Fed the tie breaker

Two more weeks for the competition, don't miss it!

Quick summary:

Two more weeks left before the Q4 competition ends! - click here to join the action.

Market stayed choppy last week as expectations firmed for a 25bps cut, pushing the policy path toward 3.5% in 2025 while the PCE report at 2.8% strengthened the case for Wednesday’s decision.

Bonds and crypto signaled caution with the 10Y rising to 4.14%, the 2Y at 3.56%, and BTC turning negative YTD at minus 4%, adding uncertainty ahead of the dot plot.

This week centers on the Fed, with markets looking for another cut into the 3.5 to 3.75% range and Powell’s guidance on 2026 likely setting the tone for whether momentum builds into year end or the market stays in chop.

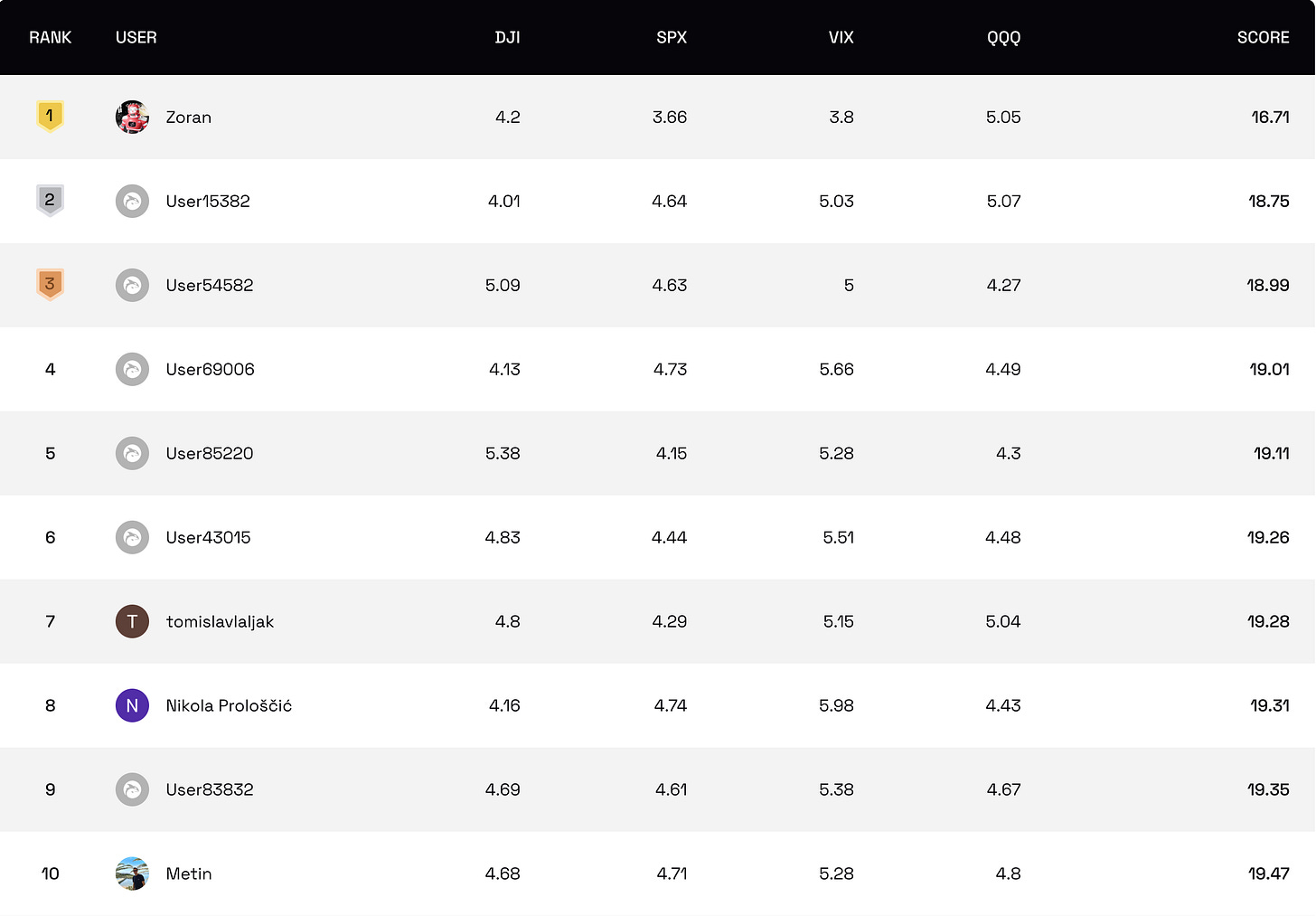

The competition

With the Fed front and center this week and momentum waiting on the dot plot, the leaderboard is tight enough that even small gains can shift the rankings.

Plenty can happen in two weeks. Play it well and goodluck!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Market stayed in pure chop as everything pointed toward the final FOMC meeting on Wednesday. With another 25bps cut fully priced in, the path points to a 3.5% rate in 2025. The bigger story came from reports that Trump is likely choosing Kevin Hassett as the next Fed Chair, a particularly dovish pick whose odds jumped on Kalshi. Hassett would almost certainly support deeper cuts next year, potentially 100bps or more, which adds to the broader bullish backdrop for 2026. The PCE report supported that view with a 2.8% reading for both headline and core, below the Fed’s September projections of 3% headline and 3.1% core. With inflation cooling and GDP steady at 3.8% for Q2 and 3.5% on GDPNow for Q3, the setup for Wednesday’s cut remains strong.

The only real warnings came from bonds and crypto. Yields moved higher with the 10Y at 4.14% and the 2Y at 3.56% while Bitcoin sold off and slipped to minus 4% year to date. BTC has led tech moves several times this year, so its weekend action is worth watching. Everything now rests on the dot plot. A shift toward lower inflation, higher growth, and lower 2026 rates opens the door for a rally that breaks above 685 on SPY and pushes toward 690 and 700. A more hawkish tone or further crypto weakness brings the lower levels back into play at 678 then 670 then 660 then 650. With no major moves recently, the FOMC will decide whether these levels hold or break.

This week is entirely centered on the Fed. Markets expect another cut that brings the policy rate into the 3.5 to 3.75% range, and the key will be how Powell frames the outlook, especially for 2026. With some data still delayed after the shutdown, the committee will be making its decision without a full set of labor numbers, which adds some uncertainty ahead of Wednesday’s press conference. We will also see trade deficit data, jobless claims, and the federal budget update, though all remain secondary. Powell’s tone and the new dot plot will determine whether momentum builds into year end or the market slides back into the same choppy pattern.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.