Quick summary:

Predicting markets to end the week higher

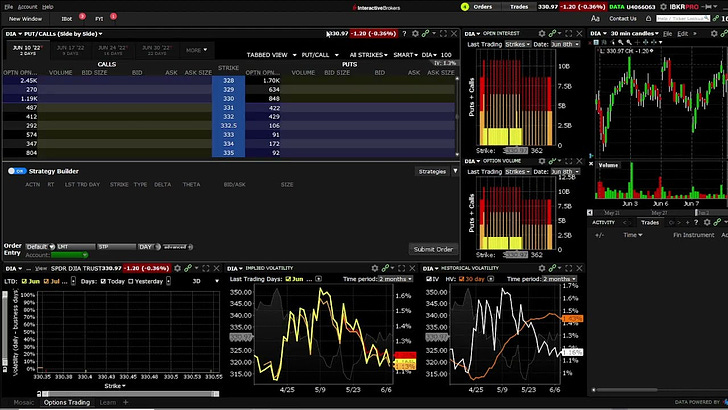

Trading SPY condors at 380/381 to 394/395 and SPY call at 380

Trading DIA condors at 307/308 to 317/318 and DIA call at 308

Watch this tutorial video to see how we trade this and how to

interpret our predictions:

NOTE: If you wish to get our updates immediately on Wednesday as the market opens, make sure to fill out the prediction survey on Tuesday (and, if you haven’t already, leave your email WITHIN THE APP - click on the link to see how). We reward our participants with early indications of where the market will end up. Everyone else gets the results a day and a half later.

Thanks for following us, feel free to share to your friends:

Our weekly predictions are here, available exclusively to our subscribers (competition participants get it a day and a half earlier if they leave their email), for Friday, July 1st 2022 (4pm EST; at market close). Keep in mind that our accuracy is much better for low volatility assets, so interpret the predictions with caution. For an overview of our accuracy thus far, see here.

Our estimate for the Friday close for our 5 major indicators and 2 stocks this week is the following:

Last week we missed the rally, this week we might miss the sell-off :)

Today is the options end of month expiration, so it’s quite possible the day ends up lower, thus taking out both of our call options for the directional hedge (reaching their stop-loss values).

However, we are still keeping the positions in hope of a Friday rebound.

How did we trade this?

We traded 380/381 to 394/395 SPY 01/07 iron condor (10 contracts) for $490 immediate gain. We bought a call for upside protection, 1 SPY 380c 01/07 for $4.36.

For DIA we are trading the following iron condor: 307/308 to 317/318 DIA 01/07 (10 contracts) for $400 immediate gain. We are also buying 1 DIA 01/07 308 call for $4.9.

If the market continues to sell-off on Friday as well, we will have to endure another bad week, albeit with limited losses. If it bounced back, the condors will be in the money and we’ll have a profitable week.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Keep following us on Twitter to stay informed about the weekly survey each Tuesday.

Hi, I'm new to the substack. I'm trying to wrap my head around all this.

So these price predictions are submitted by survey participants on Tuesday and then Wednesday the confidence intervals are sent out to all poll participants. So if you complete the poll, you will be emailed the confidence intervals?

My next question is when is the stop loss executed for both the condor and the hedger call or put? It sounded like you execute the stop loss when you receive a 50% loss on either. Do you execute this right before market close, or as soon as the strategy loses 50% or more?

Lastly, how do you determine which way you want to hedge? if the BASON model predicts a higher week, you'll buy a call at the same strike as the upper bound of the condor? If the BASON model predicts the market to fall you will buy a put at the lower bound strike of the condor?

Thanks.