Predictions for Friday, September 23rd 2022

Quick summary:

Markets expected to finish lower this week (compared to Wed open)

NOTE: We warned our survey users that the post-FOMC event might trigger a daily rally! (due to high implied volatility prior to the event). And we urged the users to WAIT with opening their positions for the week until after the FOMC event.

We opened the positions half an hour before close on Wednesday:

Trading SPY condors at 372/373 to 386/387 and SPY put at 386

Trading DIA condors at 297/298 to 310/311 and DIA put at 310

Watch this tutorial video to see how we trade this and how to

interpret our predictions:

NOTE: If you wish to get our updates immediately on Wednesday as the market opens, make sure to fill out the prediction survey on Tuesday (and, if you haven’t already, leave your email WITHIN THE APP - click on the link to see how). We reward our participants with early indications of where the market will end up. Everyone else gets the results a day and a half later.

Thanks for following us, feel free to share to your friends:

Our weekly predictions are here, available exclusively to our subscribers (competition participants get it a day and a half earlier if they leave their email), for Friday, September 23rd, 2022 (4pm EST; at market close). Keep in mind that our accuracy is much better for low volatility assets, so interpret the predictions with caution. For an overview of our accuracy thus far, see here.

Our estimate for the Friday close for our 5 major indicators and 2 stocks this week is the following:

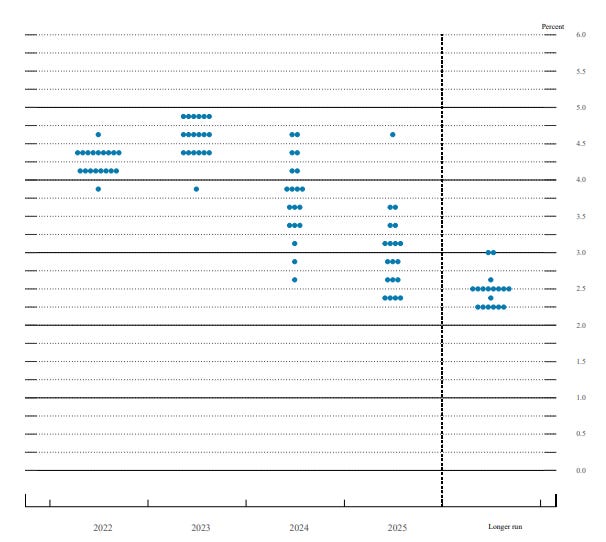

Yesterday was an exciting day. The Fed raised rates by 75 basis points for the third time in a row this year. Interest rates are now at 3.25%, and expectations for the next meeting are another 75bps, taking them up all the way to 4%. We’ll enter 2023 with 4.5% most likely. Again, think about what this does to credit markets, to consumers, to businesses. As I’ve said repeatedly since at least March, a recession is inevitable.

The Fed also produced a new dot-plot graph that signals very high tightening to continue into 2023. They are highly committed to bringing down inflation to its 2% target.

What does this mean for us? Well, the BASON suggests a lower week. We’ve already pierced through our SPX 3800 target for the week. It could go even lower.

But yesterday it was really important to keep steady, as we’ve warned our competition participants. Powell’s speeches tend to trigger brief rallies as implied volatility of options is typically very high coming into the event. Once the event is over, it drops sharply, leading to a relief rally - as it has during each FOMC meeting this year.

Yesterday the same happened but it only lasted for about 45 minutes - enough to kill your options positions if you placed them too early.

We waited until about half an hour before close and sent out another email to our users notifying them of our positions. Here they are:

How did we trade this?

As per our predictions, this week we're trading 372/373 to 386/387 SPY 23/09 iron condor (10 contracts) for $520 premium. Stop loss is at 50%.

We bought a put for downside protection, 1 SPY 386 put 23/09 for $4.35. Stop loss is at 50%.

For DIA we are trading the following iron condor: 298/299 to 310/311 DIA 23/09 (10 contracts) for $300 immediate gain. We also bought 1 DIA 23/09 310 put for $5.30. Stop loss is at 50% for both.

No UVXY this time, the range is too small.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Keep following us on Twitter to stay informed about the weekly survey each Tuesday.