Predictions for Friday, November 4th 2022

Quick summary:

Markets expected to finish lower this week

In light of Powell’s speech yesterday we warned our survey users to WAIT placing positions until after Powell’s speech, despite our predictions of the markets going lower

Why? Cause post-FOMC events tend to trigger rallies which might hurt the put positions.

So we waited and about 15 mins into Powell’s speech placed the following:

Trading SPY condors at 374/375 to 390/391 (separate legs!) and SPY put at 390

Trading DIA condors at 319/320 to 330/331 (separate legs!) and DIA put at 330

Portfolio positioning: no long-shorts this time (don’t want to go too bearish), macro remains short with hedges (see below)

Watch this tutorial video to see how we trade this and how to interpret our predictions:

NOTE: If you wish to get our updates immediately on Wednesday as the market opens, make sure to fill out the prediction survey on Tuesday (and, if you haven’t already, leave your email WITHIN THE APP - click on the link to see how). We reward our participants with early indications of where the market will end up. Everyone else gets the results a day and a half later.

Thanks for following us, feel free to share to your friends:

Our weekly predictions are here, available exclusively to our subscribers (competition participants get it a day and a half earlier if they leave their email), for Friday, November 4th, 2022 (4pm EST; at market close). Keep in mind that our accuracy is much better for low volatility assets, so interpret the predictions with caution. For an overview of our accuracy thus far, see here.

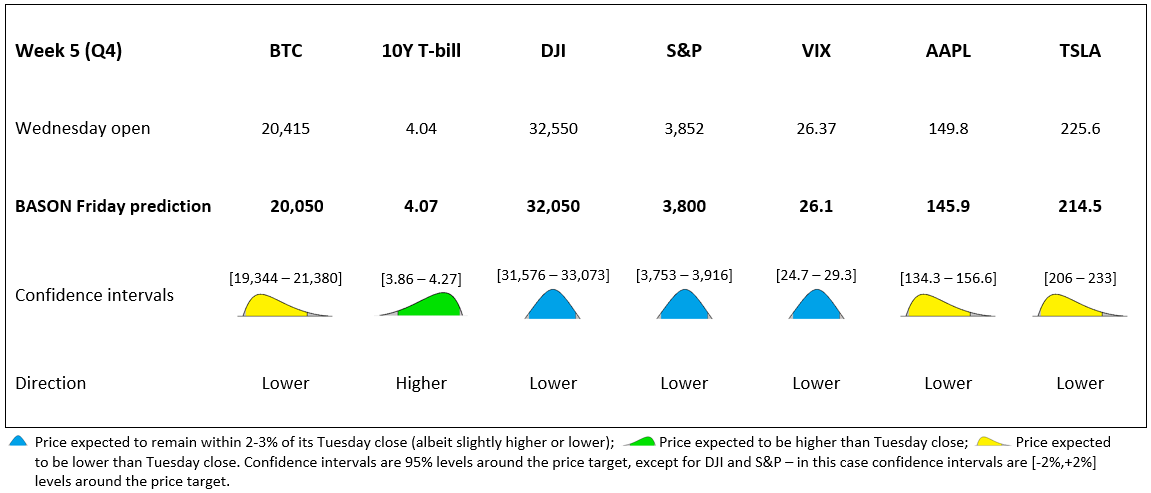

Our estimate for the Friday close for our 5 major indicators and 2 stocks this week is the following:

Now, these predictions have already been voided basically. Powell’s very hawkish speech sent the S&P down 2.5% and the NASDAQ 3.3%. We are already below our targets, meaning that our puts and bear call spreads could deliver the bulk of our return this week.

What happened yesterday? Well, pretty much what we warned our users about: an initial reaction was a knee-jerk up move, following the FOMC statement which, to some at least, hinted about slowing down rate hikes. But then, as Powell came on, he was adamant in suggesting that the Fed has no intention of slowing and that the terminal rates will be *higher* than what the market currently expects. That was the first statement that turned things around. An even more important statement was this one:

''Risk management is key here: if we were to overtighten, we could use our tools to support the economy later on; but if we failed to tighten enough, inflation would become entrenched and that would be a much bigger problem''.

In other words, for the Fed, a greater risk than overtightening is not tightening enough. Pretty much a repeat of his Jackson Hole statement from late August - a statement that also killed the rally and set the stage for further declines in September (one of our best performing months btw).

How did we trade this?

As stated in the summary, we warned our users (those who leave their emails to get our trading signal on Wednesday), not to place trades until *after* Powell started his speech, depending on how the markets initially react.

We opened our positions right about after Powell’s key remarks in the speech. We traded the following:

25 SPY bull put spread at 374/375 and 25 SPY bear call spread at 390/391 for a total of $1000 premium. We stand to lose by closing one of the legs (the bull put spread most likely, for a loss of up to $450).

We also bought 2 SPY 390 04/11 puts for $8.2. The price at the close of trading yesterday was at $15.46. So we raised the stop-limit order to $14 to pick up immediate profits today in case it starts going against us.

Similar for DIA: 25 DIA bull put spread at 319/320 and 25 DIA bear call spread at 330/331 for a total of $950 premium. We stand to lose by closing one of the legs (the bull put spread most likely, for a loss of up to $500).

In addition, we got 2 DIA 330 04/11 puts for $5.9. The price at the close of trading yesterday was at $8.8. We raised the stop-limit order to $7 to pick up immediate profits today in case it starts going against us.

We decided not to place any outright long-short positions this week. The options positions are very bearish as is, so there is no need to add fuel to the fire and expose ourselves to a potential rally (even though we would still grab a bulk of the options profits either way). We did keep the macro positions plus half the usual hedges (positions cut short).

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Keep following us on Twitter to stay informed about the weekly survey each Tuesday.