Last week we talked about the potential for a correction being higher than usual this and next week, and ended up advocating buying some protection, just in case.

Owning some protection is still the smart thing to do, even though this week’s positive news on trade deals with the EU and Japan sent markets up, along with a continuation of good earnings (well, except TSLA).

Luckily for us, the BASON signal was bullish, invalidating our own view, at least for now. This is why we always stick to the signal in our weekly positioning. The macro ideas expressed here are more medium-term anyway, taking into account temporary flows, positioning, sentiment, fiscal and monetary policy decisions, and macro news.

And this is exactly what lies ahead: a combination of all of these.

Coming into the final week of July, we get two important policy-related events: the Treasury’s new quarterly refunding announcement (QRA) on Monday and then the composition of bond issuance on Wednesday, followed by the FOMC meeting on Wednesday, the day before the month end. In addition to this, the tariff deadline day is August 1st (Friday), and we get four of the Mag7 company earnings on Wed and Thu.

The headlines next week will be on fiscal and monetary policy decisions, even though the other two events (tariff resolution and earnings) might be more important for equities in the short-term.

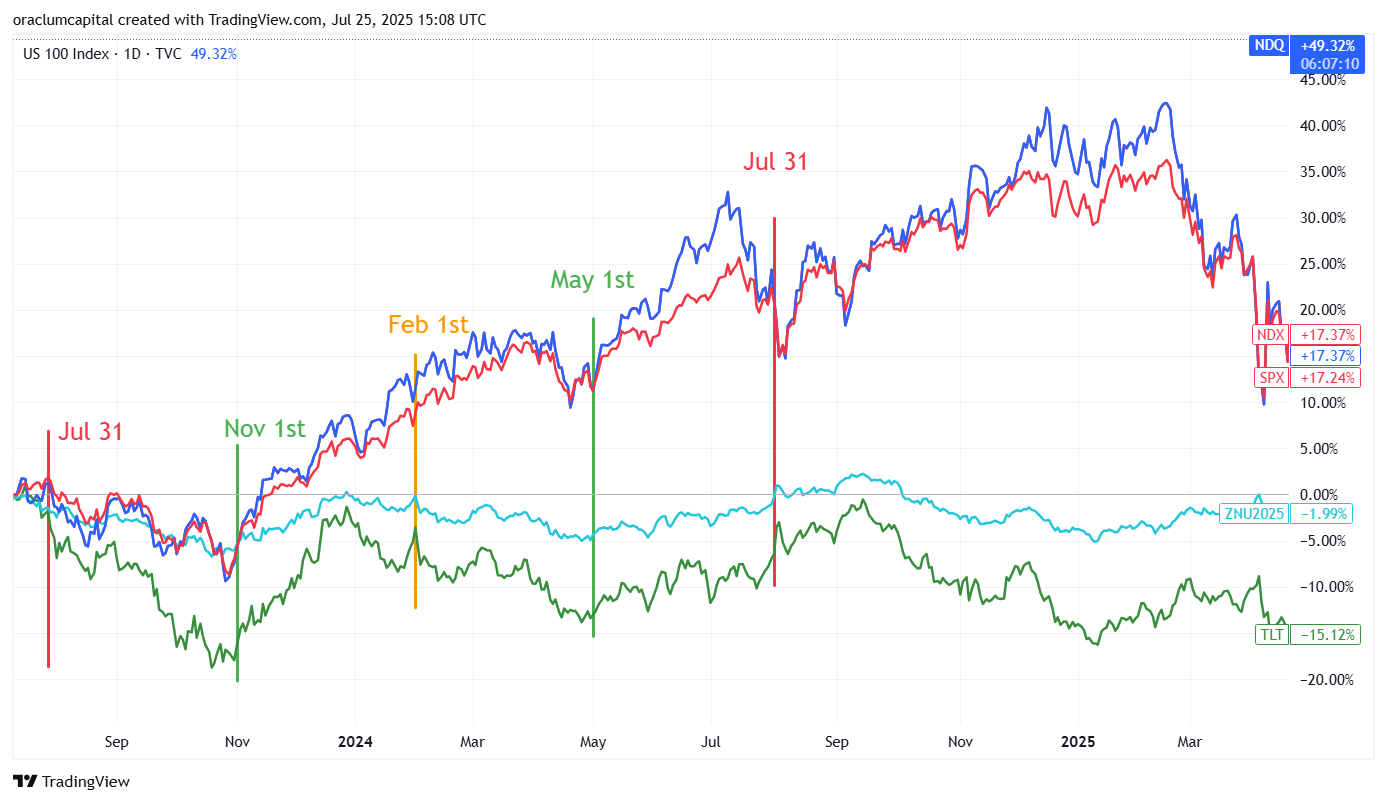

QRA and FOMC over the past two years

In the last week of July 2023, the FOMC meeting and especially the QRA decision were pivotal in setting the tone for August and September. The Fed was still hiking rates, but the crucial decision came from the Treasury as they significantly increased the supply of long-term bonds (coupons), which pushed their prices down and yields up. Both bonds and equities sold off over the next three months.

