Welcome back dear subscribers! The competition is officially open for week 4 in Q2 2022. The updated leaderboard is available within the app. Get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

Another new feature is the weekly performance tracking under your profile section. This will allow you to track your prediction prowess over time. Check it out:

Thanks for participating, and keep having fun!

Last week’s accuracy & precision

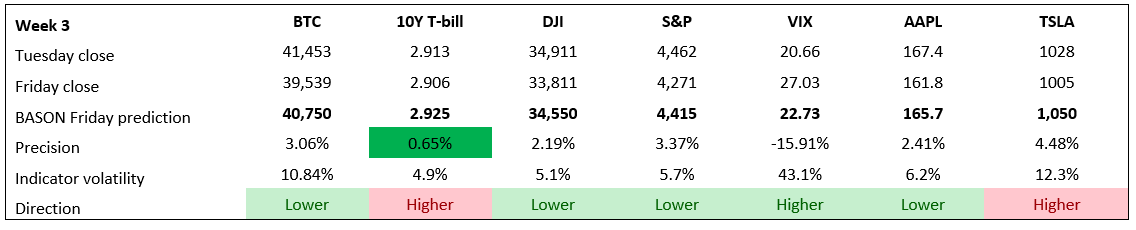

Week 3 was yet another profitable week - 29th out of 35 thus far - despite the markets going through a big sell-off on Thursday and Friday which brought down the S&P by 5.5% in less than 36 hours!

The BASON called the right direction for the S&P, DJI, VIX, AAPL and for BTC, and it was very close for the 10-year T-Bill although it finished slightly below the Tuesday close. The TSLA prediction was also working post-earnings (with most users being bullish on TSLA prior to its earnings release on Thursday), but the general market sentiment dragged it down on Friday as well.

It was a typical case of high precision (right direction), but low accuracy (higher error). The magnitude of the sell-off was surprising, but this is exactly why we keep directional hedges - like the SPY and DJI puts we held last week - to keep us profitable if the indices break the prediction confidence intervals.

Profits

These were our options strategies for last week:

This time our predictions gave us ample space to place a directional bet. We traded the usual ten 436/437 to 449/450 iron condors for SPY 22/04, for $480 immediate gain.

We also bought two SPY 22/04 450 puts for $920.

The second pair of trades was the 10 iron condors for DIA, 340/341 to 354/355, for

$310 immediate gain, in addition to one DIA 22/04 355 put for $418.

The puts for both SPY and DIA didn’t even last until Friday’s big sell-off. They returned a good profit already on Thursday. If we removed the take-profit orders, they could have given us a 200% return last week.

Regardless, they made a hefty $1,002 profit ($720 for SPY, and $282 for DJI), plus the take profit from the DJI iron condor on Friday for $209, and a loss of $222 from the SPY iron condor that also broke its lower C.I. on Friday.

In total, +$989 for the week.

It’s all about compounding those weekly gains, after all. And they are compounding into quite a return:

28.68% in 2022.

171.4% compounded gains since the start of the survey in May 2021.

That’s $27,136 for an initial $10,000 portfolio.

At the same time, S&P500 is down 11% in 2022, and up only 2% since May last year.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!