polls underestimated Trump twice before. This is probably why the markets (both betting markets and bond and equity traders) are pricing in his victory with greater certainty.

What are the markets expecting?

As we mentioned last time, in the past two weeks markets have been making the “Trump trade”: bonds selling off (due to higher nominal growth and inflation expectations), equities rallying, and even the USD gaining strength (see below).

So what would happen in case of a Trump victory versus a Harris victory?

Let’s examine 4 scenarios (summary in table below):

Trump wins, Reps take House and Senate (“Red Sweep”). If Trump wins, the coattail effect is likely to push Reps down the ballot to make crucial victories. This would allow the Trump administration to cut taxes heavily, restrict immigration, and introduce tariffs on foreign imports, thus making foreign goods more expensive. The consensus is that this leads to higher inflation pressures but also higher nominal GDP growth. This is bad news for bonds, and a decent scenario for equities which should rally strongly into year end and continue into 2025.

What will the Fed do? Probably reduce the number of cuts in 2025, and would outline a more hawkish SEP in December. This would have an initial negative impact on markets, but would not be sustained.

In terms of foreign policy, bearish on Ukraine, bullish on Israel, bearish on Taiwan (and the semiconductors).Trump wins, Dems take House and/or Senate (Split Congress, Trump presidency). This scenario would limit Trump’s policy arsenal and he would probably have issues in reducing taxes, although would be able to implement immigration and tariff policies. This could limit the equity market effect, but would still be bad for bonds. If inflation picks up due to tariffs, the Fed will once again be forced to pause cuts and be more hawkish. Same foreign policy risks, so overall not the best scenario for markets.

Harris wins, Dems take House and Senate (“Blue Sweep”). This scenario means continuation of fiscal policy and immigration policy, but also an increase in corporate taxes and capital gains taxes. A combination of high taxes and higher government spending is not a good growth stimulating policy. Alongside greater regulation it would lower productivity, and lower economic growth. Recession worries could resurface under this scenario which would be bad for equities, but not as bad for bonds. Another negative impact could be on oil, as prices would go up if the administration discourages fracking.

The FED would have to be more aggressive in this scenario and would probably increase the magnitude or the velocity of rate cuts. Initially it could be good for equities, but then the question is again back to - is it due to the recession, or is it due to a soft landing? The former, most likely.

In terms of foreign policy, probably the reverse of Trump; bullish on Ukraine, bearish on Israel (due to internal party pressures), and neutral on Taiwan (not sure how they would react to a more militarist China).Harris wins, Reps take House and Senate (Split Congress, Harris presidency). Harris would be limited in policy, and most likely would not be able to pass her tax hikes. This would be bullish for equities, as we would see a continuation of the current status quo. Immigration will be a contested issue, a ban of fracking will not go through, but fiscal stimuli most likely will.

Probably the most benign outcome for markets - and for the Fed. The Fed would keep the same policy stance and would be adamant in delivering a gradual soft landing, sticking to their economic projections plan in 2025 (rates down to 3.5%).

To sum up (see table), probably the best scenarios for equities would either be a Red Sweep or a Harris win with a Split Congress. For bonds, a Harris win, but for different reasons in the two scenarios (in the first due to a recession scare, in the second gradual inflation reduction and easy Fed policy).

However, do beware of the day-after reaction. Remember, vol is expensive coming into the event, and as the event passes, there is likely to be an unclench of volatility, which can often result in a strong post-event rally (VIX down, SPX up). The scenarios discussed above are more long-term outcomes (end of year and 2025 in particular). The day-after effect could in each case be a rally. Doesn’t mean it will, cause we have the FOMC coming up the next day, but the probability is higher.