More of the same...

Paid subscriber analysis

What have we seen in markets this week? Nothing new, more of the same. Another sideways-up week, with two breaches into all-time highs (first on Monday, then on Thursday), followed by an intra-day reversal on Thursday and a flat Friday. Or in other words, a move up (a late reaction to the FOMC fade on Monday), followed by a consolidation henceforth.

This is *exactly* what we have been writing about for the past month and a half. It continues; a sideways-up regime, where markets jump up on occasion (typically following some good economic news), and then consolidate on the new high for a few days or even weeks.

This is a difficult environment to trade the BASON and make money, but we did manage to get over 3% for the quarter (after a flat April and May), which is a good result given that this quarter has mostly been about capital preservation, not much else. I’ll give you a better overview of this next week.

Breadth

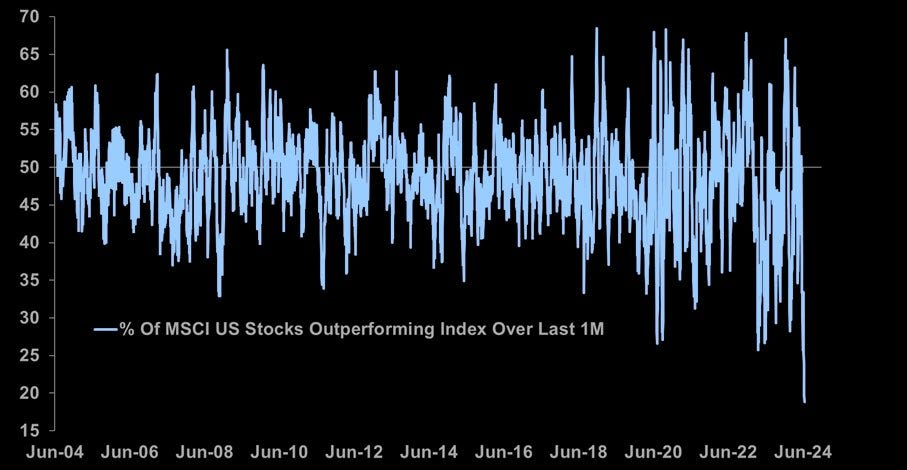

Furthermore, have a look at market breadth over the past month. Just 19% of all US stocks have been outperforming the index over the past month. That’s worst breadth we’ve had in 20 years!

Positive breadth means that more stocks are going up than down, which is driving the index (i.e. a bullish market). But now we have something completely different - most stocks are going down, and yet we still get a grind up.

Not only that, over the past month and a half we haven’t had a single trading day when SPX went down 1% (since May 1st FOMC, which we talked about as producing unclear direction, which continued after FOMC on June 12th).

This is also known as dispersion. Individual stocks are being very volatile and are trading strongly up or down (NVDA, APPL, AMD, to mention just a few), while the overall index is grinding up, without much volatility. VIX is still low, around 13.

But shouldn’t the SPX index follow the sum of its components? Nope, because it’s not just a sum of its parts. It’s traded in itself, via the options market, and it’s much bigger than its parts, affecting them more than they affect it. It’s a bit strange, I know, but the options dealer flows have gotten so substantial they have this power to pin down volatility in the overall index, despite the individual volatility of its components.

In a nutshell, the current market environment has a lot of support which is preventing any major sell-off. As soon as the move up happens, the multi-day consolidation on the index level begins. No sell-off gets sustained. Every one of them gets bought. If holding shorts, it makes much more sense to cash in soon after some strong move down occurs. Because the only reaction over the next few days will be to buy the dip (and most likely remain flat).

How much longer?

Ok, ok, you get it, it’s a boring and tedious market. But how long will this type of environment last?