Quick summary:

The second week of the Q2 competition is up & running - click here to join the action.

Last week saw the SPX and NDX experiencing severe declines of 10% and 11% respectively, indicating a strong shift into bear market territory.

The implementation of tariffs led to substantial market volatility, with new tariffs set to begin this Wednesday and China's retaliatory tariffs starting Thursday expected to keep markets on edge. Are we in for a bounce, or will the sell-off continue?

At ORCA we went short last week, with even more limited risk, and managed to pull out a 4% return on Thu and Fri amid the brutal sell-off. This testifies to the resilience of our strategy and also explains its low correlation to SPX.

Key releases this week, including the CPI on Thursday and Federal Reserve's meeting minutes on Wednesday, will provide critical data on inflation and insights into future monetary policy actions.

The competition

With new tariffs and key data like the CPI ahead, this week is pivotal. Let's stay sharp, harness the momentum, and climb the leaderboard.

NOTE: We made all the payments for the Q1 prizes. If you haven’t received the money yet, it should be on your accounts this week. If not, please do reach out to us.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

The markets faced one of their harshest downturns in recent decades following the imposition of tariffs, with the S&P500 and NASDAQ plunging by 10% and 11% respectively across Thursday and Friday. These days marked a significant lack of intraday bounces, signaling a firm move into bear market territory.

Our previous warnings about the likelihood of full tariffs materializing proved prescient as those holding shorts through the end of the week saw considerable gains. Then yesterday, the US economy traded like a memecoin. First the sell-off continued, with SPX down almost 5% again at the open, only to reverse to a 3% bounce in 15 minutes (an 800bps swing!) following breaking news that Trump is considering a 90 day delay in applying tariffs. The news was soon proved to be fake, and markets went down again, continuing the daily bounce and ended underwhelmingly - flat.

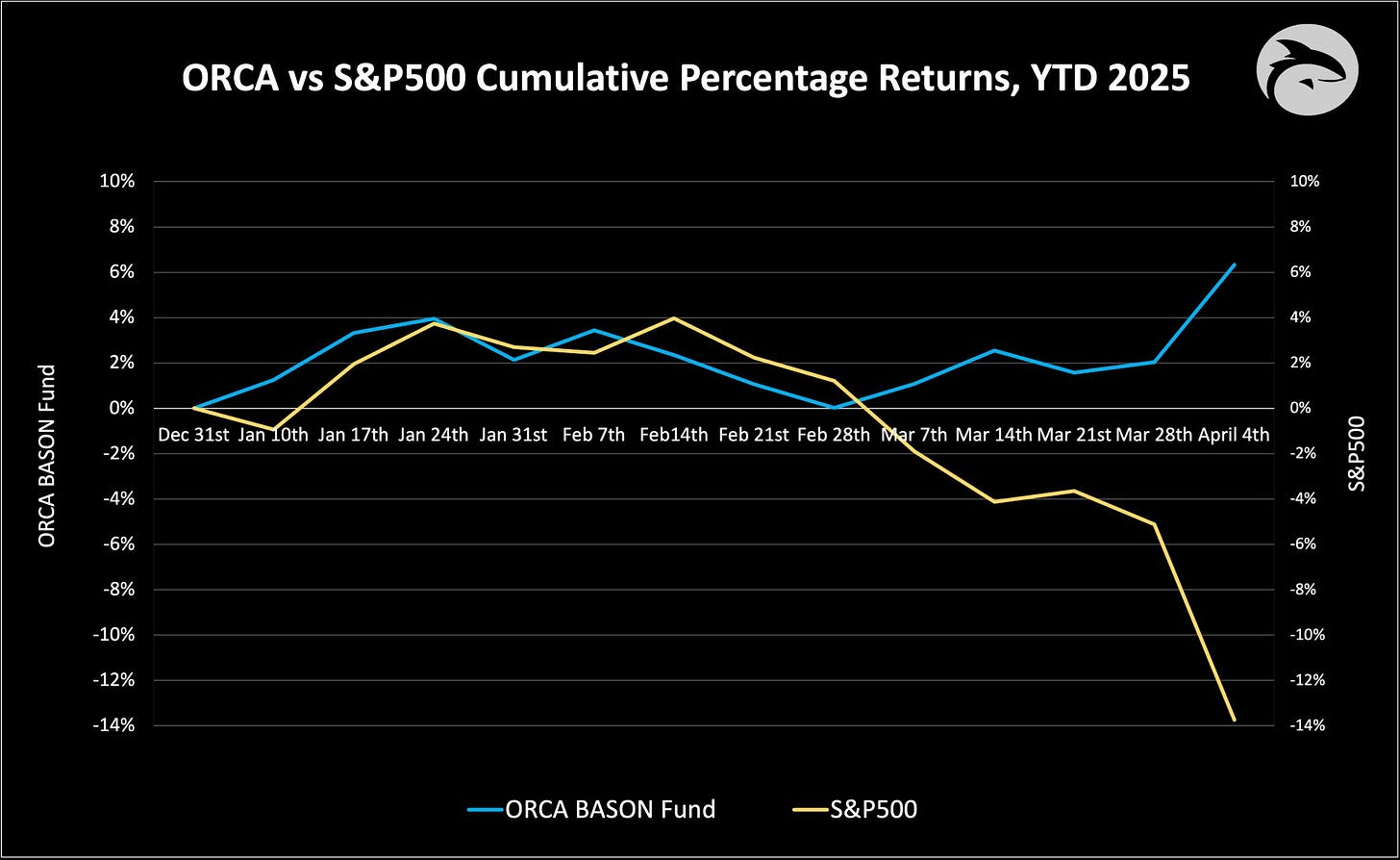

ORCA went short last Wednesday, and after a brief up move on the day, managed to pull of significant gains on both Thursday and Friday. It was with limited risk exposure that we went into this sell-off, mindful of how the previous quarter looked like - strong intraday swings, expensive options, killer time decay. Even with limited risk, we managed to pull off one of our “superweeks”; >4% return. The gap between us and the S&P500 is now 2,000 basis points (+6% vs -14%). It’s been a tough start of the year, but our resilience is now showing.

Looking ahead, the path seems fraught with volatility. The continuation of tariff policies could keep the pressure on, especially if Q1 earnings fail to provide a robust counter. We get our first earnings this week, starting with banks on Friday. However, with the VIX hitting 45—a rare event historically followed by market bounces due to volatility compression—there's a potential for some market stabilization in the short term. Nonetheless, the overall sentiment remains cautious, with further sell-offs a strong possibility if the geopolitical landscape worsens.

Additional economic releases are set to stir the market further. The implementation of new tariffs scheduled for Wednesday and the start of China's retaliatory measures on Thursday will likely intensify market fluctuations. Additionally, the CPI data due on Thursday and the Federal Reserve's meeting minutes expected on Wednesday will be closely monitored, offering fresh insights into inflation trends and the central bank's policy outlook in response to these escalating trade tensions.

Will we bounce or will we plunge?

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.