Quick summary:

The sixth week of the Q2 competition is up & running - click here to join the action.

S&P 500 touched 5,700 last week, fully recovering Liberation Day losses and signaling potential for a sustained move up *if* momentum holds.

Last week’s scare from -0.3% Q1 GDP and hot PCE inflation was short-lived, with markets bouncing cleanly off key support areas.

This week, it’s all about the Fed decision on Wednesday. There is no rate cut expected and Powell is likely to stick with a “wait and see” tone.

Earnings slow down but key names remain, including AMD and Disney; economic data releases this week include trade balance, jobless claims, and consumer credit.

The competition

We're coming off a strong week with the S&P 500 briefly touching 5,700 and momentum back on the bullish side. As we head into a pivotal stretch—highlighted by the Fed’s rate decision and key earnings from AMD and Disney—the leaderboard remains tight.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

SPX wiped out all the losses since Liberation Day, April 2nd. That level held firm after a sharp midweek sell-off triggered by a -0.3% Q1 GDP print and a hotter-than-expected PCE inflation report. But the panic was short-lived — the bounce came right at key support levels we mentioned the week before, and momentum carried through to Friday. Strong earnings from MSFT and META helped, while weaker forward guidance from AAPL and AMZN were offset by overnight optimism from China and a decent unemployment print.

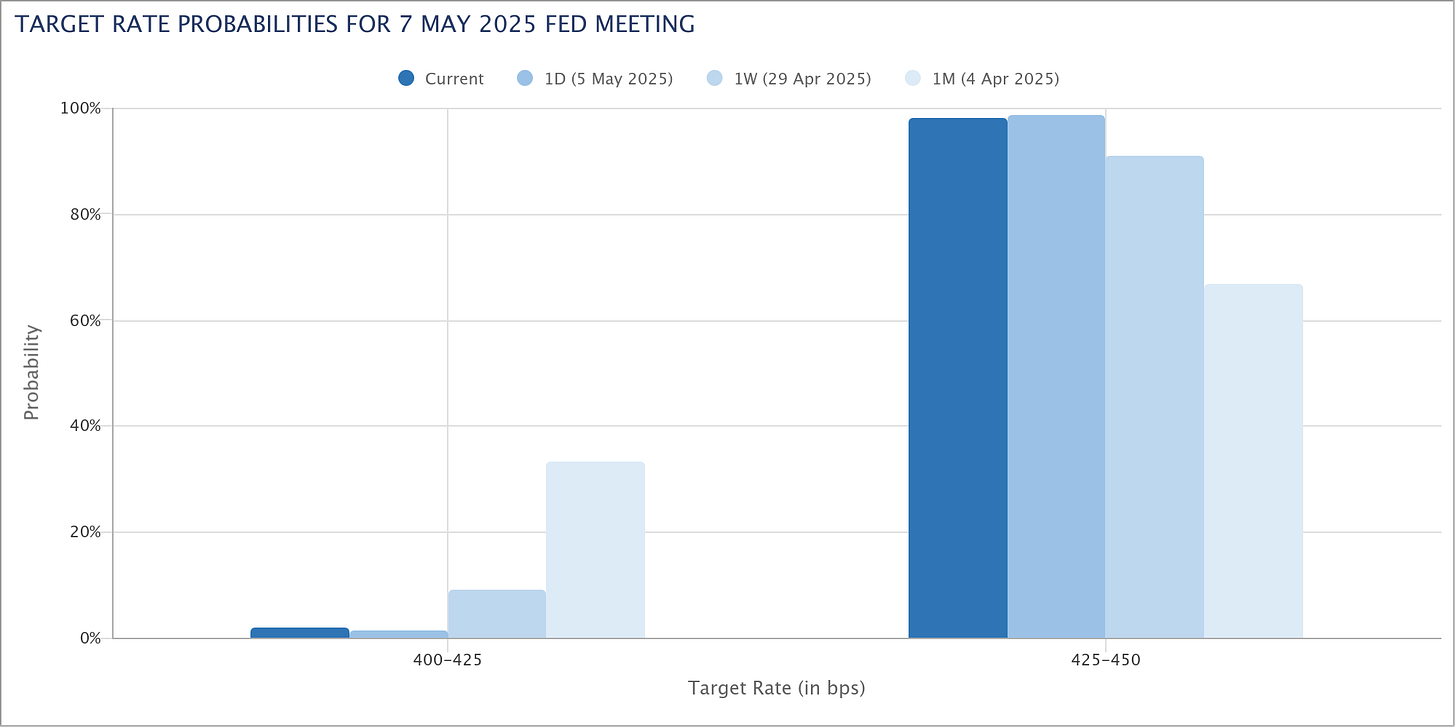

With major earnings mostly behind us (except NVDA later this month), attention shifts to this Wednesday’s FOMC meeting. No cut is expected — the market sees July as the earliest possible pivot. Powell is likely to stick with his usual “wait and see” stance. That could lead to a quiet reaction unless he surprises with a hawkish tone, which is unlikely. Meanwhile, the VIX has dropped back to 22, but realized volatility is still elevated — setting up for potential vol compression if no shocks emerge. If 5,700 breaks higher, 6,000 is back on the table.

This week is centered around the Fed’s decision on Wednesday. Rates are expected to remain unchanged at 4.25%–4.50%, despite growing political pressure. Powell’s comments may get extra attention given recent headlines, but any major shift in tone remains unlikely. On the data side, expect updates on consumer credit (Wednesday), trade balance (Tuesday), and jobless claims (Thursday) — all offering more insight into economic health after last week’s jobs beat.

Earnings-wise, while most of the big players have already reported, a few names still matter. AMD and Disney lead the lineup on Wednesday, with market focus on tariffs and streaming pressure, respectively. Others like Palantir and Uber may grab headlines, but are more likely to be background noise unless surprises hit.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.

tough week, actually - I personally expect Palantir to "fall" to $100 - if it really fell a lot (it's currently at -8.5%-for today), it would be an opportunity to make money this month and next (after the fall, growth to $125-135 is expected) .... Disney and AMD are opportunities for short-term profits .... - we'll see !! And SP500 ... hmmm ... today's fall, then recovery (?!) ... and from Wednesday "crawling" upwards (?) .... LOL - GOOD LUCK Vuk, this week !!