Results: <0.5% error for S&P and DJI amid high volatility!

Profits? AAPL to the rescue! 6% up for the year.

Welcome back dear subscribers! The competition is officially open for week 2 Q1 2022. Last week’s leaderboard is available within the app, and as of next week we’ll be tracking your performance over time. So get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

(Don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post)

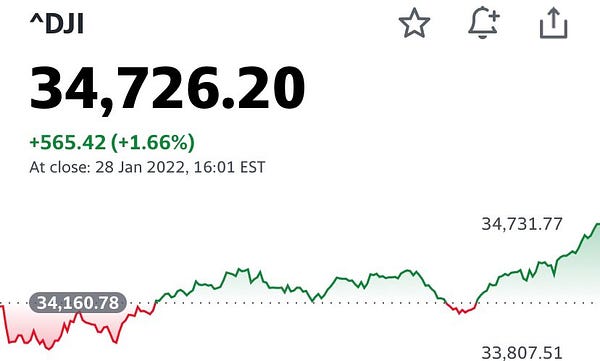

Our first week back was a week of continued January volatility (5% swings for both S&P and the DJI), but the BASON delivered another spectacular performance. The predictions were moving around our confidence intervals for most of Wednesday and Thursday, but the late Friday bounce-back brought our precision back to within 0.5% margin of error for both of the main indices:

The other predictions were also good, finishing mostly in the expected direction (the VIX and BTC in particular). The only exceptions were TSLA, which dropped down significantly on Thursday, not having enough time to bounce back to our target price (even though it did reach close to it already on Monday, closing at $936), and the 10Y T-bill, which overshot on Wednesday after Powell’s speech, and then went down again but not as far as we predicted (although still within the 2% confidence intervals).

Profits for the week? 34%!

The weekly profits this time were saved by AAPL.

We made money on the iron condor (we bought 10 SPY 28/01 contracts at 431/432 to 450/451), but the high weekly volatility killed off our 436 SPY call already on Thursday (when it reached its stop-loss, limiting the loss to $430). Had we kept on to the call we would have banged even more, but the primary goal here was to limit losses, so that was achieved. Had it been a less volatile Thursday we would have kept our position till the end.

Fortunately, AAPL came to the rescue! Its Thursday earnings set the stage for a massive Friday bounce-back, going from $159 to $170 in a single day. Our 155 AAPL call delivered a $596 profit by the end of the day (going from $8.45 per contract to $14.4 per contract).

This means that our balance for the week was:

$516 (iron condor gain) - $430 (call loss) + $596 (AAPL gain) = $682 profit.

We invested $1,829, meaning our weekly return was 34%. Taking into account the risk-adjusted total exposure (which includes the $460 potential loss on the SPY iron condor), the risk-adjusted return was 29.7%.

Lower than usual but not bad at all for such a volatile week.

Adding to our total portfolio, we are now up 113% overall, but more importantly we are up 6.8% in 2022 (remember that markets are still down >5% in 2022 thus far).

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!