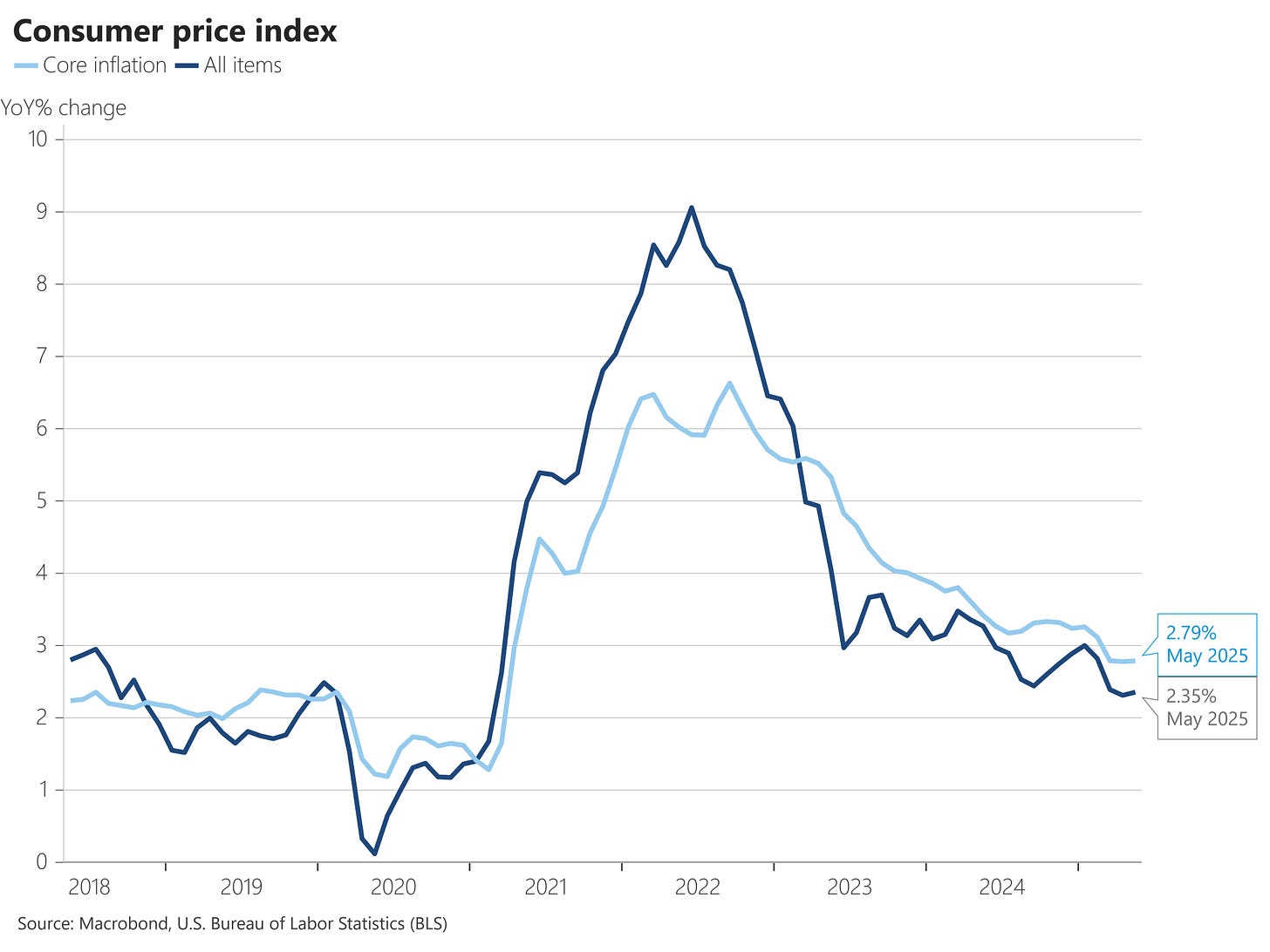

We got two inflation prints this week, and once again they came in lower than expected, triggering a short-term bullish reaction on both Wed and Thu. CPI inflation came in at 2.35%, slightly higher than April, but below the expected 2.5%. Similar to core inflation. This was mostly driven by the decline in car and apparel prices, which many thought could show signs of tariff impact in May.

Other reasons for seeing tame inflation right now is clearly due to lower energy prices, plus firms still refraining from passing on the price increases to the end consumer. Stocking up on inventory during Q1 could have allowed firms to maintain a longer runway to adapt to price increases. This is why it is still important to monitor price levels to figure out when and how we might see the tariff impact. Provided of course that we get them - rest assured, we will. Trump did it in his first term, he will do it again. The 90-day moratorium is coming up soon.

Therefore, in spite of at first glance good inflation numbers, the macro flows were not as favorable this week, and continued to push markets down. This was particularly visible on Friday, with the heavy reaction over Israel’s attack on Iran, which pushed oil prices up 8%, and brought gold back close to its all-time-high. Equities were down across the board, and bond yields shot up again. It was the panic trade overnight, which had its typical intraday reversal and then a flush towards the end, more as a sign of continued macro worries rather than another reaction to the war.

In terms of the Israel-Iran conflict, things most likely will escalate over the weekend and into next week, but I doubt there will be a bigger impact on US assets than what we have seen on Friday. Oil prices, yes, certainly, but already next week we get the FOMC, the VIX expiration on Wednesday (both on the same day), and quarterly options expiration on Friday. This is much more likely to drive US assets over the coming week.

FOMC expectations

Expectations on the Fed rate cuts are unchanged (see below). Still no cuts expected on next week’s FOMC, but now all attention turns to the dot-plot, and what the Fed is expecting inflation, the labor market and the economy to be over the next 12 months. And of course their guidance on interest rates.

Today we examine some possible scenarios for the dot-plot projections on interest rates: dovish, neutral, and hawkish. How many cuts are getting priced in before end of year (thus far only two), and what might be reactions to the Fed’s projections on the economy?

What we can be somewhat certain of is that the Fed will not cut rates next week, despite all the pressure coming from the administration.