Q1 2024: performance overview

Up 12.5% YTD

*NOTE: All reported are gross returns, before fees. Performance fees are 25% subject to a 2% quarterly hurdle (8% annual), high watermark applied. This basically means that we cannot apply a fee unless we keep making more each quarter.

March closed on a high note for the ORCA BASON Fund, marking a continuation of great performance we initiated in February and wrapping up another excellent quarter. Our monthly gross return in March soared to 4.19%, culminating in a year-to-date gross return of 12.57%.

This was the third quarter in a row in which we made a double-digit return, as shown in Figure 2. This goes to show that our change of strategy since March 31st 2023 is finally yielding the expected level of performance. Soon enough, as our returns continue to grow, we will keep gradually expanding our risk exposure, thus potentially growing even higher.

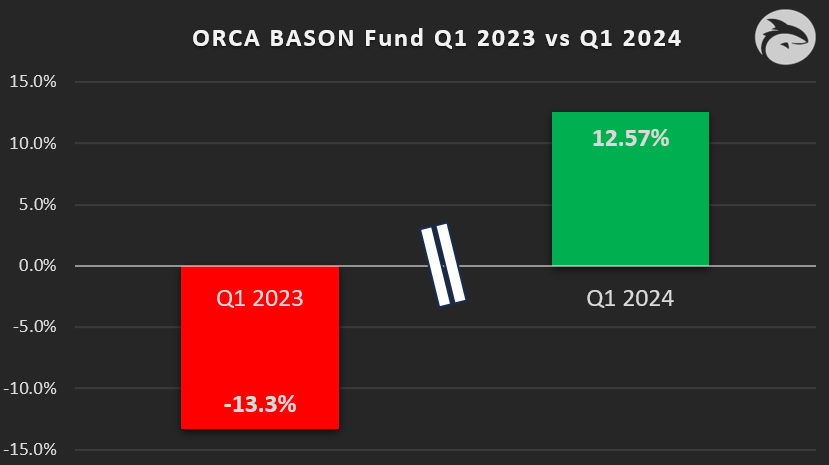

We cannot help at noticing the immense difference this entire year has made, perfectly exemplified in Figure 3. This time last year, we were struggling with our failed strategies, and had to dramatically reduce risk exposure. Fast-forward a year later, and the perspective has completely inverted. Worlds apart, our two Q1 quarters.

We also cannot help at noticing that the impressive performance over the last three quarters stems from lessons learned in Q1 of the previous year, leading us to refine our BASON strategy. By focusing exclusively on directional options from 2024, eliminating the macro aspect, and using the rest of our AUM as collateral hedge, we've made our approach more systematic, greatly benefiting our investors.

The first quarter of 2024 showcased the effectiveness of our strategy, as evidenced by the weekly returns in Figure 1. With more winning (7 weeks) than losing weeks (5 weeks), the wins and losses were mostly balanced, with exceptions in high-return weeks: February saw gains of 6% and 3%, and March had weeks with 3% and 3.7% gains.

Benchmark comparison: March and Q1

Good performance has continued across asset classes in March, and this time BASON beat all but one: gold, which outperformed all others and by some margin. A sign of things to come? Perhaps. Gold is a recession-proof asset (better than bonds and most other hedges), and investors tend to pile on when they expect a recession. Do we expect one? Not this year. But we are more than ready for a correction.

In March, the BASON tied with the European equity index, but beat S&P500, NSADAQ, global equities, commodities, bonds, and Chinese equities.

When you look at the entire quarter, the BASON again stands out and beats all others. Just barely the European equity index (12.6% vs 12.4%), but is coming in stronger than S&P500 (10.2%), NASDAQ (9.1%), global equities (MSCI, 8.4%), gold (8.1%), commodities (0.3%), and the two declining assets, Chinese equities (-3%), and US government bonds (-1.9%).

Consistency is what matters, however, and this is our third quarter in a row where we are able to outperform (or at least tie) with all of our main benchmarks. No other asset class delivers the same consistency with the same double-digit return each quarter.

Thanks for reading! Next week we’re back with our regular Saturday paid content and macro positioning. We’ll talk about QT and the so-called “no landing” scenario.

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.