Results: big miss, but no losses

The importance of stop-loss & take-profit orders. Still up >16% in 2022

Welcome back dear subscribers! The competition is officially open for week 9 in Q1 2022. Last week’s leaderboard is available within the app. Get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

Two more weeks left before the end of Q1 and our first quarterly winners are announced!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

Well, a huge miss last week (6.5% for S&P, 5.3% for DJI), but we managed to protect ourselves from any losses of our predictions gone wrong. In fact, we even gained 0.8% ($203 to be exact).

How come? A good stop-limit position for AAPL and the SPY iron condor, and a lucky break with the SPY put during Powell’s speech on Wednesday (when the S&P fell 2% in one hour), where we capped an immediate 71% profit. We had a take-profit order that materialized just before SPY started to rally up again. We told you about this already on Thursday, when our predictions were made public. Their large error still leaves a bad aftertaste, but at least they didn’t cost us any losses.

What happened last week?

The BASON anticipated a negative market reaction with respect to the Fed interest rate decision. However, as the Fed met expectations with only a 25bps increase and lowered the uncertainty, the market rallied and what ensued was an SPY short squeeze. How exactly? Through options activity and option dealer’s delta hedging.

A bunch of SPY out-of-the market puts that were due to expire on March 18th (the regular monthly expiration date, so a lot of volume here) lost their premiums, their deltas went to zero, so option dealers who sold these puts had to reduce their exposure by buying SPY. As this started to happen on a massive level, after Powell’s speech (and continuing the rally from Tue), more and more put holders got squeezed and were also forced to buy back SPY to cover their losses. SPY rallied 5% as a consequence, doing the exact opposite of what we had predicted.

It could have went the other way if the sell-off on Wed had been strong enough - in that case it would have been the exact reverse play, and we would have had our most profitable week ever.

But the most important thing here is the following: we expected a big win in case of a sell-off. The sell-off didn’t materialize, but our downside was very much protected.

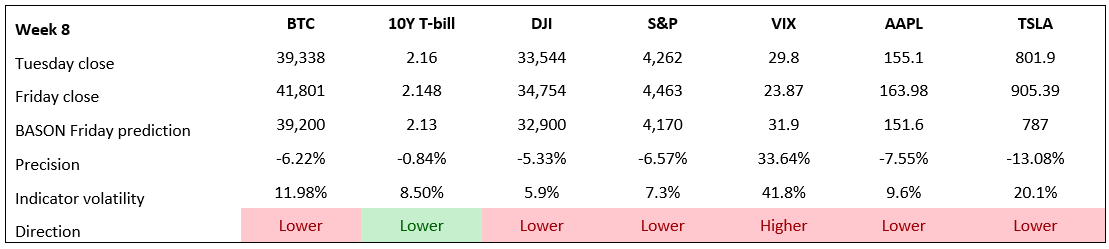

In terms of accuracy, you can see that it was a huge miss on all directions except for the 10year T-bill. But also notice the immense volatility in S&P or DJI - 7% and 6%. The VIX had a 42% swing, AAPL 9%, TSLA 20%. These are typically the kind of numbers that make our predictions obsolete.

Which is why the most important thing in this game is to stay alive. Limit losses, take profits when available. Set this up automatically to avoid any possibility of an emotional reaction.

P&L for the week!

As mentioned, we prevented all losses and actually made $203 last week.

This was the prediction from last Wednesday (public on Thursday):

…we sold 414/415 to 429/430 SPY 18/03 iron condor (10 contracts) for $790 immediate gain … Falling outside the condor, the loss is limited to only $200…

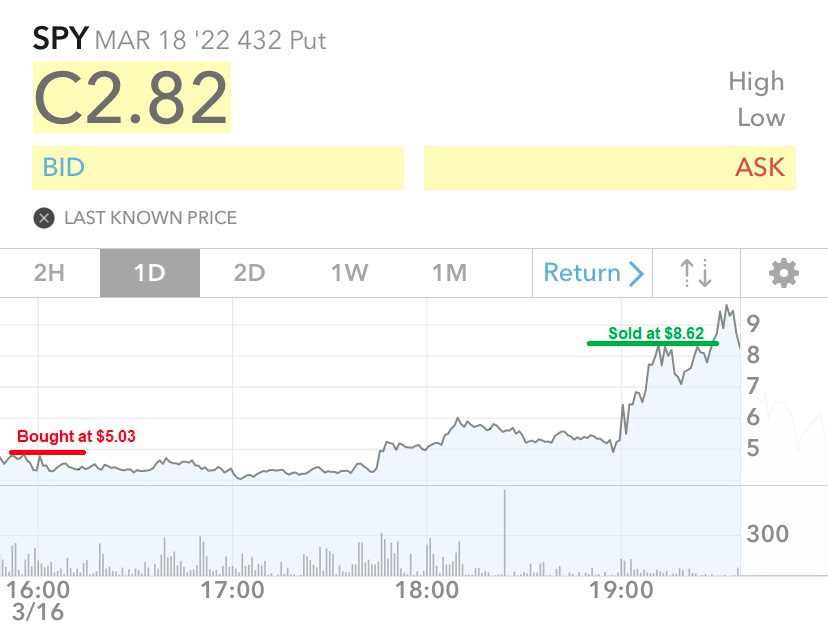

We also bought 2 432 SPY 18/03 puts for $5.03 each ($1,006 total). Interestingly, these puts already triggered a take-profit yesterday! They sold at $8.62 (70% profit) during that downward rally when Powell started speaking…

Also, we sold the 144/145 to 157.5/160 AAPL 18/03 iron condor (10 contracts) for $1100 immediate gain.

A loss of $200 for the SPY iron condor, $315 for AAPL iron condor, and a (lucky) gain of $718 on the SPY put (lucky because the big sell-off happened soon after we bought it, and our trigger happened soon before it started going down again).

In total, our portfolio is now up 16.8% in 2022.

Overall, since we started the survey, we are up 142%.

$10,000 invested in the BASON since May last year would have given you $24,249 by now, whereas the same $10,000 invested in S&P500 would have given you a slightly improved $10,645 (these additional $600 came as a result of last week’s rally).

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!