Quick summary:

Four more weeks left in the Q4 survey. It’s up & running - click here.

Last week was jumpy, but we managed to take some profits (1.2%) as our down prediction for the week came at the right time on Wednesday.

However, the week ended on a high, tapping into an important supply zone for both SPX and NDX. A sell-off ensued on Monday.

November ended up another great month for BASON, benefiting primarily from that first week, when we made 5.7% post-QRA and post-FOMC.

Make sure not to miss our next three Saturday newsletters! We will present a bull and a bear case for 2024, as well as our own macro positioning coming into next year.

The Q4 competition is entering its tenth week. Four more weeks left in December, don’t miss them, especially if you’re still in the running for the prizes! Prizes are as last quarter, $5,000 distributed across the top 20 participants.

After nine weeks, this is the leaderboard:

NOTE: For all those new to the whole thing, here is a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

First a bit about last week’s market action. It was jumpy again, but ended up with a strong up move. BASON came in on Wednesday and the prediction was that markets would go down for the week. As we entered our positions on Wed, by mid-day Thursday we made a decent return, taking profits gradually.

However, markets erupted since and finished Friday on a high, tapping into a massive supply area (NDX went over 16,000, SPX was knocking on 4,600). So the BASON ended up wrong, but we were lucky enough to grab some profits as the initial moves were negative. Overall about 1.2% up for the week. It wasn’t big, but it enabled us to make up all the small losses over the past three sideways weeks, adding to a great opening week in November.

November performance

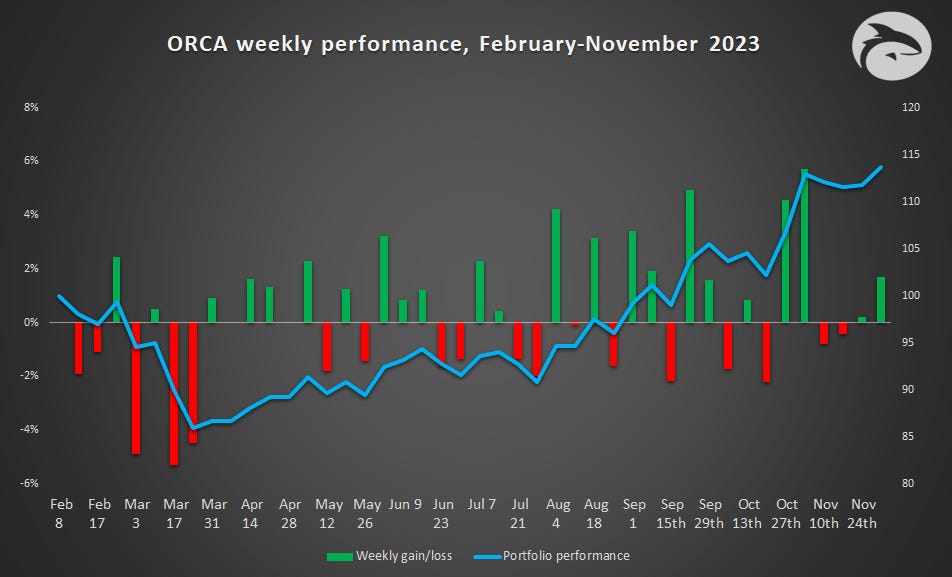

As for November, we did a fine job. It started brilliant. The first week was our most impressive week year-to-date, delivering 5.7% and driving the bulk of our monthly return. After that we basically remained flat for the next three weeks (a negative 1% altogether) as the markets didn’t move much during our Wed-Fri period. In the final week we made slight gains on Wednesday and Thursday, adding another 1.7% to our monthly performance (eventually corrected down to 1.2%).

Over the past four months we achieved two months with over 5% growth (September and November), one month with over 9% growth, and one month with 1% growth (October). Our last monthly loss (of around 1.6%) was back in July. With the stellar performance over these last four months, we are now up over 30% since our March lows, outperforming each asset class during that period. It is a testament to the strength of the BASON and our trading strategy, now fine-tuned to optimize the weekly returns.

If you’re an accredited investor, we invite you to express interest on this link, obviously non-binding and only informative, so that we can get in touch:

NOTE: We are allowed to “generally solicit and advertise” the existence of the fund under Rule 506(c) of Regulation D of the Securities Act of 1933 in the United States, but we are only allowed to respond to accredited investors. If you are not an accredited investor, please refrain from contacting us over this matter.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.