Quick summary:

New survey is up & running - click here.

Last week’s performance: missed direction, small errors, small profits

We lost money on the calls, but gained on the condors

We are still up 55% in 2022, while the S&P is down 14%

Welcome back dear subscribers! The competition is officially open for week 10 in Q2 2022. The updated leaderboard is available within the app. Get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Thanks for participating, and keep having fun!

Last week’s accuracy & precision

To sum it up in one meme:

It started with a sell-off on Wednesday and our calls dropping over 50% in value. This was followed by a decent rebound on Thursday, sending us very close to our targets for all 7 indicators. By the end of the day, the calls regained almost all of their lost value from Wednesday, and the condors were well in the money. This is typically when we introduce stop-losses on all positions. And good thing that we did, since by Friday’s open, the calls reached their limits and were sold at a loss. An hour before close, we closed the condor positions to pocket a small profit and offset the losses from the calls.

Notice an interesting paradox here. Two weeks ago, we predicted a correct upward direction for all indicators, but bought puts for protection instead of calls, and were surprised on the upside (and lost money despite having 7/7). We opted for such a strategy because we are in a bear market, so the obvious protection is on the downside. Last week, we did the opposite, and were caught back surprised on the downside. It’s still our mistake, no doubt, but it’s more a reflection on our trading rather than BASON’s performance.

Altogether, the missed direction costs us this week, but the errors were still decent on most indicators, particularly for the Dow. Oddly enough, TSLA was almost exactly at our price target on Thursday’s close, but Musk’s comments on Friday about firing 10% of the workforce sent it downhill. Oh well, one must embrace such uncertainty :)

Performance

As explained above, we took a directional hedge on the upside and were caught surprised in the other direction.

…10 SPY 03/06 iron condors, ranging from 411/412 to 426/427 for $460 immediate gain.

In addition, we bought one SPY 411 03/06 call for $6.77 per contract.

Similar play for DIA 03/06, where we traded the following iron condor: 326/327 to 335/336 (10 contracts) for $330 immediate gain, and one DIA 03/06 call at 326 bought for $7.25.

SPY call was sold on Friday open at $4.32 (loss of $245), and the DIA call was sold at $5.77 (loss of $148). The condors did better, even thought SPY was dancing dangerously close to the bottom confidence interval before we sold it.

DIA was closed at a profit of $314, while SPY was closed at a profit of $115.

Altogether, just enough to barely make a profit (after brokerage fees) of $36 for the week. Small, but we’ll take it!

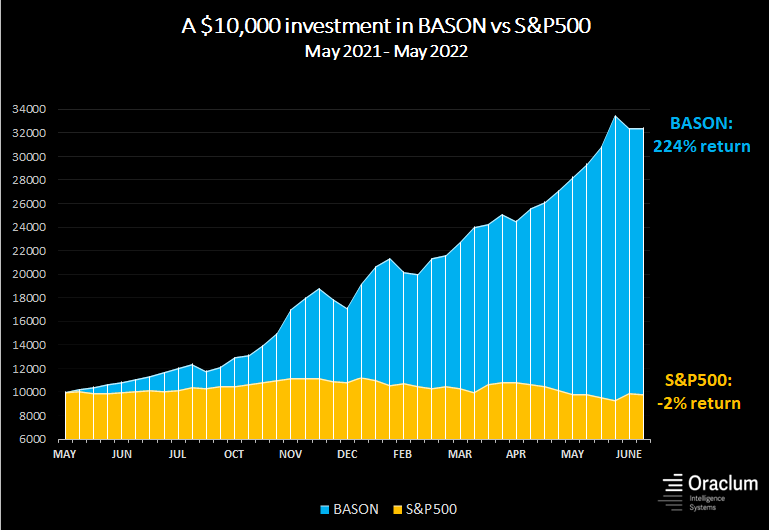

Overall, this didn’t really affect our performance much, we’re still 224% up overall, and 55% up in 2022, with S&P500 being down 14% in 2022, and 2% since we started this competition.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!