FOMC: a cut, but at what cost?

Paid subscriber analysis

As expected and fully priced in, the Fed cut rates by 25bps, down to 4%.

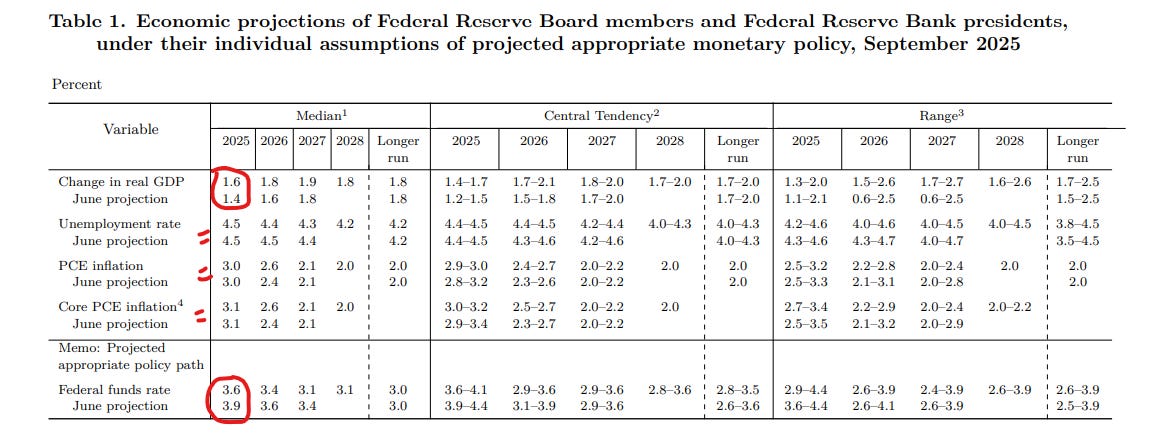

Furthermore, in the Summary of Economic Projections (SEP) it signaled that it expected 3 rate cuts before the end of the year - this being the first one, so 50bps more expected to come in over the next two meetings (Oct and Dec), when the rates should be down to 3.5%.

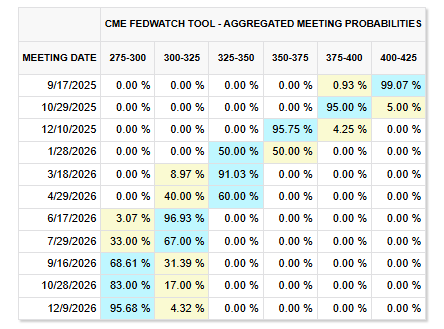

This is also in line with market expectations over the past few weeks, however the probabilities have now adjusted quickly, and we have a 95% probability of one cut in each of the two following meetings:

So, the golden question - is this bullish or bearish?

Under normal circumstances, this SEP and the dot-plot would both be a bullish sign, or at least not as bearish as feared because the Fed is cutting as expected, and sees inflation and unemployment unchanged from their June projections.

However, Powell’s speech sent a very different tone. He talked about a slowdown in both supply and demand for workers being very unusual and suggested that downside risks to unemployment went up. He also said that he can no longer say the labor market is solid, and that risks to inflation are tilted to the upside. This is a very stagflationary expectation from the Fed, and quite bearish for all assets. Which is why both equities and bonds went down during the speech. As did tech and crypto, and surprisingly even gold.