Quick summary:

New survey is up & running - click here.

This is week 10, our final week in Q4 (back in mid January)

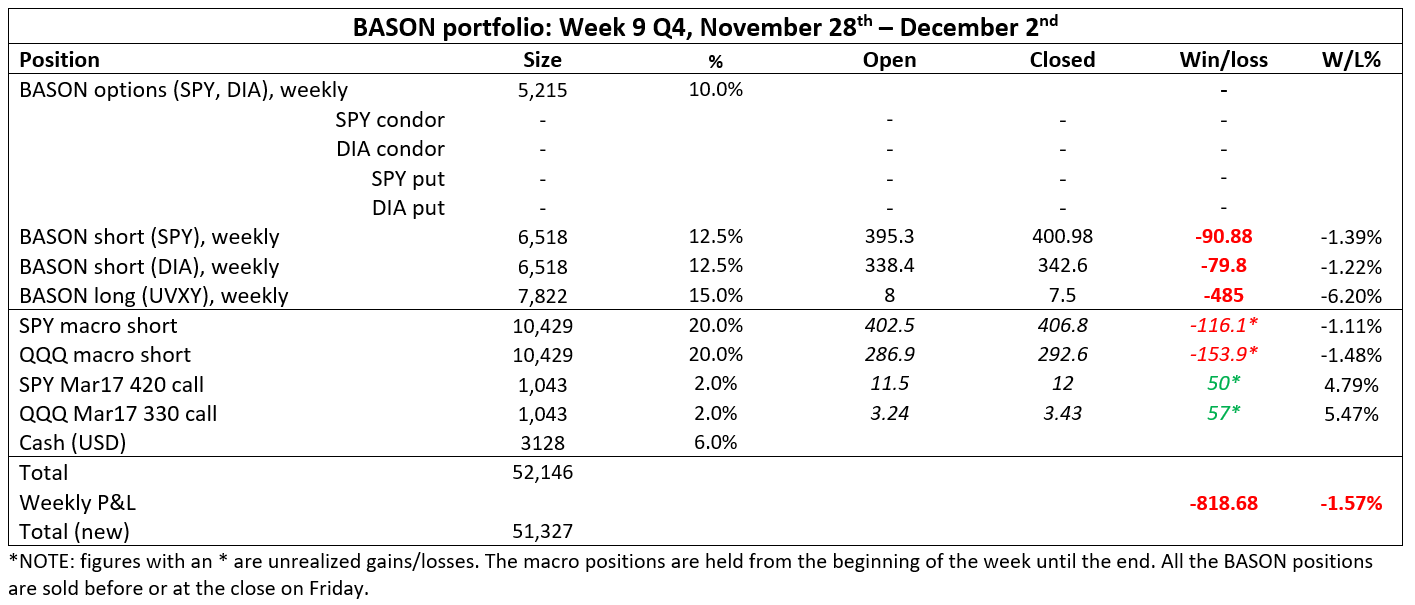

Bad performance last week, options weren’t even activated, other positions were closed already on Wednesday

Portfolio was down 1.5% last week, up 156% overall

The Q4 competition is now open for its tenth and final week for this year. Thank you all so much for playing with us throughout the year. We will have an exciting announcement for you soon.

But for now, focus on the final week :) Competition is fierce. Just check out the margins separating some in the top 12. Very impressive everyone! Best of luck this week!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance and portfolio update

Last week was action packed - Powell’s speech on Wednesday, the core PCE numbers coming out on Thursday, and the jobs report on Friday. Powell’s speech on Wed - suggesting a 50bps hike next meeting - first sent the markets off to a rally frenzy (SPX up over 150 pts that day). The PCE numbers coming in lower than expected should have kept the frenzy going, but it didn’t. And then, a better than expected jobs report sent markets down on Friday (with the sell-off continuing on Monday), in the classic “good news is bad news” scenario, as investors are now expecting the Fed to continue tightening.

For us, the Wed rally was already bad news, as it forced us to close all of our opened long-shorts. Not only that, it didn’t even trigger the option positions (we warned our users not to take any positions until during or after Powell’s speech). By the time the rally started, the prices went so far away from our targets that the puts never even filled. Luckily for us.

This, for example, is a case where I would have typically bought calls to seize the opportunity, but I didn’t as that would imply going against our predictions. Doesn’t really make sense to do stuff like this during our ongoing test phase.

So losses had to be incurred, no big deal. The biggest loss came from the UVXY longs, but they were also closed on Wednesday. The only gains came from the macro hedges. On Wed these gains were quite high, enabling us to stay around zero for the week. But by Fri, they also lost in value and gave us only limited gains.

The overall weekly performance is thus a -1.57% loss, and the total gain is +156% overall. Still in the position of preserving the annual gains thus far, in a market still scrambling to find direction. This week will probably be no different, any gains or losses are likely to remain small, but we will definitely finish the year on a big high.

For next time we will prepare a detailed overview of our performance this quarter and discuss ongoing possibilities with this method.

So stick around, continue playing, and thanks for supporting us!

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!