Welcome back dear subscribers! The competition is officially open for week 6 in Q2 2022. The updated leaderboard is available within the app. Get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Thanks for participating, and keep having fun!

Last week’s accuracy & precision

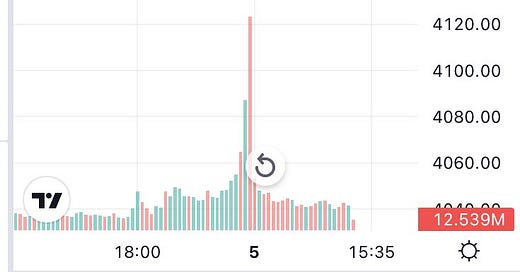

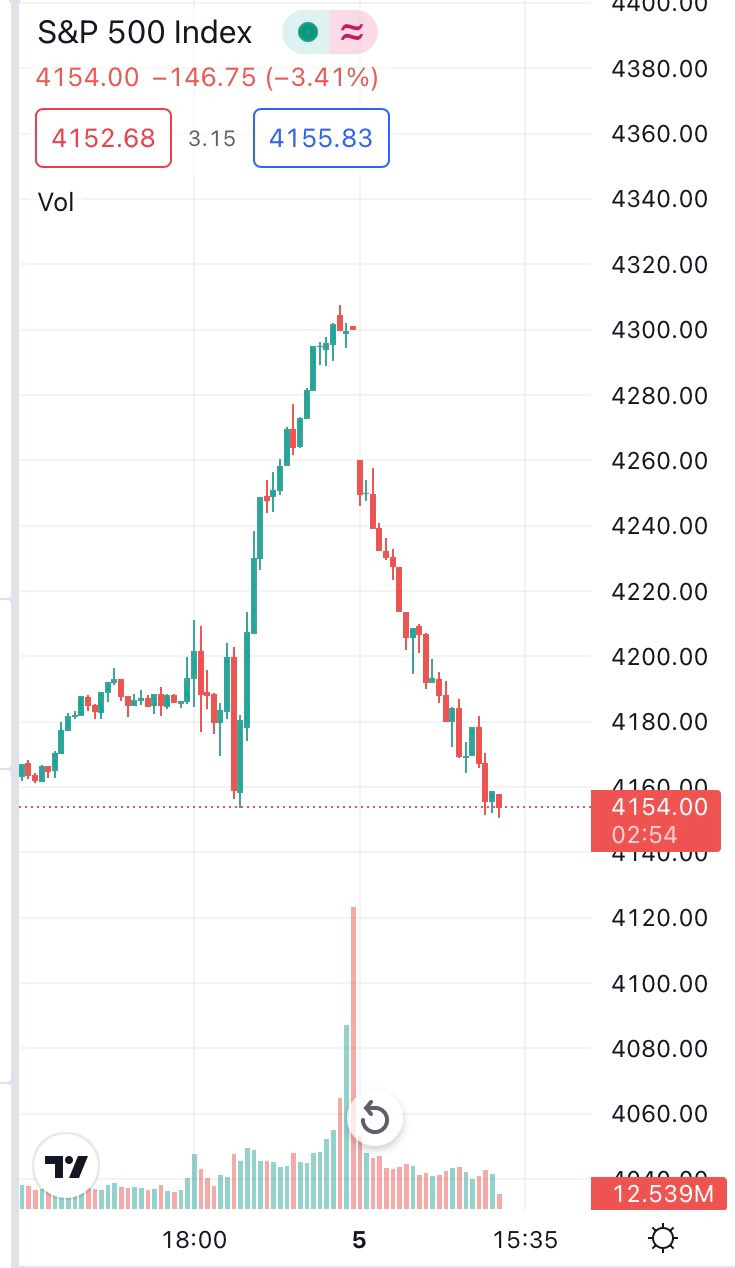

FOMC meeting on Wednesday. The Fed announces it’s raising rates by 50bps for the first time in 20 years.

The markets’ reaction? Huge rally, S&P breaches 4300 in the space of 2 hours (up by 3% that day).

Explanation for this counter-intuitive move? It was “priced in”! This move reduces uncertainty just as it did in March, after which the markets rallied, plus Powell said no more double hikes like this one.

Well, it didn’t last very long. The very next day, all the gains from the rally were wiped out (down 3.5% that day). So much for reducing uncertainty and the hikes being “priced in” :)

During this crazy 6 point swing, our S&P prediction went from breaching its upper confidence interval to breaching its lower confidence interval in the space of only a day and a half.

It finished within the intervals, eventually, by Friday’s close, but with a missed direction - lower instead of higher. Same for the Dow, although both with decent accuracy.

This makes it a very similar week to the one before - direction was a miss, no doubt, but the predictions remained firmly within their boundaries.

And most importantly, we had hedges in place that saved us once again.

Profits: hedges and condors both delivered

Quick Tip (again): during very volatile weeks, don’t let the condors expire, feel free to close them earlier (when you can) to take profits. This is what we’ve done the past two weeks.

For all those users copying our strategies, make sure to follow us on Twitter, where we tell you exactly when we sell our positions, so that you can react quickly as well.

This was the crucial tweet from last Friday:

To remind you of last week’s predictions:

We traded 10 SPY 06/05 iron condors, ranging from 411/412 to 429/430 (10 contracts) for $500 immediate gain. We only bought downside protection this time, one SPY 430 06/05 put for $12.70.

In addition we also traded 10 iron condors for DIA, 325/326 to 336/337, for $250 immediate gain, and also bought a put for protection (1 DIA 06/05 338p) for $7.70.

So the SPY put was bought for $12.7 and sold for $18, while DIA was bought for $7.7 and sold for $11. The hedges made us a total $860 profit. The condors made us $271, so altogether the week finished with a profit of $1,131.

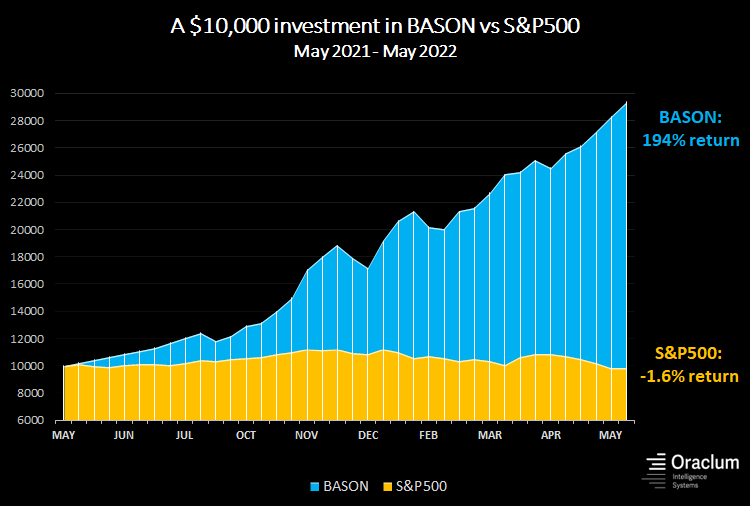

Compounded gains?

39.8% in 2022.

194% compounded gains since the start of the survey in May 2021.

That’s $29,396 for an initial $10,000 portfolio.

The S&P500 is still delivering a negative return throughout the observed period, of -1.6% since May 2021. And it is down -14% in 2022. The chasm keeps getting wider.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!