Quick summary:

The Q4 competition is up & running, five weeks down - click here to join the action.

The rest of the Mag7 (Google, Microsoft, Amazon, Meta, and Apple) earnings start today with Google. Microsoft and Meta on Wed, Amazon and Apple on Thu.

But this is just the beginning. This week brings essential data, including the first Q3 GDP estimate on Wednesday, the PCE inflation report on Thursday, and the September jobs report on Friday. So many data points it will most likely be another volatile and jumpy week.

Yesterday, the Treasury announced their financing estimates for Q1 2025 (QRA), and they came in higher than expected, thus piling the pressure on the Treasury to increase coupon issuance tomorrow (triggering a sell off in long-term bonds). However, this is unlikely, if anything due to the elections coming up next week.

Do not miss the Saturday playbook for elections and the FOMC next week. We will, to our paid subscribers, provide a set of scenarios of what might happen and why:

The competition

As we dive into Mag7 earnings week and brace for crucial economic reports, the stage is set for some serious market moves. Let’s seize this moment to solidify our positions or climb the leaderboard as we push through this pivotal stretch!

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

It’s been a bumpy ride last week. Mon and Tue both started with a sell-off, only to reverse all or most towards the end of the day. Then we got a sharp sell on Wed, lackluster price action on Thu, and another rollercoaster on Friday.

For the BASON it is difficult to make money when this happens. We went short on Wed, but neither a long nor a short position made money last week. We cut our losses during the Friday reversal and came out a negative 0.5%.

QRA

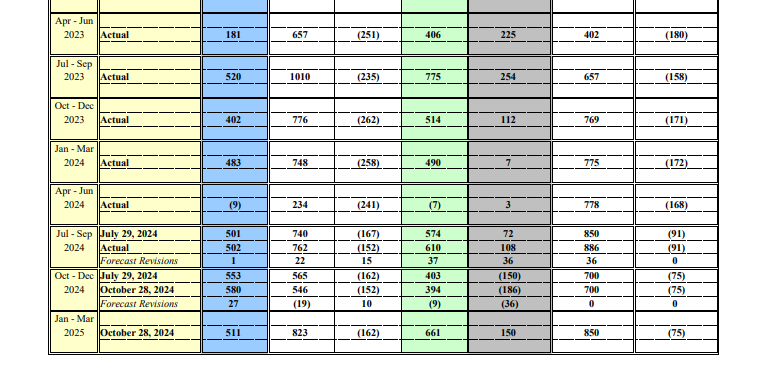

Yesterday the US Treasury announced its financing needs for Q4 2024 and Q1 2025. The Q4 estimate is around $546bn, which is a bit lower than what was announced in July. But the estimate for Q1 is $823bn which is higher than was expected. Typically this would imply that the Treasury will have to increase its coupon (long duration bonds) issuance, as the share of Bills (short duration bonds) would go over 40% in composition.

To remind you - more coupon issuance means a greater supply of long-duration bonds, which lowers their price and pushes yields up (as we have been witnessing over the past month). This should have a negative impact on equity prices (recall the Aug-Oct 2023 situation - this old post provides a great explanation of the whole trade). However, lately we haven’t seen this. Because the driver behind the latest yield push up was not the Treasury supply. Other factors were at play, as we explained.

So it all comes down the the actual composition decision which is announced tomorrow before market open. However, I do not think the Wed composition will carry that much weight this time. There will be zero reason for the Treasury to change its policy direction this close to the elections, meaning that they probably won’t increase the supply of coupons (long duration bonds), even if they certainly should.

If, however, they do increase coupons (low probability), markets should sell off.

If they reduce coupons (even lower probability, almost non-existent), markets would rally.

But the most likely scenario is no change in size, and no change in guidance. Which means we move on to the next data points: GDP growth and earnings.

Earnings

In addition to the QRA, several critical economic reports will hit the wire this week. The September jobs report, set for release on Friday, will be a key focus as the Fed looks for signs of labor market weakness ahead of its November 7th meeting. We’ll also get the first estimate of Q3 GDP on Wednesday, followed by Thursday's PCE inflation report, which will show whether inflation continues to cool. Remember, we are now in a very data dependent macro environment, as investors look to hints about the economy to realize the soft landing scenario, or to start selling in panic.

As for earnings, below is the calendar, check out some of these names. In addition to the Mag7 we also get AMD (the proxy for NVDA earnings, right?), PayPal, BP, McDonalds, VISA, Eli Lilly, Coinbase, Uber, Intel, Exxon, etc. But we all know who will drive the market.

All in all, buckle up—this week could get wild, but it might also set the stage for a solid year-end rally once the dust settles.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.