Dear readers,

thank you all for being with us this year. Thank you to our investors for trusting us and for believing in us, thank you to our paid subscribers for your support, thank you to our diligent survey participants without whom the BASON would not exist, thank you to our new subscribers for joining us, and to everyone who is an avid reader of the newsletter.

If we can sum up our 2023 in one word it would be: volatility. It’s been a year full of ups and downs, but a year that we nevertheless end up on a high, with an almost 20% YTD return, and with an almost 40% return since our March lows when we dropped the losers and continued to gradually build back. In those 9 months in particular, we have beat every benchmark out there.

Today, we will show you in detail our 2023 performance, and announce the competition winners of both Q4 and 2023. Congratulations to all!

Let’s begin.

A year in review: video

In this video, I explain what we did this year, what went wrong, how we fixed it, how the BASON works in general, and what the future holds for our fund. It’s not too long, only 9 minutes, open it up and enjoy:

In light of our announced funding targets for next year, we are accepting new investors, and are happy to accommodate you if you’re interested.

If you’re an accredited investor, we invite you to express interest on this link, obviously non-binding and only informative, so that we can get in touch:

NOTE: We are allowed to “generally solicit and advertise” the existence of the fund under Rule 506(c) of Regulation D of the Securities Act of 1933 in the United States, but we are only allowed to respond to accredited investors. If you are not an accredited investor, please refrain from contacting us over this matter.

2023 performance

You saw most of it in the video, but we are happy to provide a few figures here as well.

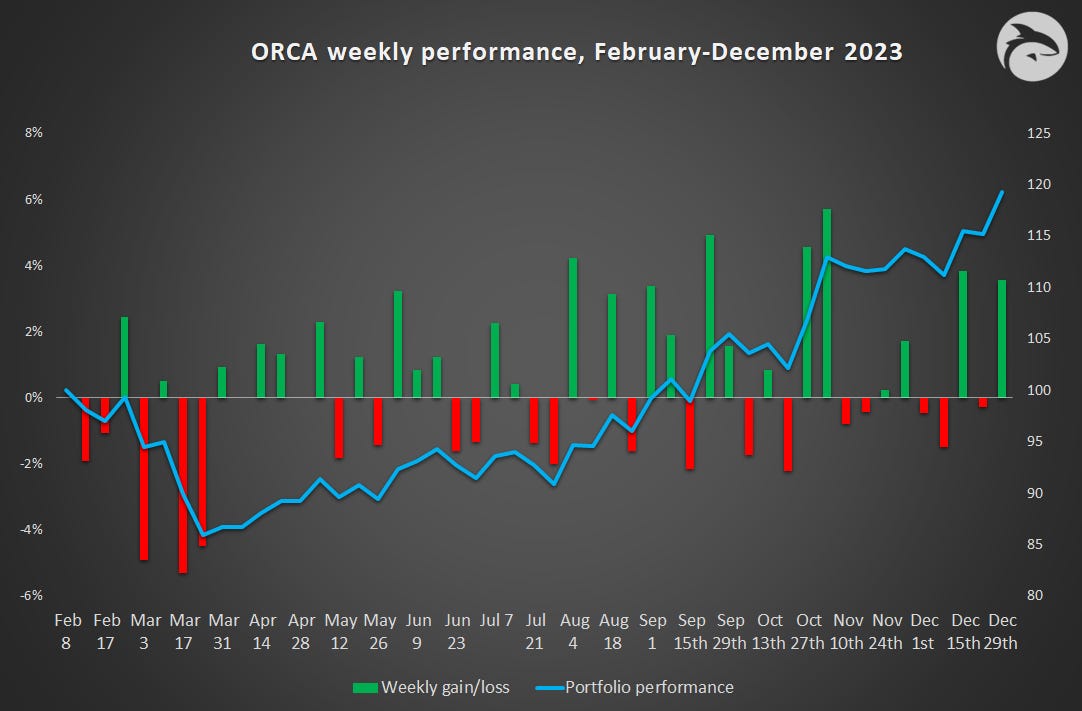

As we explained in the video, after figuring out what went wrong in March, we dropped all the losing strategies, and had to lower trading sizes, thus lowering risk exposure to only 1% each week initially, in Q2. Notice a clear difference in returns achieved during Q3 and Q4 and during Q2.

There is a very good reason for this. It took us a while (5 months) to get back to breakeven, especially given lower risk exposure. Once this was finally achieved in August, we could increase risk exposure and increase our sizing, which resulted in much bigger returns. Over the past five months, in four months we had 5% or higher monthly returns. And not a single losing month since July.

When we got it right, and the markets really pushed strongly in our direction, we could count on 4% to 5% returns for that week. When we got it wrong, we risked only up to 2% of our overall portfolio for that week. This is in stark contrast with our March and February performance where the losses amounted to 5% weekly, while the gains were subdued.

We made 37% since those March lows sticking to one simple strategy. It was and still is a clear sign of where our focus should be.

We did this with a Sharpe ratio of 2.4, a Sortino ratio of 2.9, and a very low correlation with the market (0.23), meaning that the strategy is indeed a great diversification method, and is still able to consistently beat the benchmarks.

