This week was to be centered around NVDA earnings. They did not disappoint. But the rest of the market did, at least since after NVDA reported its earnings. But it certainly didn’t look like that on Wednesday after close:

On Wednesday after close, in addition to great NVDA earnings (a beat in both revenues and EPS, all-in-all an excellent quarter) we got the news that a US trade court blocked President Trump’s tariffs claiming that the President exceeded his authority in imposing tariffs on global imports. Basically, this is not something that can be done via executive order, but needs to go through Congress. The post-market reaction was a 1.5% push up. And yet, by the open on Thursday, the effect was halved, and by mid-day the entire move was erased.

Why? Hard to say exactly, it was probably a combination of several reasons: end of month rebalancing flows from equities to bonds (which made that down-up move on Friday), the tariff court order was not going to last (an appeal was made, and the appeal court quickly accepted it the next day), the fact that this only adds to uncertainty over tariffs, rather than eliminates them, etc.

Either way, we got a flat week after that, with zero impact of either NVDA or initially positive tariff news. Not ideal for all of us options buyers :)

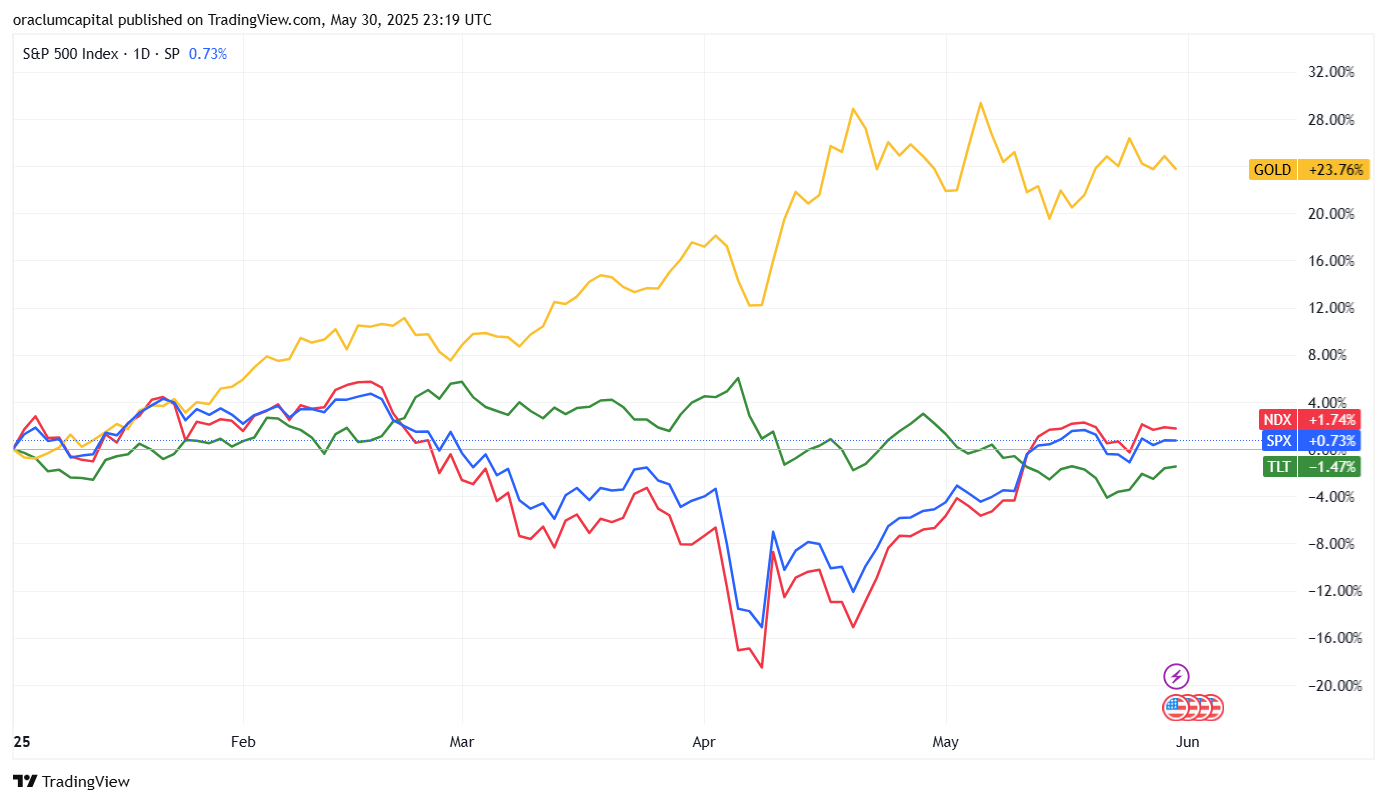

But looking at a bigger picture, we are still flat on the year in equities, although only 3% away from all-time-highs, still negative on bonds, and with gold leading the pack at +23%. However, the bullish momentum in equities is still alive and well.

