Last week we finished with a warning: coming into OpEx week, there was a higher likelihood of a sell-off on the condition that we got a strong negative catalyst like no trade deal between US and China, and/or a worse than expected CPI for April (taking tariffs into account).

Neither of these came true, quite the opposite actually, which is basically now triggering the alternative scenario:

However, if not, if markets bounce on bad China news and if CPI comes in line or better than expectations, and we manage to get through till the end of May without a major down move, then we keep riding the bull into the summer - expect further vol compression (VIX back below 18), and a sideways-up market regime.

Today we talk about this in greater detail, and we examine how realistic is this scenario where we get a market up, vol down trade all the way into the summer. Or is it a “Sell in May and Go Away” kind of trade?

What’s macro data telling us?

But first, a look at the macro data.

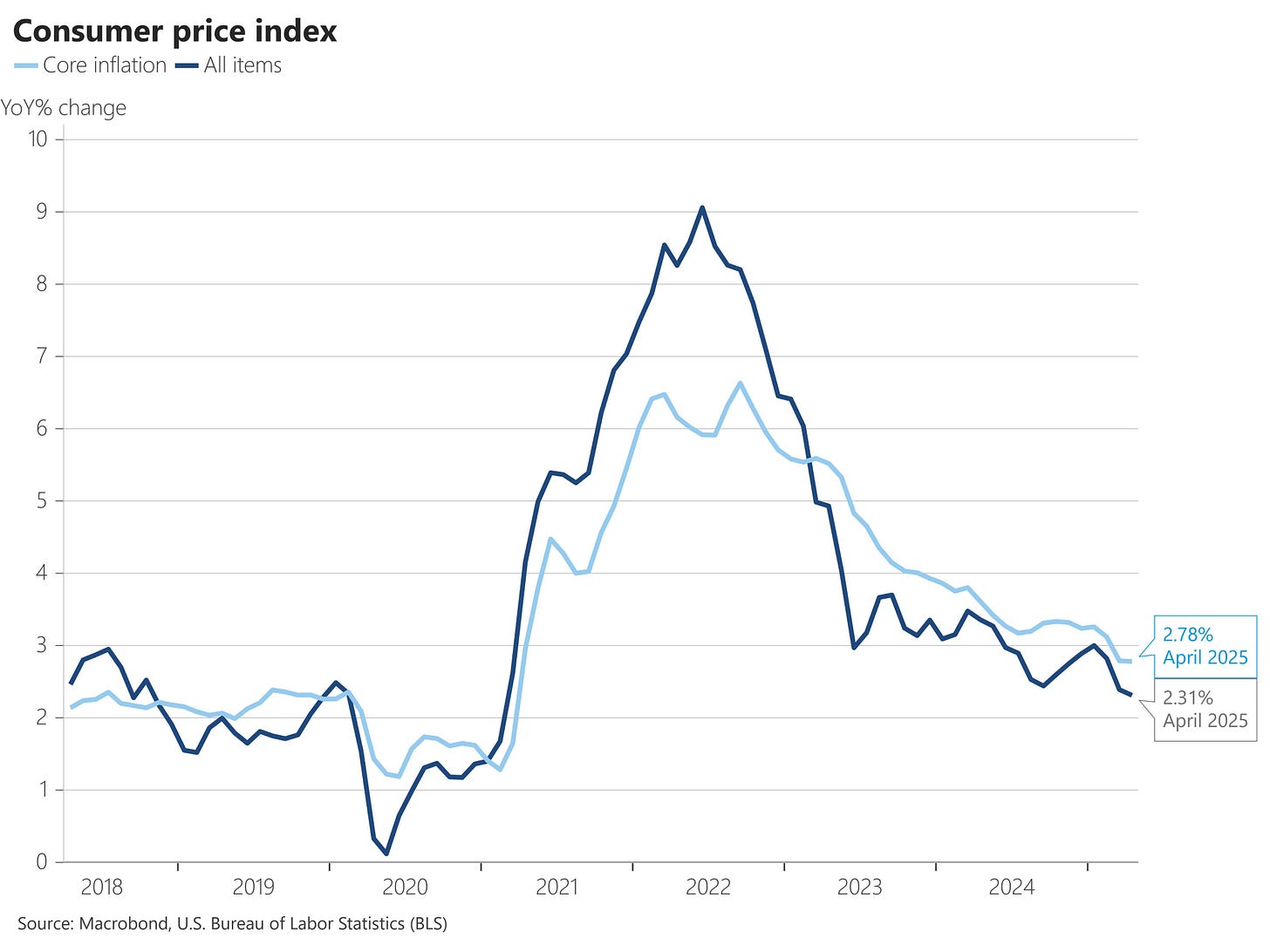

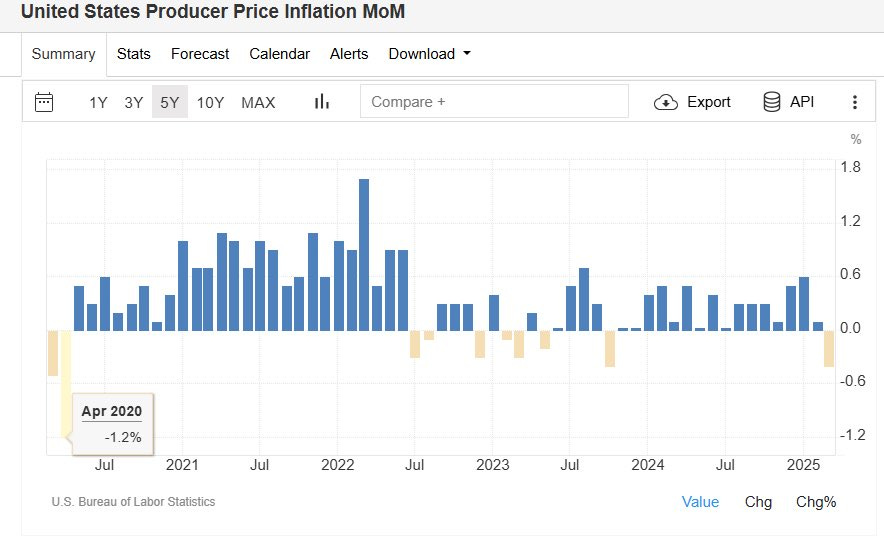

CPI and PPI both came in lower than expected for April.

Core CPI (the more sticky one) is at 2.8% YoY in April, and headline is down to 2.3%, both of which are now close to the Fed target rate, and both are at new 4-year lows:

Even better for PPI. The monthly for April was actually down, coming in at -0.5% vs 0.2% expected, also pushing down the YoY PPI to 2.4%, and core at 3.1%. It was the lowest monthly PPI since the COVID lockdowns:

This would be good news for markets in any case, but it was even better given the rising inflation expectations in April due to tariffs. Yesterday we also got the Michigan consumer survey where, despite flat real data in April, consumers are expecting inflation to be at 7.3% (up from 6.5% last month) by this time next year. Both Dems and Reps are expecting higher prices, although Dems much more than Reps. Clearly an overreaction to tariffs, but it’s interesting to see the discrepancy between consumer expectations and real data, at least for now. A very mild reaction of prices post ‘Liberation Day’ suggests that markets might be shrugging off tariffs as a recession threat. At least for now.

This is also shown in the GDP data, from the Atlanta Fed’s GDPNow, where the Q2 estimate is (as of May 16th) at 2.4%. As if nothing really happened in April.

And that’s exactly how markets have been playing it since mid-April. We talked about this last time - there are flows that happen regardless of the news (which were all incredibly bearish), that keep driving markets up and keep squeezing shorts. And just as everyone is getting ready for the next short, a catalyst happens (like the US-China trade negotiations last weekend), inflation data stays contained, and the up move becomes a self-fulfilling prophecy. Reflexivity in markets is a powerful thing.