The competition is officially open for its final week (10/10) in our 2021 series, the last week before we reopen in January. This is therefore the final opportunity to make an accurate prediction on our 5 indicators and 4 stocks in order to get the $1000 prize. Just in time for Christmas :) so jump right in:

As for last week’s results, the BASON was once again stellar in its performance.

8 out of 9 of our indicators were called correctly, four of which within a single percentage point margin of error: the S&P500 (-0.25% error), DJI (-0.33%), the 10-year T-bill yield (0.07%), and oil prices (0.95%) - see the table below. BTC was the only one to go in a different direction last week.

This prediction was harder than it might appear. Following the previous two weeks where the markets were shot down by Friday, after moving up on Tuesday and Wednesday, it was easy to expect the same after Tuesday’s and Wednesday’s big gains. But the BASON predicted a strong end of week across the board, with S&P500 reaching its all time high.

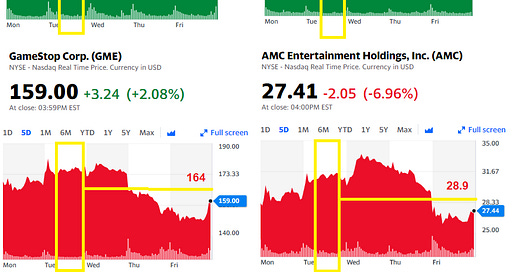

The stock predictions were equally impressive (see table below). Three stocks were correctly predicted to go down, despite their mid-week gains: TSLA, GME, and AMC, while AAPL was the only one predicted to go up to its all-time-high at 176.3. It ended up surpassing that level (finished at 179.5), pushing it close to becoming the first company with a $3 trillion valuation.

Notice when the predictions were made (the yellow interval square around Tuesday) and how the prices of the stocks behaved afterwards (the yellow line indicates the target price for the end of week):

It would have been expected for all three to follow AAPLs rise until the end of the week, especially since the two major indices were also predicted to go up. But the BASON suggested otherwise and got it right.

Profits for the week? 94%!

Now for the fun part. What was the weekly return?

This is what we did last week:

we bought 2 SPY 10/12 calls at 463 strike, which will generate anything between the usual $400 and $1000. We also bought the iron condor for SPY 03/12, at 462/463 to 472/473, selling 10 contracts for an immediate $450 gain. We get to keep the $450 if the price remains within this narrow corridor upon expiry on Friday.

Both were well in the money by the end of Friday. We confirmed the $450 from the iron condor and made an additional $717 from the calls. A total of $1,167.

Last week we also announced we were buying AAPL for the first time (given it was correct in 8/8 weeks thus far - 9/9 now!):

We bought 2 AAPL 10/12 calls at 170 strike for $1000, where we stand to earn around $500 if the price finishes close to our $176 target.

The price went even higher and we made $821, or an 82% return just on AAPL!

In total, for an investment of $1100 for the SPY calls and $1000 for AAPL calls (plus risking a $550 loss on the iron condor), we got $1988, or a 94% return! (75% risk-adjusted)

This puts us at a $6200 profit for the past 9 weeks, and $9100 in total for the past 21 weeks => a 91% return for the overall portfolio compared to 12% on the S&P500.

(Don’t worry, I’ll show all of this graphically next week)

…join the competition!

Participate in our survey competition regularly to get our predictions before others get it, and try to make some profits from it.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday morning). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!