They haven’t been able to break 6,000 again, but there wasn’t any major move to the downside these past two weeks (they briefly broke 5,800, but recovered to remain range-bound between 5,830 and 5,950). Remember, we keep saying we are in a period of structural weakness between May OpEx and the June OpEx, or at least before the vanna and charm flows kick in again, which should happen in the second week of June. In the meantime we were looking for some major catalyst to push markets down, but it hasn’t happened. And given that it hasn’t happened, the probability that we keep going sideways-up for the rest of the summer keeps increasing.

In other words, being bearish keeps getting worse. Sell-offs are sharp, but last very short, so all medium or longer term put options keep losing money. Even the VIX hedge is not ideal - same jumpiness, same quick short-term moves.

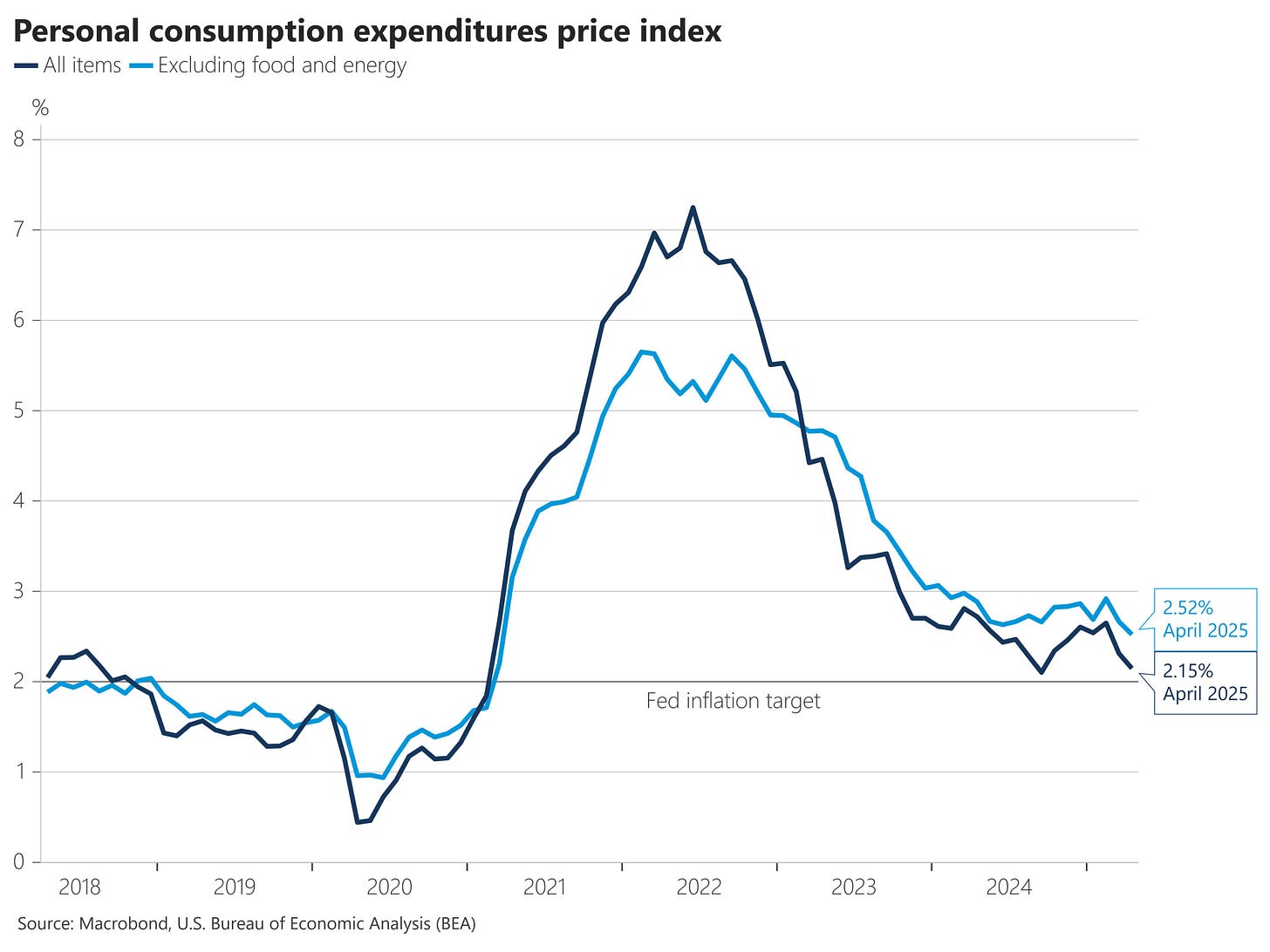

Also, the macro data is coming in decent. On Friday we got a PCE inflation print that came within expectations. The core PCE price index rose 0.12% in April, the lowest since Feb 2021 (very similar to CPI inflation actually). Headline is now down to 2.1%. This is better than even the Fed was expecting in its dot-plots:

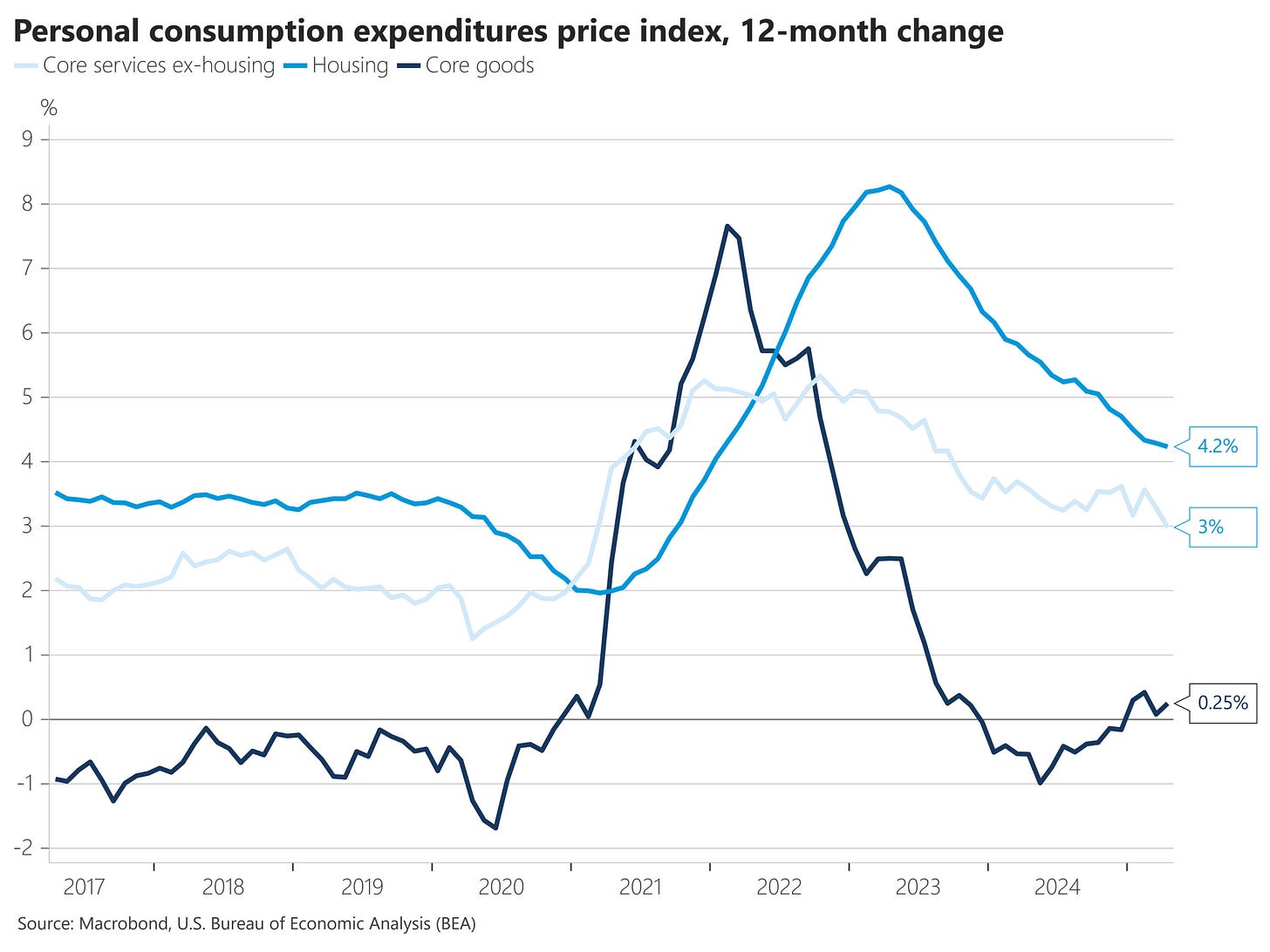

Note the one thing that keeps being high: housing prices. Core goods inflation has been tamed completely, and housing - even though it’s declining - is still growing at 4.2% annualized. That’s a lot, and is definitely the reason that consumers still feel high prices affecting their living standards.

Therefore, once again we see no impact of tariffs on consumers just yet. We need to wait for the May projections and we need to see what the final tariffs will be (if there are any), but the bullish argument keeps getting stronger.

Which doesn’t mean it will be right. More on this in the paid section below.

Take a little break and help us make this newsletter even better

If you haven’t already, share your thoughts by filling out this short survey - it only takes a minute, and your feedback helps us shape future content.