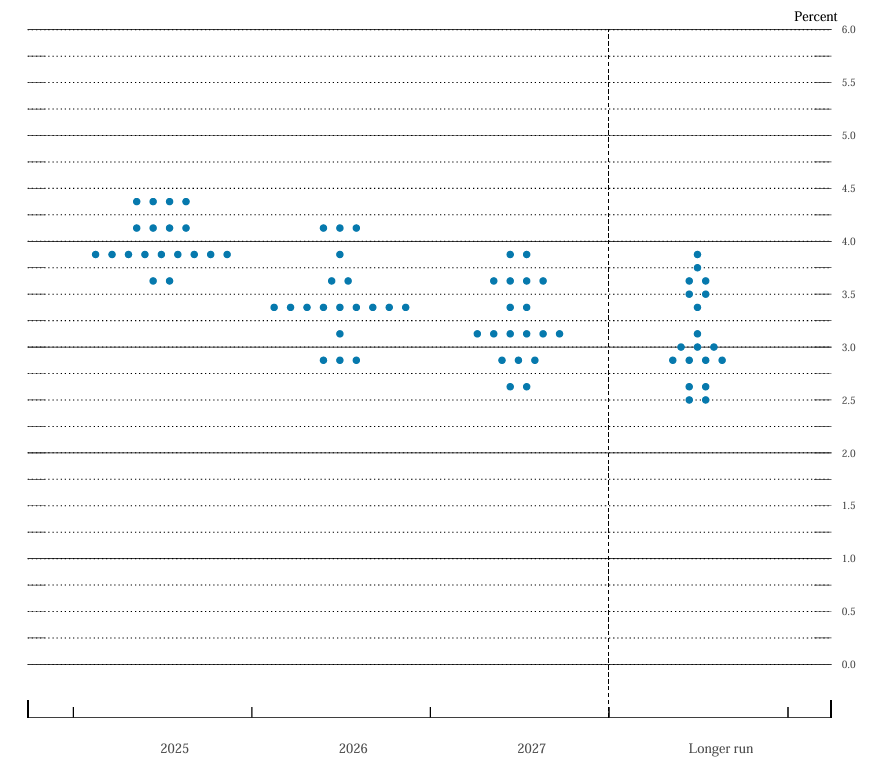

A big nothing-burger from the Fed today, as expected. No change in interest rates, and no change in interest rate projections for 2025 and beyond.

Still only two rate cuts for 2025, and a 3% rate anchoring in the long run.

The only interesting changes were (1) the reduction of the GDP growth rate for 2025 (from 2.1 to 1.7), and an uptick in inflation expectations (from 2.5 to 2.7 and 2.8 core):

And (2) an announcement they were pausing QT, which can be interpreted as bullish:

“Beginning in April, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion.”

The reaction on markets? Vol compression, as we announced on Saturday to our paid subscribers:

They could provide an additional boost to the unclench of vanna and charm flows, bringing the VIX down below 20, and set the stage for a medium term rally.

The most likely outcome is: vol compression continues, we get a relief rally next week. It probably won’t be anything too aggressive.

Vol compression means that volatility is going down, and this compression is helping push markets up. Therefore it looks like we did get a bottom after all that selling last week, and now with the Fed coming in as expected, without any recession scares or any dramatic changes to policy, it’s essentially supportive for markets.