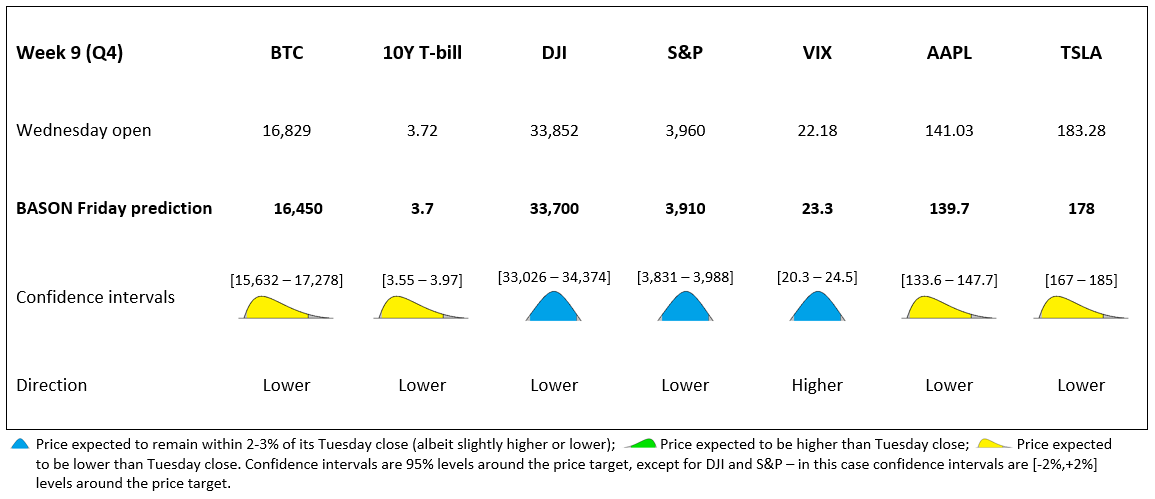

Predictions for Friday, December 2nd 2022

Quick summary:

Markets were expected to finish lower this week

Yesterday’s Powell speech sent markets up, breaking our option price targets so we ended up not opening the options positions at all

We just opened the long-shorts, and kept the usual macro plays with hedges

Watch this tutorial video to see how we trade this and how to interpret our predictions:

NOTE: If you wish to get our updates immediately on Wednesday as the market opens, make sure to fill out the prediction survey on Tuesday (and, if you haven’t already, leave your email WITHIN THE APP - click on the link to see how). We reward our participants with early indications of where the market will end up. Everyone else gets the results a day and a half later.

Thanks for following us, feel free to share to your friends:

Our weekly predictions are here, available exclusively to our subscribers (competition participants get it a day and a half earlier if they leave their email), for Friday, December 2nd, 2022 (4pm EST; at market close). Keep in mind that our accuracy is much better for low volatility assets, so interpret the predictions with caution. For an overview of our accuracy thus far, see here.

Our estimate for the Friday close for our 5 major indicators and 2 stocks this week is the following:

Powell’s speech was the key event yesterday (it was basically like an FOMC event, at least according to the market reaction) and it moved markets against most of our positions. We warned our survey users not to engage in any trades until after Powell’s speech. By the time we were looking to open, the prices moved so far away from our triggers that there was no point opening the positions at all. We notified all our regular survey users of this.

For us, this was a good call given that markets shot up fast in a classic short squeeze rally. Our short positions were opened on Wed after the market open (see below), but they were closed as the rally went heavily against us. So a loss was incurred there ($650 total loss to be exact), as was with the macro shorts ($300 loss for now). But the macro hedges are performing really well (up $500), so we’ll let them run their course by Friday. Should be a lackluster performance similar to last week. Still protecting our annual returns.

How did we trade this?

As said, no options positions this week in our BASON strategy. We opened the long-shorts as follows:

SPY short: sold $6518 worth of SPY shares (at $395.3 per share)

DIA short: sold $6518 worth of DIA shares (at $338.4 per share)

UVXY long: bought $7822 worth of UVXY shares (at $8.00 per share)

We lost on each of these and closed them in the midst of yesterday’s rally. We are also down in our macro positions (short $10.4k in SPY and $10.4k in QQQ), but are up on our OTM call hedges expiring in March 2023.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Keep following us on Twitter to stay informed about the weekly survey each Tuesday.