Quick summary:

Congrats to all Q3 winners! Today we kick off the Q4 competition, the final quarter of the year. Let’s end the year on a high note!—click here to join the action.

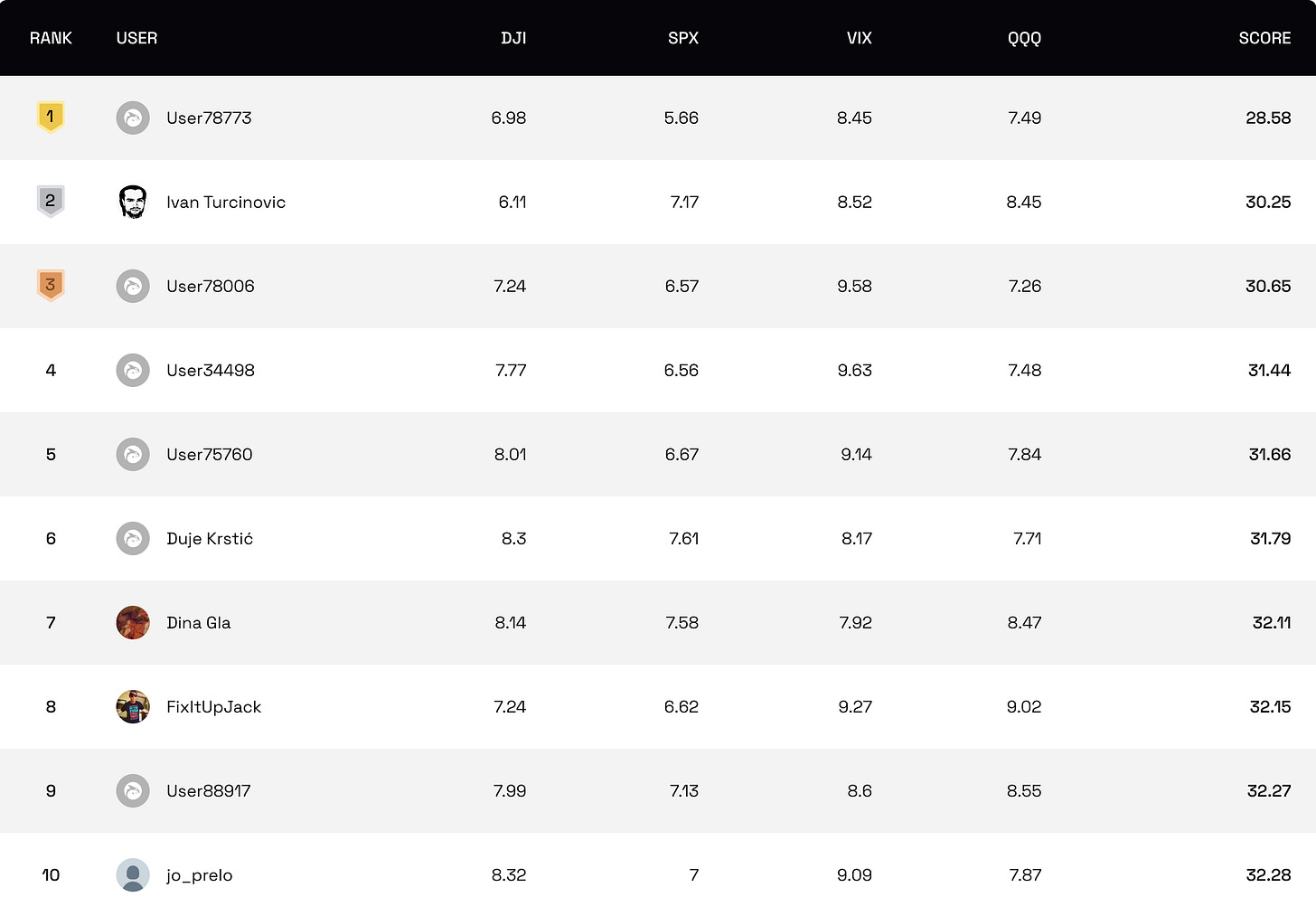

This Q3, our competition was as fierce as ever, marked by a 1.67 point difference at the top. This speaks to the high stakes and keen strategies employed. Congratulations to our winners and a great job to all who participated!

