New competition for 2025: bigger rewards, more winners!

This is the final week of the 2024 competition

Merry Christmas 🎄 dear readers!

This is the final week of the Q4 competition - click here to join the action.

Today, we want to announce the new rewards format for our survey competition:

Quarterly reward pot is now $8,000 (instead of $5,000)

Top 30 users get rewarded each quarter (instead of top 20)

Top 40 users get rewarded in the annual competition (instead of top 20), where the prize is still 3% of the Fund’s earnings for next year. And the Fund is opening next year at $30m AUM. Just sayin’

Last week was incredible for us, best week ever as we made 6.8% returns in three days. It was mainly a consequence of us shorting the markets following the Fed’s hawkish message on Wednesday. More on this on the Saturday blog.

We presented our view for 2025 for our paid subscribers, don’t miss it.

The competition: an upgrade!

This is the final week of the 2024 competition and final week of Q4. The survey will be open until tomorrow (Christmas day) at 8am ET, as usual, and the predictions are to be made for Friday, Dec 27th, as usual.

Good luck!

What we really wanna talk about this week is our Christmas present for 2025: the new rewards system for our survey competition.

Quick overview before we dive in:

Quarterly reward pot is now $8,000 (instead of $5,000)

Top 30 users get rewarded each quarter (instead of top 20)

Top 40 users get rewarded in the annual competition (instead of top 20)

What the survey competition is all about

As the ORCA BASON Fund and our forecasters’ population grow, the reward system of the Survey Competition needs to adapt. It has remained unchanged since February 2023 when we launched the fund, and after two successful years, we are pleased to inform you that the rewards system will evolve.

But first let’s see what stays the same.

Everybody has an equal opportunity to get a reward. We reward performance of our users on a quarterly basis, irrespective of who they are, when they joined us, and what their performance was in previous periods.

Scoring and ranking will not change. Each week, we score each user’s forecasting accuracy (relative to every other user who submitted the entire survey) for four assets. We ask you where the S&P500, Dow Jones Industrial Average, QQQ (an ETF following the Nasdaq), and the VIX index will be at the end of the trading week. The more accurate you are relative to the rest of the users, the lower the score you get. The user with the lowest sum of individual assets’ scores is ranked first. The second lowest, the second, and so on.

We reward consistency – one-hit wonders (when someone nails it in a particular week and badly misses the rest) are not a good basis for consistency. Users hopping on and off the survey do not benefit the BASON the same way as those who fill in most of the surveys (even if they miss a few of them, or miss big from time to time). BASON loves consistency, and we need to make sure this kind of behavior is rewarded properly. That is why we will still implement three things:

Top performing forecasters across all 48 to 50 weeks in a year will share an annual reward directly tied to the Fund performance (i.e., 3% of the success fee of the core Orca Fund).

Top performing forecasters will share fixed quarterly rewards for accuracy across 11 to 13 weeks in a given quarter.

Missing a week of the survey is not tragic for a user’s chances to get rewarded, but still, it is better if they don’t, so we assign a penalty score of 5 each time the survey is not filled out completely.

What is changing?

A few things, but the principle is simple – we want to reward more users with more money. We ran some analyses, made simulations forecasts, and this is what we designed for our survey users:

1. The Quarterly reward is increasing to $8,000 (from the current $5,000)

2. The quarterly reward will be shared by the Top 30 users on the Quarterly Leaderboard (instead of the Top 20 concluding with Q4 2024). We decided to use the majority of the increase in the quarterly reward to expand the number of users that will share it. But still, everybody can get more.

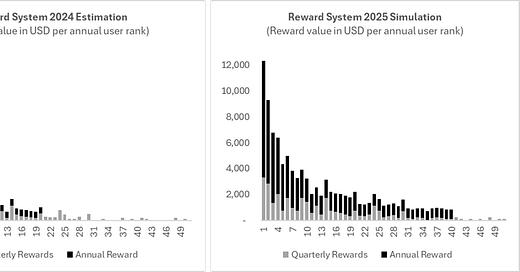

3. The annual reward will be shared between the Top 40 users on the Annual Leaderboard (instead of the Top 20, concluding with 2024). Keep in mind that this year we started with 5m AUM, and the 3% of our performance-based earnings is going to be around 24k USD to be distributed across the 20 best performers this year. We are starting 2025 with 30m AUM. So that’s a lot more money potentially to distribute if we maintain the same profitability next year.

In short here’s the overview:

We ran a series of simulations to be sure that the changes we were making would result in what we wanted – a better and broader reward system that motivates adequate user behavior and improves the accuracy and strength of the BASON signal.

We played with different result distributions, the fund's expected size, and the fund's annual performance. The 2024 competition is not over, but here is an illustration of one such simulation (the distribution of quarterly and annual ranking that stays the same as in YTD 2024, while the annual reward pool is tripled and the quarterly reward is increased to 8,000$):

Why do we need changes?

First of all, our logic is that by increasing the quarterly reward we will motivate even more new users to join, and our current top forecasters to be even more consistent in filling out the surveys. This can only help improve the BASON signal.

Second, we found that 40~50 top-performing users contribute a very sizable share of the statistical significance of the signal (the Pareto principle also works here). The Top 20 was too narrow of a group to reward all of those who contributed every week to the accuracy of the signal. This means that we will be expanding the reward base in the years to come as well!

Lastly, our Fund has grown 5X in size in 2024. If we continue to grow and repeat the performance of the past two years, as we hope, our annual reward pool should increase considerably. If that happens, every rank (the current Top 20) that will share the annual reward in 2024 might, under new rules in 2025, get a 90% to 200% increase in the particular rank’s reward value. And to this pool we add 20 more ranks.

If we repeat the growth and performance of 2024 the upside for our users that are rewarded for their accuracy, which is at the core of the Fund’s success, will be significantly higher. We expect this will happen and we hope to be in a fantastic position to reward as many users as possible. However, as you know, past performance is no guarantee of future returns.

But if you help us by joining the survey or spreading the word we will do our best to use the BASON signals to generate great returns and share the proceeds along the way.

Good luck in 2025!

Last week’s performance

Last week, the Federal Reserve took a bold step, opting for a hawkish pivot in their economic forecasts during the FOMC meeting. The spotlight was on the updated projections which saw the Fed raise the anticipated rate from 3.4% to 3.9% and adjust the long-term target rate from 2.9% to 3.0%. This adjustment, reflective of increased PCE inflation expectations moving from 2.1% to 2.5%, sparked significant market sell-offs.

During the press conference, Fed Chair Jerome Powell pointed out the “uncertainty around inflation”. This stance sent the SPX tumbling by 3%, the NDX by 3.6%, and rocketed the VIX up by 73%, indicating a rush to risk aversion. Following this, Friday saw a stark reversal with an almost complete V-shape recovery in the markets, triggered by a softer PCE report.

This week, as markets operate on shortened hours on Tue, and with a closure on Wednesday for Christmas, we anticipate a low vol week. On Tuesday we get updates on new home sales and durable goods orders, and the regular jobless claims on Thursday. That’s pretty much it.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.

Merry Christmas !!!!! To you and your family