Quick summary:

Markets expected to finish lower this week, in the wake of higher than expected CPI inflation numbers

Trading SPY condors* at 370/371 to 384/385 and SPY put at 385

Trading DIA condors* at 301/302 to 311/312 and DIA put at 310

Watch this tutorial video to see how we trade this and how to

interpret our predictions:

*NOTE: We changed the way we buy the condors - one leg at a time, instead of all together. In the video, this simply means we first trade the bear call spread, and then the bull put spread, with individual stop-losses on each.

See the explanation in the final section of the post as to what this means.

NOTE: If you wish to get our updates immediately on Wednesday as the market opens, make sure to fill out the prediction survey on Tuesday (and, if you haven’t already, leave your email WITHIN THE APP - click on the link to see how). We reward our participants with early indications of where the market will end up. Everyone else gets the results a day and a half later.

Thanks for following us, feel free to share to your friends:

Our weekly predictions are here, available exclusively to our subscribers (competition participants get it a day and a half earlier if they leave their email), for Friday, July 15th 2022 (4pm EST; at market close). Keep in mind that our accuracy is much better for low volatility assets, so interpret the predictions with caution. For an overview of our accuracy thus far, see here.

Our estimate for the Friday close for our 5 major indicators and 2 stocks this week is the following:

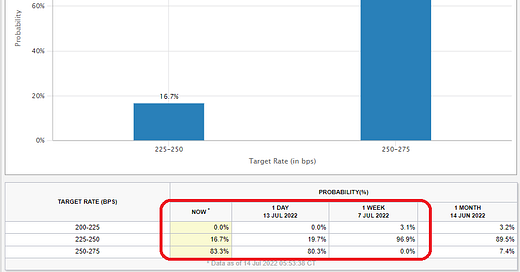

Yesterday the new CPI numbers for June came out. Consumer prices increased 1.3% in June, which makes it a 9.1% inflation over the past 12 months, beating all consensus expectations. Core inflation (minus food and energy) also went up higher than expected, to 5.9%. The consequence? The markets are now pricing in a 100bps increase of Fed interest rates at the Jul 27th meeting. The probability went from 7.6% 24 hours ago (and 0% a week ago!), to over 83% today! That is some shift in expectations.

Most likely, the markets will decline as a consequence of this, as the BASON has anticipated even before the inflation rate was announced (remember, all of these predictions were made before the CPI numbers came out - the survey closed half an hour before it).

We’re expecting lower values for both the main indices, both of our stocks, and for Bitcoin. The 10-year T-Bill however is expected to go slightly higher (although it’s more likely that investors will flock to bonds now, pushing the yield down, but never mind), and the VIX is expected to pick up this week.

How did we trade this?

We traded 370/371 to 384/385 SPY 15/07 as-if iron condor (10 contracts) for $460 immediate gain. But as emphasized, we bought separately the bull put spread (370/371), and the bear call spread (384/385), placing a 50% stop-loss on each strategy.

This means we further limit our overall losses where only one of these two is eliminated if the price breaks the bounderies.

We also bought an ITM put for downside protection, 1 SPY 385p 15/07 for $9.72. A high price to pay, but it was a necessary hedge in case the markets react with a substantial sell-off.

Same thing for DIA, 301/302 to 311/312 DIA 15/07 (10 contracts) for $420 immediate gain, with separate put (301/302) and call legs (311/312).

And one ITM put, DIA 15/07 312p for $5.9.

The puts have 70% stop-losses today, and 50% tomorrow.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Keep following us on Twitter to stay informed about the weekly survey each Tuesday.

Vuk - I sent you a DM on an alternate way to play this with a diagonal calendar Strategy. There’s no right or wrong on this. Just something to track.