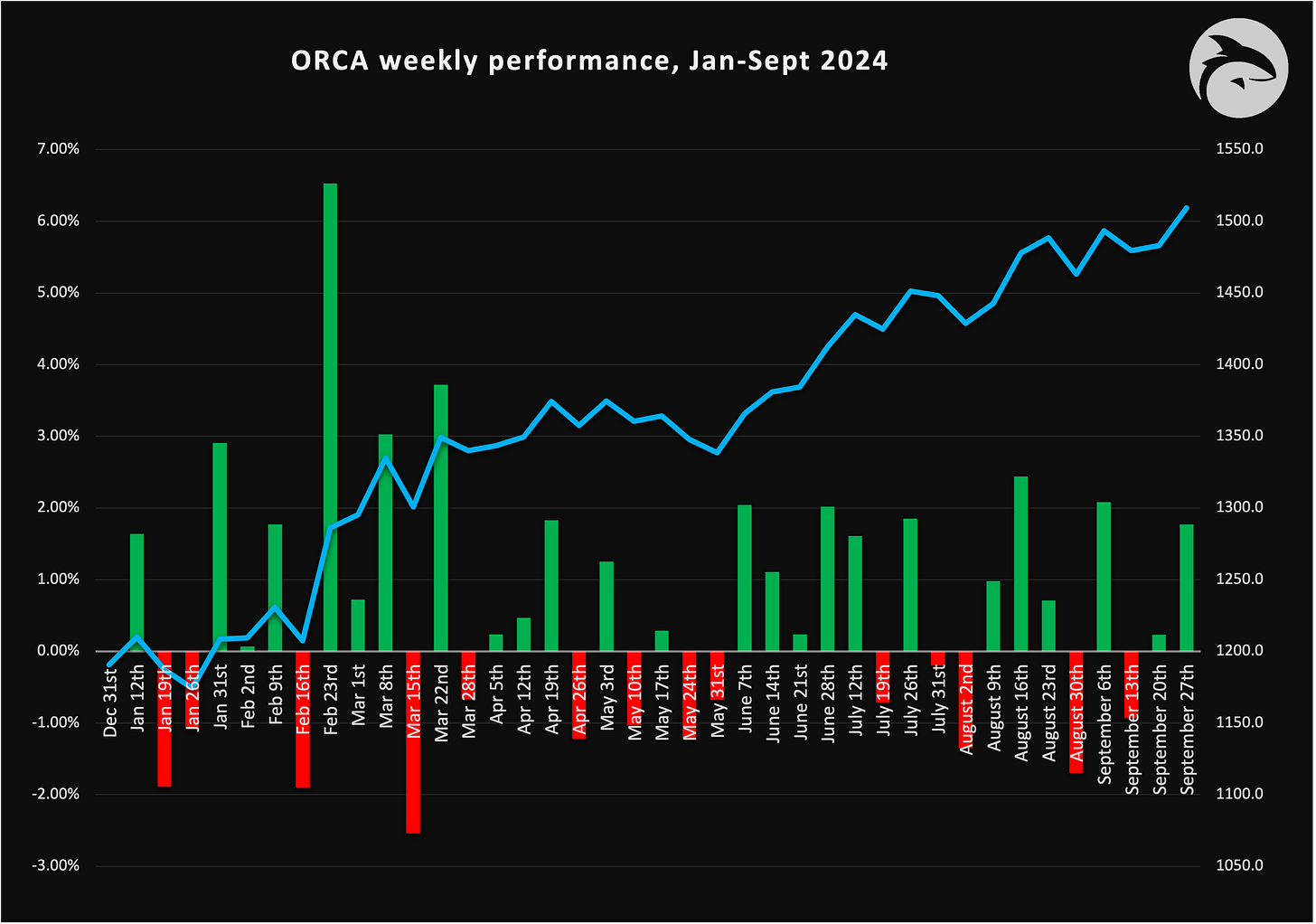

ORCA BASON Fund was up 6.88% in Q3, and 26.78% year-to-date in 2024

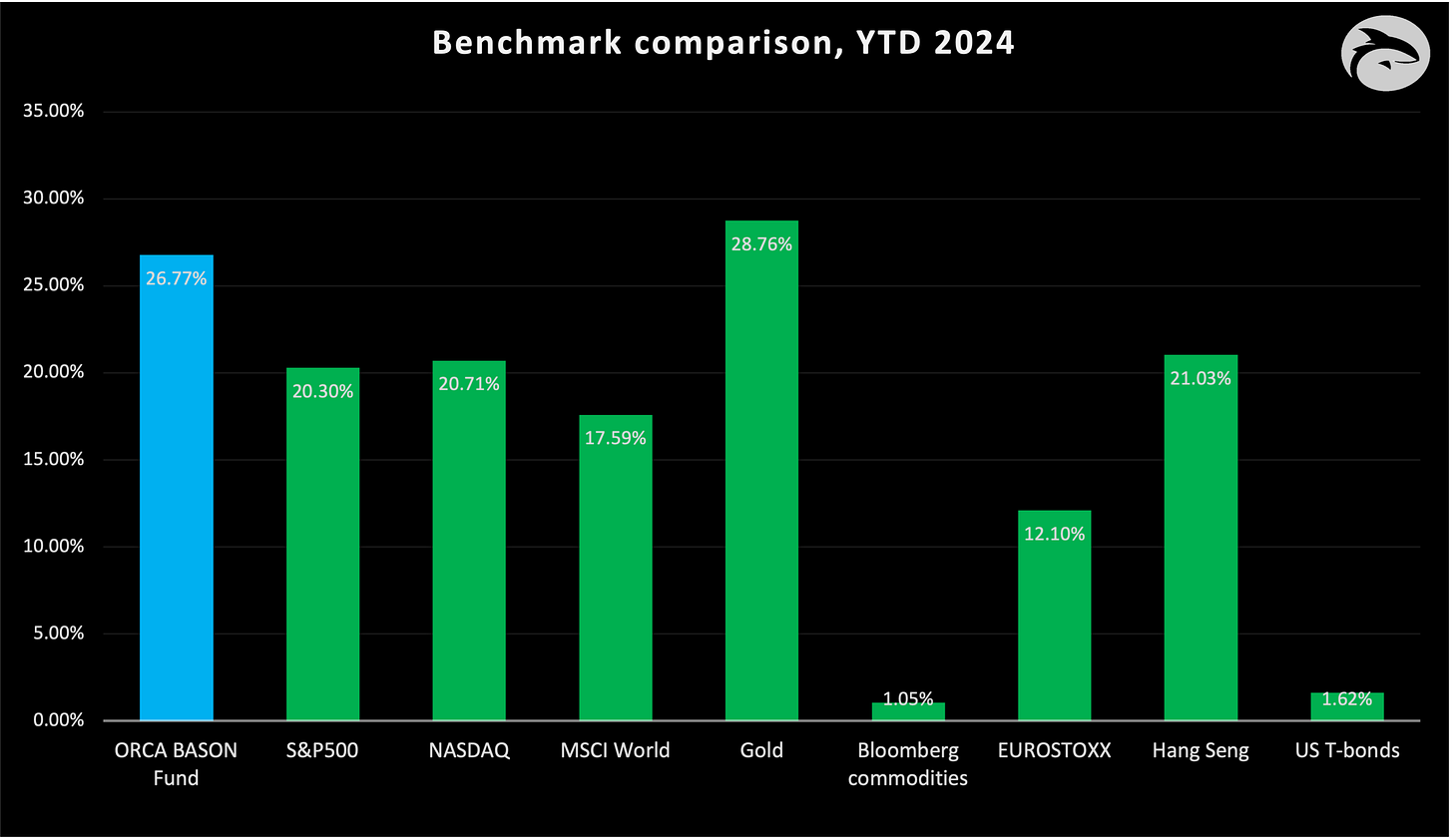

This result beats most benchmarks this quarter, all asset classes except for gold and Chinese equities (after their super rally in the last four days of the month)

On Saturday we are back with our regular weekly analysis for paid subscribers, talking about the paths forward for Q4.

The competition

And there we have it—another quarter has flown by, bringing our Q3 competition to a close. This quarter was full of energy, with sharp forecasts and even sharper competitors. Making accurate predictions is always tough, but this quarter our participants, the Q3 competition winners, really showed their skill and smart strategies.

In a thrilling close, a significant 1.67 point difference has separated the top contenders, showcasing the fierce competition and skillful play at hand. Let's give a big round of applause to everyone, and a special shoutout to User78773 for snagging the first spot with their outstanding insights, walking away with the $1,000 prize.

Everyone in the top 20 gets rewarded, so the rest of the $4000 prize money is distributed according to the rules of the competition ($600 to second place, $400 to third, and so on. Places 11 to 20 get $100 each).

NOTE: Payment details will follow shortly. For newcomers to the Leaderboard, we will be in touch via email to gather your payment information. Returning top performers can expect their rewards by week's end.