On November 1st 2023, a complete reversal - the Fed stopped hiking, and the Treasury shifted to using short-term bonds to finance the deficit, thus reversing the market impact completely. Both bonds and equities rallied 15% over the next two months.

After February 1st, bonds went down while equities went up (until April’s correction), but from May 1st onwards, the soft landing scenario started to get fully priced in, yields went down, equities shot up.

And then after July 31st 2024, the unwinding began slightly before the policy decisions, and culminated with the Yen carry trade on August 5th, which saw that abrupt panic sell-off last summer. The sell-off was short-lived, however, and markets continued their sideways-up ascent ever since, interrupted only by tariff wars from Feb to Apr 2025.

In hindsight, it all looks so simple, doesn’t it?

But on this newsletter, we paid particular attention to these market-moving events back then (recall here or here). By now, we can arguably say their impact has been reduced, especially for the QRA - it no longer moves equities the same way it did back in 2023 and 2024. The FOMC is still obviously important, but is lately more likely to trigger a reaction to the downside, given that markets are pricing in mostly neutral or positive news from the Fed.

Which brings us to today.

In July 2025, what can we expect from our policymakers?

As we all know by now, there is considerable pressure from the Trump administration to push for more stimuli, both fiscal and monetary. And on Wednesday, we most certainly won’t get any monetary stimuli.

The Fed will not cut rates in next week’s meeting. They will likely remain a bit hawkish, postponing cuts until they see more data on the impact of tariffs on inflation. Or in other words, do exactly the same as in the past few meetings: nothing.

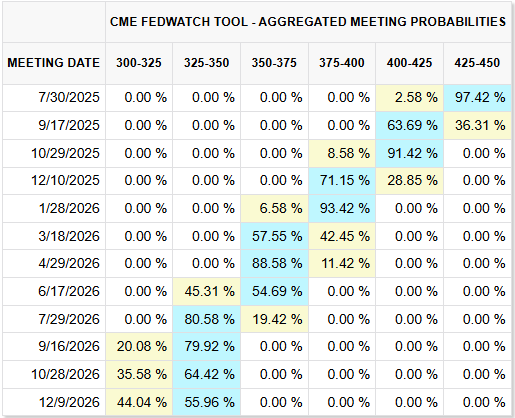

There is a higher chance they postpone for October than commit to a cut in September at next week’s meeting. Markets are gradually pricing in that outcome as well (see table below, no cut in September is now at 36%). I do expect Powell to stick to the same story as usual, and wait until Jackson Hole (end of August) to deliver some major shift in strategy (like announce that he will indeed cut twice this year). But not before that.

There’s still 2 rate cuts expected for this year, but we could also see this gradually starting to get priced out.

Echoing what I wrote two weeks ago - I don’t see the rationale of why the Fed should cut. Not when risk assets are at all-time highs, when the labor market is super resilient, when GDP growth is above 2.5%, and when there is still uncertainty over the tariff impact on inflation. What are we supposed to stimulate? An already strong economy that is bracing for a potential burst of inflation? This is not the set of conditions eligible for a cut in interest rates. Regardless of what the administration thinks.

The only reason the administration wants this is so that they can affect the long end of the yield curve, i.e. reduce the 10Y yield - which is an important policy goal that reduces borrowing costs for the government.

Which brings us to the QRA and how the Treasury might want to affect the 10Y without help from monetary policy - very similar to how Yellen used to do it during 2023 and 2024: reducing the issuance of long-term bonds (coupon bonds).

In other words, the government would primarily take on short-term debt (financed through short-duration T-bills, <1 year maturity), and pause or reduce the issuance of long-term debt, increase the buyback of coupons, thereby reducing its supply, and pushing up the price of long-term bonds - thus reducing their yields. Basically, the November 1st 2023 scenario. Very stimulative. Combined with the Fed’s dovish stance back then, we got a complete reversal and ended 2023 with a very strong positive flow into equities.

Their second alternative is to leave things unchanged - no reduction in coupons, but some increase in buybacks. This is the scenario that was already priced in, and markets have moved considerably in this direction, bracing for an even more expanded stimuli package.

However, keep in mind that things with the Treasury are not as straightforward as with the Fed. A stimulative Treasury, deciding to favor short-term over long-term debt can also signal a Treasury that has little intention to cut the budget deficit or reduce the debt burden. On one hand, yes, this is pure fiscal stimuli, but on the other bond markets will not favor further fiscal profligacy from the US government. So despite their best efforts to reduce the 10Y yield, it might not work. Remember, the bond market has not been kind to the Trump administration thus far.