Increasing likelihood of a correction

Paid subscriber analysis

…but most likely not before FOMC on Jan 29th.

This might seem like a contrarian call, but bear with me (pun intended!).

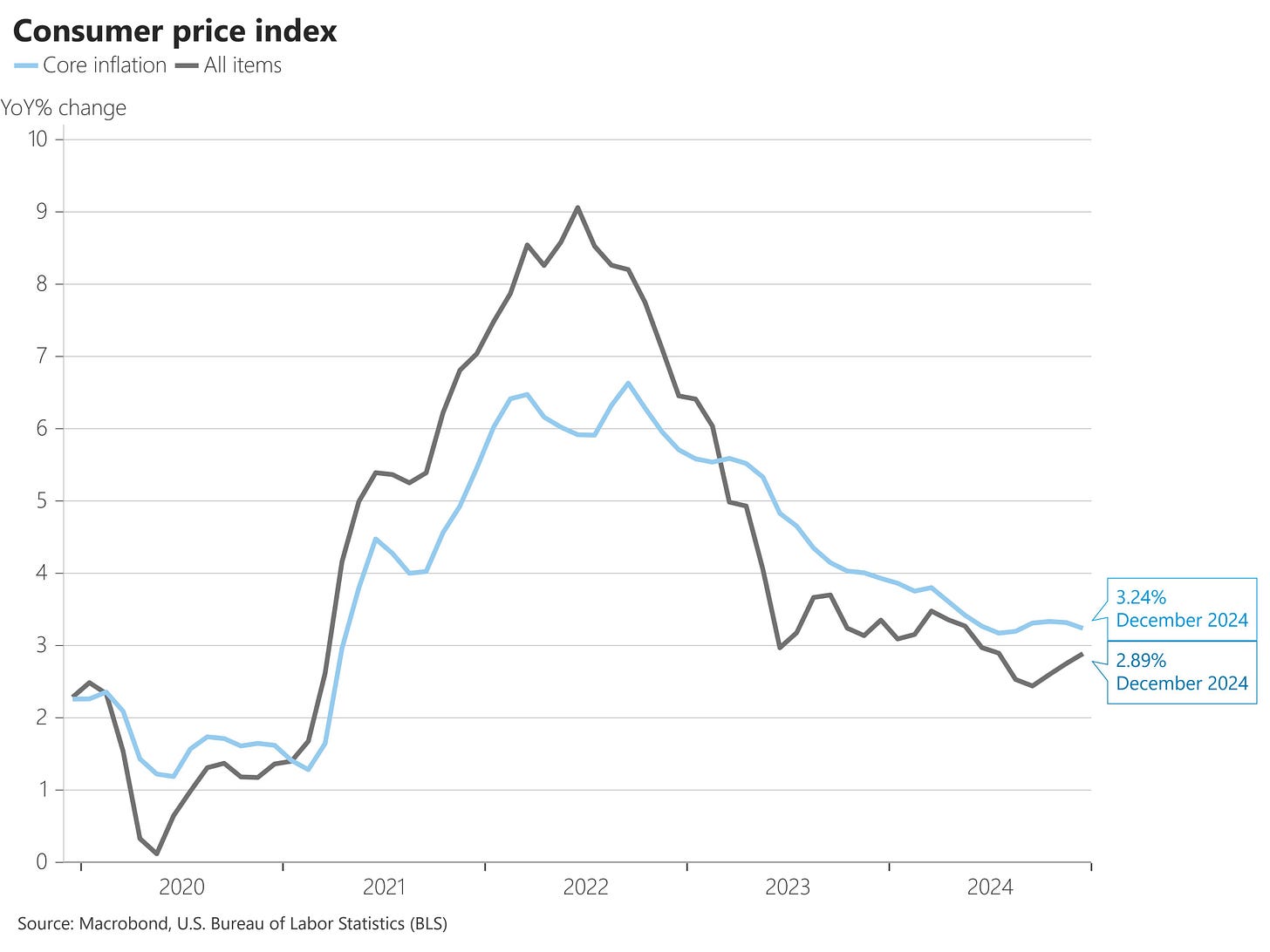

We got some important inflation data this week. First the PPI came in colder than expected on Tuesday, after which the market first rallied, but was very jumpy afterwards (going from +0.5% to -0.5% to +0.3%). Then on Wednesday, the CPI came in as expected, while the core CPI came in slightly lower than expected and markets rallied powerfully on the news (+2%). Even though headline inflation is still on a slight uptrend (currently at 2.9% annualized), core inflaiton is declining, which is all the market needed to rally.

After a consolidation on Thursday, markets continued to rally on OpEx Friday, making another push above 1%, managing to break out of the technical downtrend (on the 4hrs and the daily) of the last two weeks. The 5-period SMA also jumped above 20- and 50-SMAs, which tends to be interpreted as a bullish signal when coupled with a positive MACD. But those are just technicals anyway.

It was a welcomed rally, after really mixed price action since the beginning of the year, but we’re not out of the woods quite yet. This is still overall very jumpy price action, with the market struggling to find direction.

Interestingly, the BASON performed well in the last two weeks, capturing the sell-off last week (+1.25%), and the rally this week (+2%). Usually it hates jumpy environments, but this time it worked splendidly.

Anyway, the price action over the next two to three months will rely heavily upon the FOMC on Jan 29th. And then the first Treasury QRA under the new administration on Feb 3rd and 5th.

We see two potential scenarios developing from this point, one of which more likely than the other. And once again the crucial catalyst will come from the bond market.