It was a weird week in markets. We got a 25bps cut from FOMC this week, widely expected, and we got further confirmation of three cuts before the end of the year - one for each FOMC meeting left. Powell’s statement was more hawkish, as he talked about a slowdown in labor markets and upside risks to inflation. Basically, his tone signaled stagflation.

Market reaction? Well equities went up eventually, but most of the move was overnight Wed to Thu (when liquidity is typically lower). The rest of the time it was merely sideways, as if still digesting the news.

But for me, the most significant reaction didn’t come from equities or other risk assets, it came instead from the bond market. Yields shot up after FOMC, and continued their assent the next day.

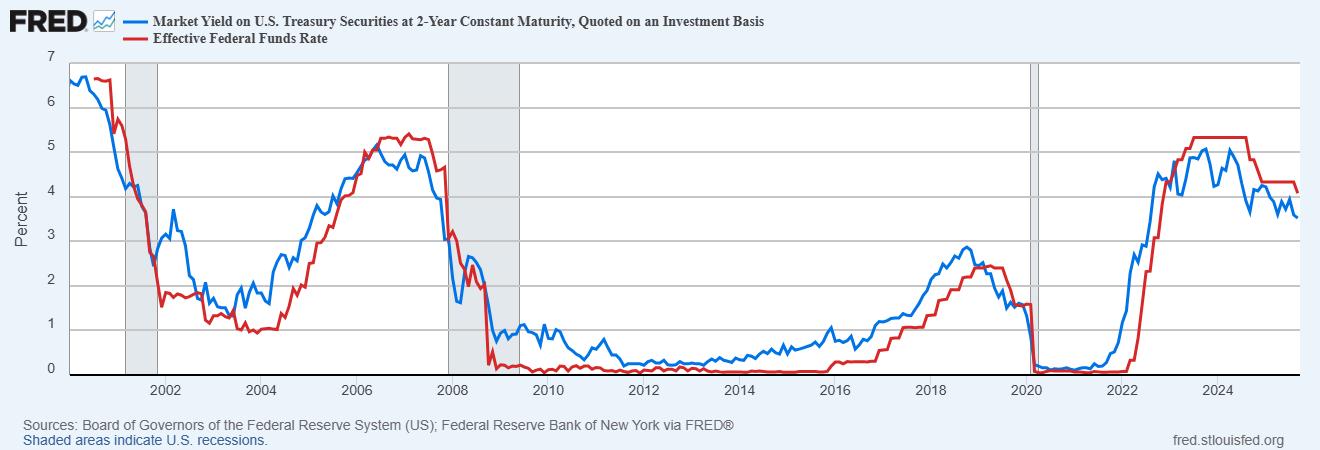

When central banks cut rates, bond yields should go down (and most often they do). Why? Because they are anchored on CB rates. The 2Y is especially reflective of this - it is often seen as a way for bond traders to frontrun CB decisions, but it’s usually well anchored around the CB rate, as can be seen here:

This can mean two things. Either the bond market overpriced the Fed cuts, and expected too much too soon, so it needed to adjust upwards (which is why the 2Y went from 3.5% to 3.6%), or this is sign that the bond market doesn’t believe the Fed’s rate cut projections and is more concerned on inflation remaining a problem in the medium run. Hence the 10Y climbing back above 4.1%.

If anything, this adds additional uncertainty and makes it very puzzling as to why equities went up on Thursday (and even a bit on Friday). One reason could be that most investors were short into FOMC, expecting a “sell-the-news” type of event - 25bps is priced in, and any hint of hawkishness could be a good sign for a reversal. However, when a trade is crowded, especially on the short side, and those shorts get closed already on the day (during Powell’s speech, e.g.), we could have gotten a simple short squeeze into Thursday. This could explain why markets remained mixed throughout the day. Of course, it’s hard to tell why exactly.

I spoke about this a bit on the NYSE floor yesterday, have a look:

September window of weakness

Well, now that the FOMC is over, we are back to our playbook from before. We are entering the traditional September window of weakness period over the next two weeks. Or as some traders would say: sell Rosh Hashanah, buy Yom Kippur (ChatGPT it).