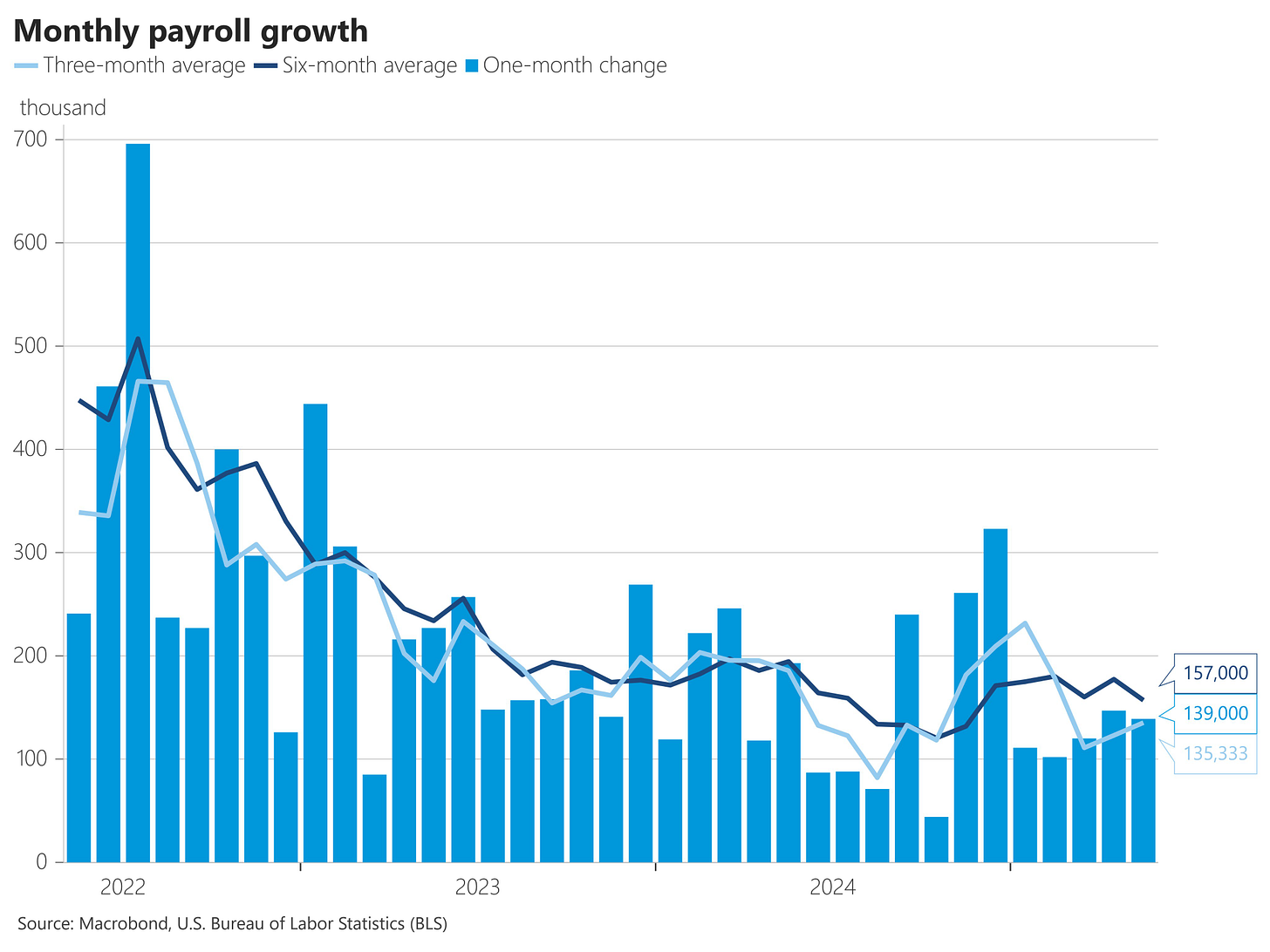

On a more serious note, in the paid section we focus on the implications of what’s next for markets after quarterly OpEx (June) and all the upcoming June macro data (jobs report came in better than expected yesterday, we still have inflation and GDP data coming up, and the FOMC in two weeks).

But first, the plat du jour. The special relationship between Musk and Trump seems to be over. Many saw it coming - as if that was a difficult one to predict: two giant egos, neither of which is used to backing down. The dirty laundry is being pulled out, the nation is entertained, and TSLA stock was down 15% on Thursday.

The fallout

I always analyze these things from the perspective of self-interest. I do believe that Musk was lobbying Congressmen and Senators to block Trump’s Budget Bill, and that he was primarily doing so because of the negative implications for TSLA and the EV market. Trump’s Budget Bill slashed EV tax credits and that was a big deal for Musk, clearly. All that concern over the deficit and pork spending is just a smoke screen.

Furthermore, Musk is clearly frustrated that his efforts at DOGE didn’t yield nowhere near the anticipated impact. He gleefully talked about making $2 trillion worth of budget cuts and enjoyed the parallels with how he cut 80% of the staff in Twitter, and that he was gonna do the same to the Federal government. Well, running a company is not the same thing as running a government - a harsh reality most of these Grand Ideas “businessmen” have trouble of understanding. Just like budget deficits, and particularly trade deficits, are *not* like cash flow statements or balance sheets of a company. Apples and oranges. But that’s a topic for another time.

DOGE claims to have made $160bn worth of cuts - which, if taken at face value, is about 2.3% of the $6.8 trillion US budget. However, when you dig into that number, the reality is much different. Nonpartisan research groups have estimated the cost of DOGE’s cuts to be around $135bn (things like paid leave and productivity hits), and this doesn’t even include costs of potential lawsuits against the government, nor the impact of loss in tax collection by the IRS. This brings us to a net impact of possibly less than 25bn (or 0.3% of the budget).

And that’s what you get when you do unselective cuts and treat the government like a business. I wrote volumes on this topic back during the Eurozone sovereign debt crisis (2011-2015) emphasizing that unselective spending cuts and tax hikes (that was the European approach) is a terrible way to restore confidence and sustainably fix public finances. What you need are structural, institutional reforms. Slow, boring, but deliver over time.

Therefore, frustrated in his failure and realizing that this big new budget is only going to emphasize this, Musk lashed out. He’s not wrong that the budget is an abomination, but I feel it’s for the wrong reasons.

Market impact?

In my opinion, the brief sell-off that happened on Thursday was it. Yes, the implications for TSLA and the EV market are significant, but markets shrugged this off pretty quickly on Friday when the new jobs report came in better than expected.

If the feud continues, we might see some more dirty laundry get thrown out there, but apart from pure entertainment value, I don’t see this having any further impact on markets.

The passage of the Bill however, might. If the Bill passes Congress, we get two forces in the opposite direction: the push factor is coming from tax cuts, which is always bullish, but the pull factor might come again from bonds. This week we saw bond yields gradually decline to 4.3% on the 10Y and 3.8% on the 2Y only to shoot back up on Friday and the jobs report to 4.5% on the 10Y and 4% on the 2Y.

Interestingly, the bond market reaction on the Musk vs Trump feud on Thursday was a decline in yields. One would certainly expect the opposite if the Budget Bill raises concerns on debt levels and whether there will be enough demand for bonds to buy this new huge volume of upcoming US debt (at >4% interest rates).

But the Trump administration has now clearly pivoted to making sure the economy stays robust (good jobs data, declining inflation, rising GDP), and pressuring the Fed to cut rates, which would solve their bond issuance problem, reduce the interest payment burden, and make the passage of the Bill easier to swallow. Even talks on tariffs are not as prominent as they were just a month ago. The pivot is here.

In the end, markets care much more about the state of the economy. On Friday we got a rally following a good jobs report (139k jobs were added in May, despite continued tariffs uncertainty; and unemployment stayed at 4.2% and the labor market looks stable), making a push to close at 6,000 in the S&P, meaning that the next stage of the cycle is ready.