Welcome back dear users.

First of all, please accept our apology over the survey not working properly last week. We were transferring the system to our new survey app, and because of it, the values for the week were reset to default settings, which is why many of you noticed that the ranges for most parameters were way off. Once the survey was live it was impossible to change them back.

Because of this, we won’t take week 10 into account for any of your scores. It wouldn’t make sense due to misplaced range values.

However, all this perturbation means we are close to our new and improved version of the survey. Oraclum Surveys 2.0! Here’s a sneak preview into how it will look like, starting from the first week of July 2023:

Cool, huh?

We’ll let you in on all the details, and we’ll do a video walk-through of the new survey to show you all the changes and new features.

We expect no more difficulties in transferring from one system to another, but glitches are always possible, so bear with us in that first week of July.

But before all that, two more weeks left on our old survey:

Week 11 and 12, the final two weeks of June and Q2. Make them count!

Last (two) week’s performance

Over the past two weeks markets kept going up. Not even the hawkish message from last week’s FOMC - where the Fed kept rates unchanged, but signaled two more hikes before the year-end - was enough to push markets down. Even trading on Wednesday after the announcement sent markets back up after an initial negative reaction, while Tuesday saw a post-FOMC rally. The only reversal came late Friday, which was the quarterly options expiry day (notice the spike in volume in the final 30 mins).

We didn’t participate with our options positions last week due to our survey signal not being ready, but we did trade the week before, taking advantage of another good directional prediction for SPX.

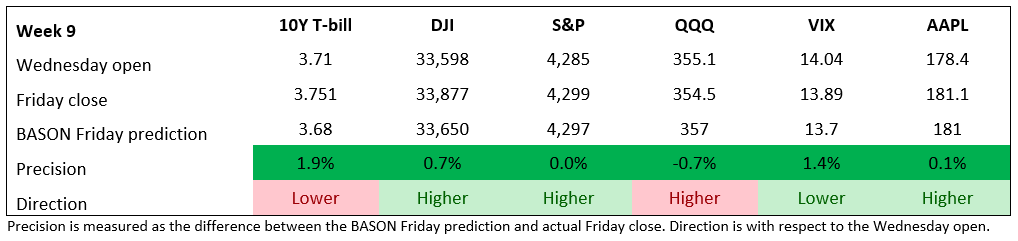

Not only that, the SPX prediction was almost perfectly accurate for Friday June 9th: 4,297 compared with 4,299. Pinpoint.

Every other indicator finished within 2% errors, even with a slight miss in direction for the 10Y T-bill and QQQs.

This week, the market was closed yesterday, we get housing data in the mid-week, and PMI on Friday, but most importantly, Powell is doing a two-day testimony in front of Congress on Wed and Thu. Expect volatility here. The market will once again wager every single one of his words. Silly, but that’s our reality :)

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter!