Results: a hit and miss

Started great, but then reversed. CPI & FOMC meeting coming up this week.

Quick summary:

Three more weeks left in the Q4 survey. It’s up & running - click here.

It was one of those weeks, starting good, but then reversing the next day and killing our profits by the end of the week.

This week is packed. CPI came in today, at 3.1% (up 0.1), and core is at 4% (up 0.3). In line with expectations.

Then on Wed we have the FOMC meeting, their last meeting of the year, where we get an updated dot-plot of Fed members expectations for next year as well as the summary of economic projections (SEP).

Make sure not to miss our next two Saturday newsletters! Over the weekend we presented the bull case, next week we’re going to present the bear case for 2024, ending up with our own macro positioning coming into next year.

The Q4 competition is entering its tenth week. Three more weeks left in December, don’t miss them, especially if you’re still in the running for the prizes! Prizes are as last quarter, $5,000 distributed across the top 20 participants.

After ten weeks, this is the leaderboard. The margins up front are once again razor thin! It will be a tough race to the bitter end. Good luck!

NOTE: For all those new to the whole thing, here is a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Another sideways week that eventually finished higher. That pretty much sums it up. No significant action on Monday and Tuesday, and then Wednesday opened higher only to follow-through with a sharp sell-off. By Thursday, it was as if nothing happened. Markets kept on rallying. Interestingly, SPX hit 4,600 twice on Friday, and failed to make a sustained move higher afterwards. This week will be very interesting with respect to those targets, especially with FOMC coming up.

As for BASON, the prediction was for a down move. As markets opened high on Wednesday and kept falling down since, we ended the day with close to 2% gains. But by Friday, it all reversed and we ended the week negative 1.5%. It was a missed prediction, simple as that. Limiting the drawdown is the important part.

FOMC week

This week is FOMC week. The last one this year, when we get the new dot-plot and new economic projections from the Fed. The decision on the rate is pause, with 99% probability assigned to it. So that won’t be the part investors are focusing on.

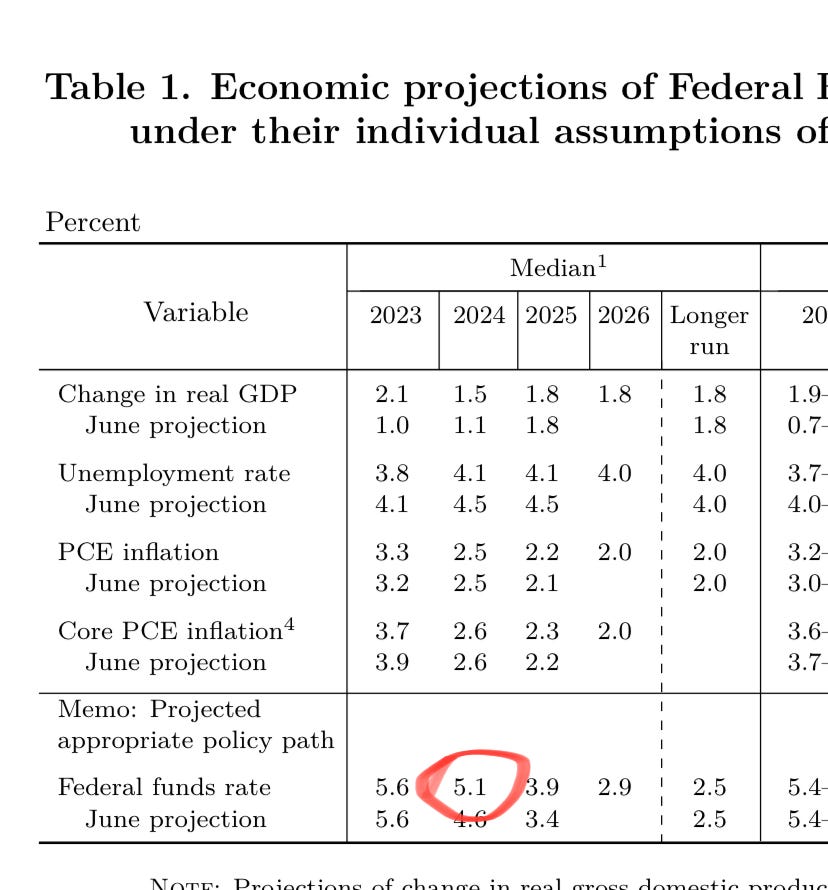

What they will look at is the projection of the Federal funds rate for 2024. Last time, in September, the projection was at 5.1% (see table below). This time, after the latest policy statements from Fed members, the ease in inflation, and the change in expecations since Nov 1st, pricing in over 100bps of cuts for next year, this is likely to go down as well. Not by >100 bps, but down to say 4.7 or 4.8%.

How will all this impact markets over the short term (specifically by the end of the week) is for you, dear readers, to tell us.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.