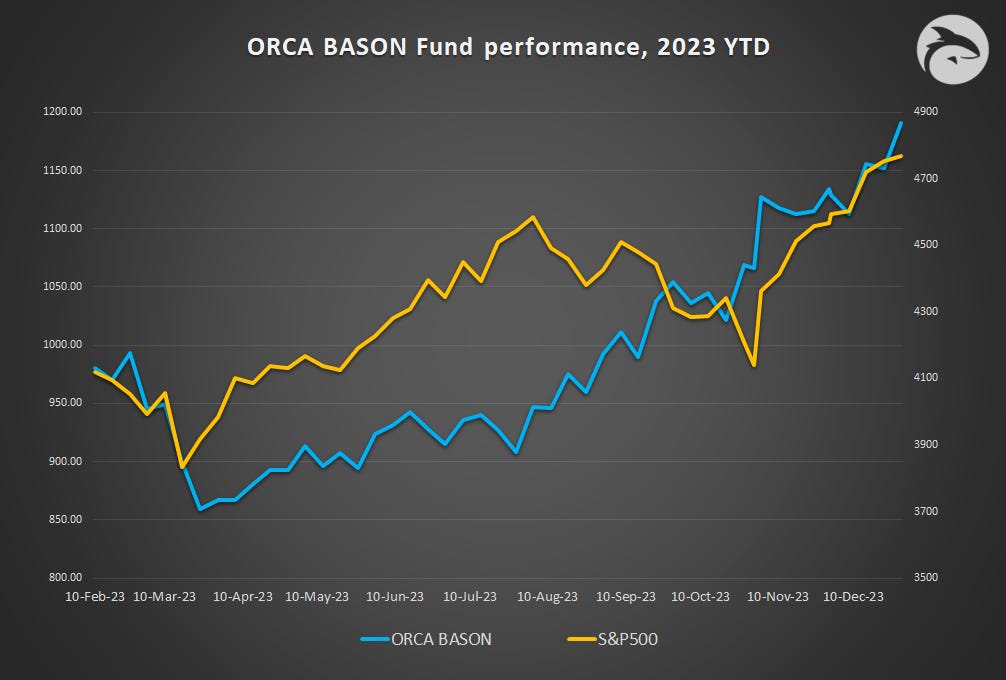

Even if we compare ourselves with S&P since February 8th, when we started trading, we have outperformed it (before fees).

Benchmarks

This was the year when equities outperformed everything else. S&P500 delivered 24%, the NASDAQ 30%, MSCI World index of global equities made 14%, and the EUROSTOXX index made 9%. Most emerging markets did great as well (e.g. Brazil, Mexico, India, all with double digit returns), with China being the only big market to really disappoint.

Other asset classes had a poor year, especially when compared to equities. Bonds overall did bad for the third year in a row, still reacting poorly to high interest rates, commodities ended up negative, which was expected amid strong disinflationary trends, while gold delivered a decent, but still relatively low 5% return. The entire year ended up being “risk on”, as riskier assets like AI-driven tech stocks and cryptocurrencies heavily outperformed.

In that light, the BASON did a decent job with a 19% return, despite slightly lagging behind the two major US indices and some emerging market indices.

However, if we focus on comparing ORCA’s returns to that of all other benchmarks since March 31st, since we fixed our strategies and gradually made a comeback of over 37%, in those 9 months we outperformed every single aforementioned benchmark:

Last but not least, it also makes sense to have a look at our performance with respect to the aggregate performances of other hedge funds. While some individual names surely had great years (we have to wait for the final reports in January), on aggregate the performance was subpar, underperforming the equity benchmarks, and almost all underperforming the BASON (with the marginal exception of hedge funds focused on Technology stocks). The table below shows a comparison of all such fund indices, aggregated by BarclayHedge.

Competition winners!

It was pure joy watching how the competition unfolded this year. We had a race to the top till the bitter end. Two of our top performers were locked into a fight that wasn’t resolved until the very last week.

In the end, it was the user named “jo_prelo” who won the whole thing, huge congrats! That took some consistency over the entire year. Especially since coming in at second place was “User27890”, who won the competition in both Q1 and Q2. A worthy battle between our two top performers.

Looking at the entire winners list, we see some very familiar names, and are very happy to have you all being engaged for so long. Thank you once again, your performance will be rewarded.

The distribution of the annual rewards is defined in the competition rules (Article 10). We will distribute a total of 3% of what we made as a fund this year (not investor profits, the fund profits).

NOTE: Please give us until the end of January to distribute the rewards, both annual and quarterly will be paid out together. We need to get the final accounting package done to calculate the full performance fees across all investors, take out the performance fees, and then we allocate the 3% of our profits to all of you.

In Q4 it was even more brutal for the top spots. Eventually, a new user won it, under the anonymous handle “User28895”, beating Ivan and the overall winner “jo” by a very tight margin.

Congratulations to all of you making the top 20 in both the quarterly and the annual rankings. We look forward to paying you your well deserved prizes!

With that we wish you all a very happy new year! May it be prosperous and successful, and may the markets be steady and predictable - to whatever extent they can :)

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.