Welcome back, dear subscribers.

It’s a special day at Oraclum Capital. As announced a few weeks ago, today we launch our new survey app for our market prediction competition that you all know and love.

Coincidentally, it’s also 4th of July, so happy Independence Day to all our American subscribers!

This is a milestone for us, and we’re happy to give all of you an even better user experience, with more features, and hopefully a more exciting competition that will turn all of you into great predictors of markets in the years to come.

Q3 has just started, the new $5,000 prize allocation is up for grabs (Q2 winners have been announced and are featured below), and the survey is live:

What’s new in the app?

Apart from our fancy new design, there’s a few new features out there. First, we’ve included a more detailed profile section (under My profile) where you’ll be able to track a bunch of stats of your performance. Second, the leaderboard (on the desktop version) now tracks not only the overall quarterly (or annual) score, but also your scores across each of the 4 indicators we use to evaluate your overall performance, predictions for DJI, SPX, QQQ, and VIX (please have some patience on transferring the old leaderboard results into the new one). The survey itself is also more cleaner, much more user friendly and professional. It’s also more mobile friendly than the previous one. You can come back to your results and see what you’ve predicted and change it as many times as you like before the deadline.

Here is a quick video walk-through of the desktop version of the survey featuring myself and our COO Scott Alford. Have a look and please do reach out if you need some help with it:

Follow us on our YouTube channel.

Winners from Q2

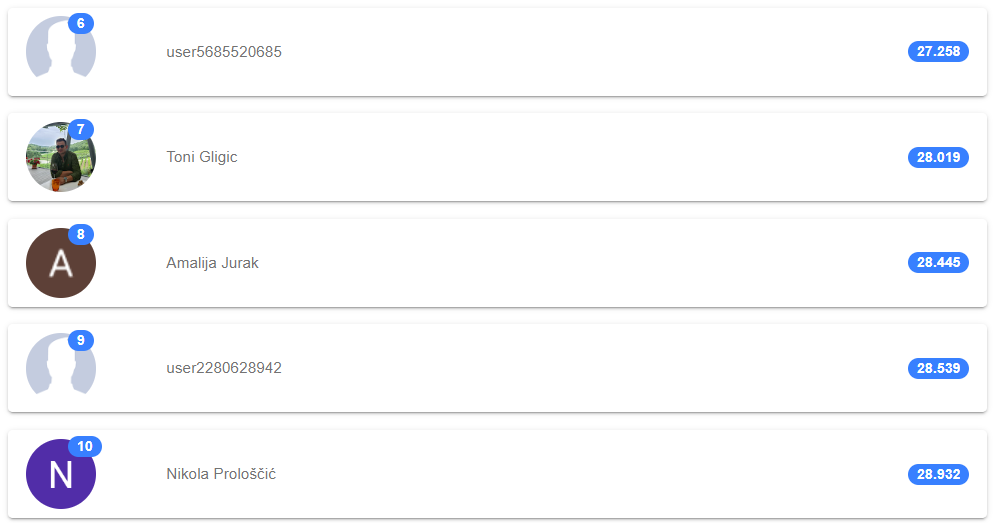

Now for the most fun part, congratulating our Q2 winners!

The top 20 list features some familiar names, and some new ones. The winner (decided to stay anonymous) is actually the same winner from Q1 - congrats again on your amazing and consistent performance!

Notice the margins separating the top 4 players: less than 0.4 points. Wow!

We will reach out to each of you this week.

However, one interesting thing to compare this time and last time was the score. Even though Q2 was a quarter when markets mainly moved up (with sideways trading mostly during May), the precision scores were lower for the top participants than in Q1. For example, the top 4 this time (with a score of 24) would be around 15th place last time.

But this shouldn’t surprise you. The reason is that our competition was 4 weeks longer in Q2 (as we started Q1 in February). So if you divide the scores per number of weeks, the top 20 participants all actually had better performance in Q2 than in Q1.

And it shows. Our prediction precision was much better this quarter than the previous one. More on that below.

Overall, great job everyone and thanks again for playing! Looking forward to seeing you all by the end of Q3 :)

Q2 performance

As we end the second quarter, we can see clear signs of improvement in the fund’s performance. Out of 13 weeks we traded over the past three months, we were correct in our predictions and made money in 9 weeks and were wrong and lost only in 4, meaning we were correct and made money 70% of the time.

This is now fully in line with our 2022 and 2021 performance. We are back to our best in terms of precision accuracy. Alongside our successful, newly implemented downside protection strategy (which is containing losses within 1% to 2%), we are now ready to increase our risk exposure on the upside in Q3, and deliver those big returns we’ve gotten used to over the past two years. Q2 was important for consolidation after a bad start in Q1, and now that this process is done, we are getting ready for liftoff in Q3.

…join the $20,000 competition!

This week it’s another 4-day trading week with the interruption coming up today, due to 4th of July. Volume was very low yesterday, as expected, as markets didn’t make much moves. Out of big events coming up this week, the Fed will release minutes from its last meeting, and there some new economic data coming up, but nothing as important as the week before.

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter!