Quick summary:

The Q3 competition is up & running, 3 more weeks left! - click here to join the action.

Despite solid economic data, the market's subdued response reflects the typical challenges of September, tempering expectations for immediate gains.

BASON went short last week and delivered a good return (2% gains), amplifying its advantage over other asset classes. It currently stands at 25% YTD, 49% since inception (Feb 2023).

This week's focus is on the CPI and PPI releases (Wed and Thu), crucial for setting expectations before the Federal Reserve's meeting on September 18th.

On Saturday, we’ll dive deep into expectations for next week, when we get Vixperation, FOMC, and Sep OpEx all in one go. Don’t miss it!

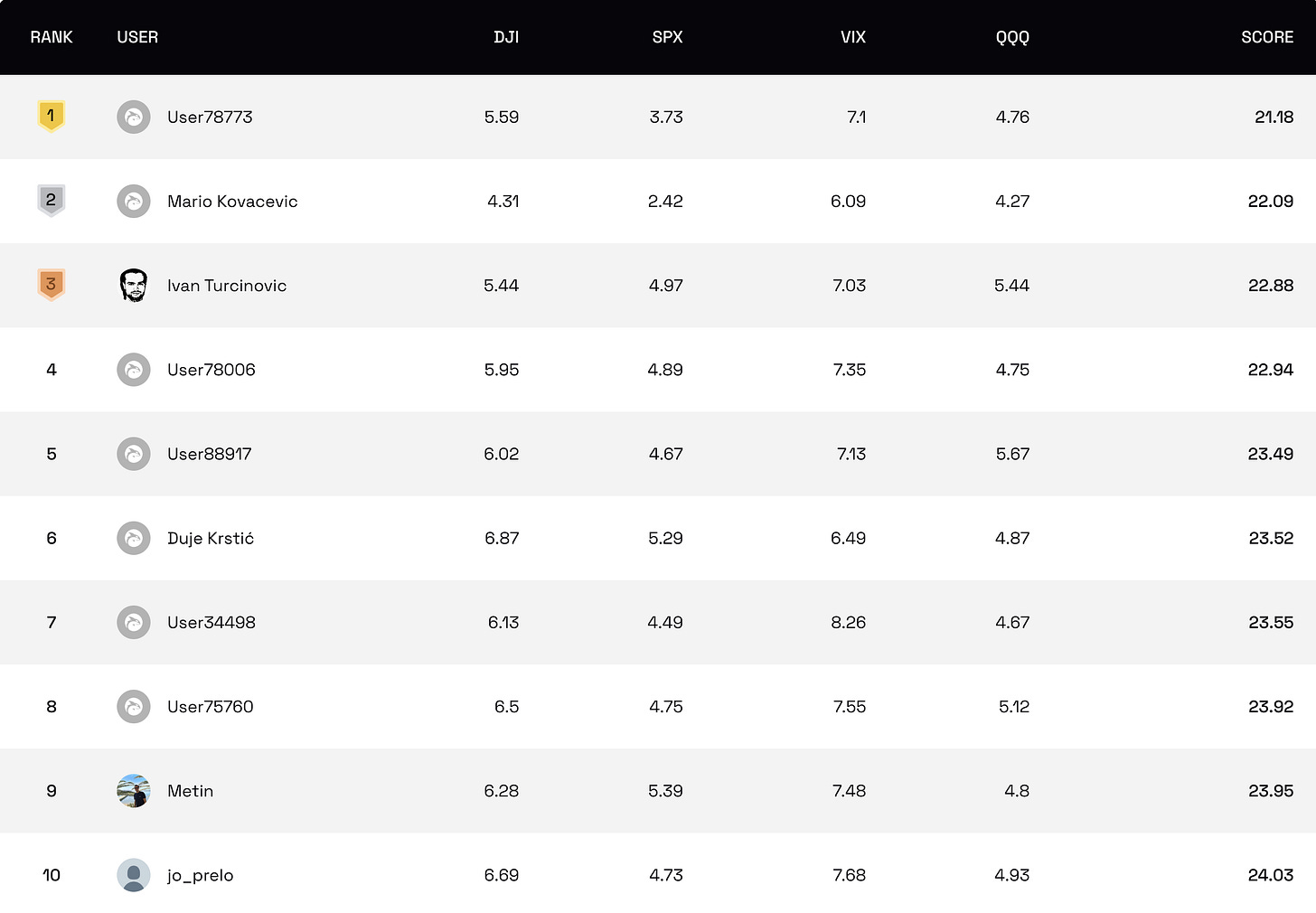

The competition

As we’re getting ready for the CPI and PPI releases, alongside the market’s usual September challenges in play, it’s a good time to focus on securing your positions on the leaderboard. As we enter the final three weeks of the Q3 competition, let’s make the most of the upcoming insights to navigate the market wisely and enhance our standings.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Despite positive economic data the market’s subdued reaction reflects September's historically tough performance. However, hopes for a year-end rally are high, fueled by expectations of a soft economic landing and potential Federal Reserve rate cuts, aiming for a 6000 SPX target by year-end. Whether or not this happens will depend primarily on upcoming economic data, the first of which (inflation) is coming up this week.

Technical indicators hint at a potential downturn for major indices like SPY and QQQ in the coming weeks. Although not foolproof, these signs typically suggest that any dip might offer a good buying opportunity, possibly leading to a rebound later in the year.

Last week BASON delivered on its short positions, making 2% from the overall market decline. While we missed the sell-off on Monday, we made our returns on Friday, as the markets reacted negatively to the August jobs report.

The next few weeks are pivotal, with key events such as the monthly VIX expiration and an important Federal Reserve meeting. This week, the market focus will primarily be on the release of the CPI on Wednesday and PPI on Thursday, providing the last data point on inflation before the Federal Reserve's meeting on September 17-18. How the market responds could either enhance the end-of-year rally or lead to a reevaluation if new economic data shows weakness. This period will crucially test the market's strength, potentially setting the tone for the rest of the year.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.