Here's our top 20 rankings for this quarter.

A mix of familiar faces and new challengers—well done everyone, kudos for your impressive performances!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

ORCA performance: Q3 2024

ORCA BASON Fund keeps grinding up!

Year-to-date, we are up 26.78%, which puts us among the top performers of 2024. The only asset class providing a serious challenge was gold (up over 28%), having one of its best performing years ever. Investors are flocking towards gold perhaps in need for a good hedge in case the recession does happen. In other words, investors are happy to stay long in the market, but shift some of their profits towards gold to stay hedged in case of a sudden turn to the worse. Geopolitical tensions and the uncertainty of the upcoming US election is only adding to these trends.

To that end, the BASON has also been a stellar performer, and can provide the same type of excellent hedge against the rest of the market.

But it’s not just about beating the market (S&P500) return. What differentiates the BASON Fund are two things: (1) low volatility, and (2) low correlation to the market.

As for this quarter, we managed to outperform all the major indices (S&P500, NASDAQ, MSCI, EUROSTOXX), as well as bonds and commodities. However, two asset classes stood head and shoulders above the rest: Gold, having one of its best years ever, and the Hang Seng index, which saw its entire rally in the last four days of September after the new Chinese stimulus package.

The best two hedges in 2024? ORCA BASON and Gold. Especially given the low volatility. The Hang Seng, even with its rally in the final days of September, only just caught up with the US indices. 2024 is shaping up to be a great year for equities.

Market overview: the week ahead

As for this week, the main focus will be the September jobs report on Friday, which could provide important signals about the labor market’s strength. Investors and the Federal Reserve will be closely watching for any signs of further weakness, which might impact future interest rate decisions.

Additionally, key economic data, including manufacturing and services PMI, construction spending, and factory orders, will offer further insights into the state of the economy. Several Federal Reserve officials, including Chair Jerome Powell, are set to speak throughout the week, and their comments could provide further clarity on the central bank’s outlook after the recent rate cut. Keep an eye on these factors as they drive market sentiment.

Thanks for reading.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.

A job very well done considering what was going on in the market in Q3 !! Congratulations to the entire team. Congratulations to all the winners of the Q3 competition! My predictions were almost 70% ahead of what was happening the very next week. I hope for an excellent result in the last Q4 of the entire Fund. Good luck everyone.