Predictions for Friday, June 10th 2022

Quick summary:

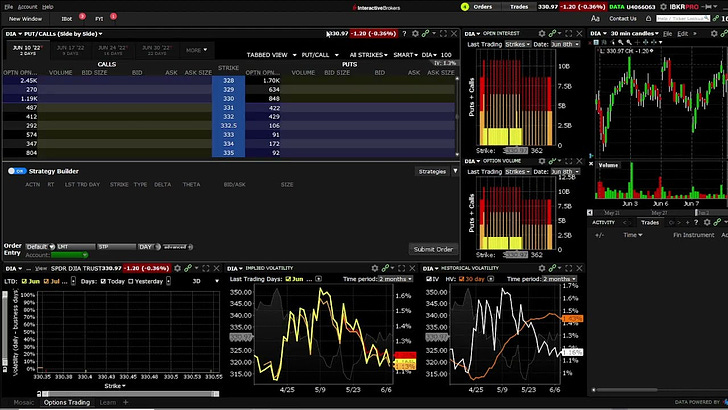

Markets expected to go down this week (see attach)

Buying puts for downside protection

Trading SPY condors at 405/406 to 419/420 and SPY put at 420

Trading DIA condors at 323/324 to 333/334 and DIA call at 334

NEW: A video explaining how to trade based on our predictions.

We have uploaded a video explaining how to read our BASON predictions that you receive every week, followed by a tutorial of how to make option trades based on our predictions through the IBKR trading platform.

IMPORTANT: Read the disclaimer below!

NOTE: If you wish to get our updates immediately on Wednesday as the market opens, make sure to fill out the prediction survey on Tuesday (and, if you haven’t already, leave your email WITHIN THE APP - click on the link to see how). We reward our participants with early indications of where the market will end up. Everyone else gets the results a day and a half later.

Thanks for following us, feel free to share to your friends:

Our weekly predictions are here, available exclusively to our subscribers (competition participants get it a day and a half earlier if they leave their email), for Friday, June 10th 2022 (4pm EST; at market close). Keep in mind that our accuracy is much better for low volatility assets, so interpret the predictions with caution. For an overview of our accuracy thus far, see here.

Our estimate for the Friday close for our 5 major indicators and 2 stocks this week is the following:

The bear rally that was present for the past several weeks is likely to subside this week, although we have to emphasize the new inflation numbers due tomorrow before markets open (8:30am ET). There will most probably be a knee-jerk reaction tomorrow morning after the release, so to be on the safe side we will activate the stop-loss (i.e. take profit) orders already today by the end of trading.

This is in case we get a massive surprise on the upside that could kill of our profits for the week. However, it is also a protection against a large move downwards that would break the lower confidence intervals of our condors.

How did we trade this?

We traded 10 SPY 10/06 iron condors, ranging from 405/406 to 419/420 for $480 immediate gain.

In addition, we bought one SPY 420 10/06 put for $6.23 per contract (reached $9 at close yesterday).

Similar play for DIA 10/06, where we traded the following iron condor: 323/324 to 333/334 (10 contracts) for $440 immediate gain, and one DIA 10/06 put at 334 bought for $4.2.

If the market continues to go down, and ends up within our condor C.I.s, we stand to make a decent profit once again. If it reverses on Friday after the inflation report, our puts will reach their stop-orders, and we will still carry a decent profit.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Keep following us on Twitter to stay informed about the weekly survey each Tuesday.