Results: all in red, but with minimum loss

Welcome back dear subscribers! The competition is officially open for week 4 in Q1 2022. Last week’s leaderboard is available within the app. Get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post)

For the third week in a row we had an almost identical situation. Strong growth on Wednesday, a huge sell-off on Thursday (new inflation numbers this time), and a rebound on Friday. However, this Friday the rebound was suddenly reversed after the announcement that Russia might attack Ukraine any time soon (which is by now already debunked). Markets finished the day with another sell-off, thus breaking all of our prediction boundaries.

As always we offer full transparency, and this is, sadly, the first time all of our predictions went against us, despite the errors again not being very high (less that 3% for the first four indicators, despite high volatility). But, the direction was wrong, the confidence intervals breached, so the week was clearly a loss.

Oddly enough, just a few hours earlier on Friday, at least 5 of these would have been correct.

This is why we keep emphasizing that the BASON is still in its testing phase throughout 2022, and that it does not constitute financial advice. There will be good weeks and bad weeks. Thus far there’s been an overwhelming number of good weeks and their profits more than compensate the losses from the bad weeks. It’s only a question of how to consistently limit loss exposure and benefit from any asymmetry that may arise.

Profits Losses for the week?

The good news is that our take profit strategy kicked in already on Wednesday (when the predictions were overshooting) and prevented any major losses for the week.

We finished the week with a mere $203 loss, which is more than bearable. This is a <1% loss for the portfolio in a week where markets lost 3-4%.

Specifically, our take-profit strategy enabled a minimum $189 profit on the SPY calls on Wednesday before close, and a $124 profit on AAPL calls on the same day.

Had the iron condor remained within its C.I.s we would have made a decent return amidst the sell-off, despite the missed directions. But given that it went down too much, we lost the $516 here. Given what might have happened, this is clearly a good result.

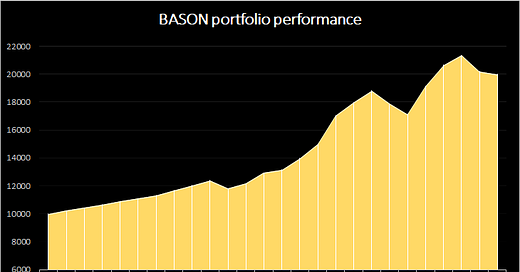

Altogether our portfolio is down 3.1% in 2022 ($655 to be exact), but still up 100% overall, and is still doing much better than the markets in general.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!