FOMC: very hawkish

Paid subscriber analysis

In our paid subscriber post last week this was one of our main conclusions:

B) Hawkish; also pause with hike (a hike is very unlikely next week), still not there with the inflation fight, data dependent, but more hikes left (higher for longer during 2024 before something breaks). Also, anything that suggests uncertainty over future tightening falls within this scenario.

The first scenario is priced in, the second is not. Given that we assign greater probabilities to the second scenario - in that we expect at least one more hike before the end of the year, or at least a more hawkish Fed/more uncertainty - we are happy to take this trade as it currently provides a better risk-to-reward ratio.

Our positioning was to go for put spreads with Oct 20 expiry. The SPX puts were at $14 per contract when we bought them, the NDX were at $48 per contract.

Yesterday the SPX spreads went to over $24, and NDX over $86.

What now, post-FOMC?

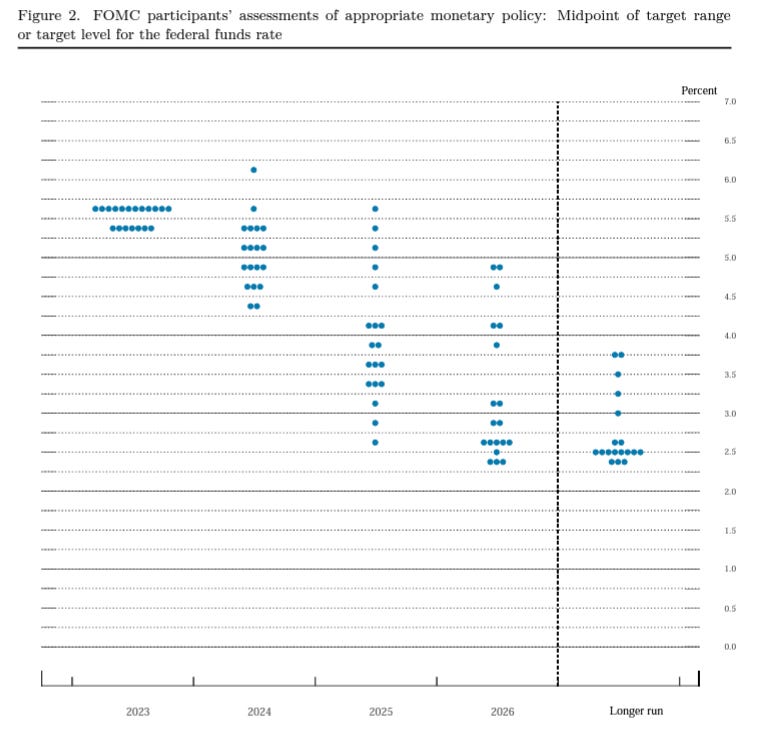

Especially after such a hawkish summary of economic projections - one more hike expected before the end of the year, and only 50bps of cuts priced in for next year (as opposed to 100bps of cuts which were expected). This simply reiterates the higher for longer scenario and puts a huge dent in the soft landing scenario.