Welcome back dear subscribers! The competition is officially open for week 2 in Q2 2022. The new leaderboard is available within the app. Get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

Also, keep in mind, this week the last day is Thursday, the 14th, as the next day is Good Friday so the markets are closed. Therefore, the predictions will be given to you tomorrow (and on Thursday morning publicly for those the non-participants).

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

Before we get into last week’s stellar performance, a few words from our Q1 winner, Jack Welch:

Congrats once again Jack for an awesome performance! There’s some real competition going on in the game now :)

Results

We got of to a flying start in Q2, where each of our 5 indicators and 2 stocks were called in the right direction, with the two indices once again within 1% margin of error.

It took a few bounces to get there though. Markets fell sharply on Wednesday when we sent our first predictions, and we made a point then that we’re expecting a bounce-back by Friday closer to our targets. They indeed bounced back, slightly overshooting for the Dow, and slightly undershooting for the S&P500. The same was true for the VIX, while the 10Y yield just kept on rising, 6% above our target. AAPL and TSLA finished lower, as expected, but lower by a wider margin than we predicted. Luckily for us, AAPL finished just within its C.I.s for us to make a profit.

Profits

Here’s what we bought last week:

This week, we traded 10 SPY 08/04 iron condors, 444/445 to 456/457, for $450 immediate gain. We also traded 10 DIA 08/04 iron condors, 341/342 to 347/348, for $350 immediate gain.

Finally, we traded 10 AAPL 08/04 iron condors, 167.5/170 to 177.5/180, for $580 immediate gain. Stop-losses are set at 30%.

The SPY iron condor ended well within its C.I.s, so we pocketed a $432 profit here. The DIA iron condor was dancing very close to its lower C.I. (342) on Thursday, so once it shot back on Friday we decided to activate the take-profit and took $171 on these contracts. AAPL had a similar issue so we also sold it earlier and took $487 profits. In total, this amounts to $1,090 profits in the first week of Q2. Not bad at all.

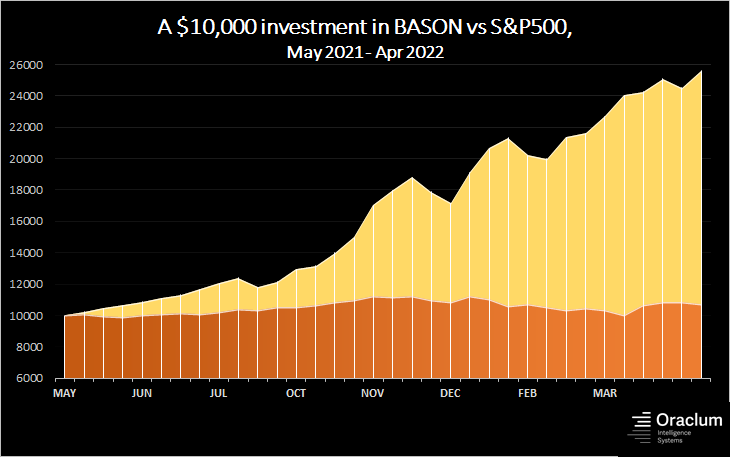

This means our portfolio is now up 23.2% in 2022.

Overall, since we started the survey, we are up 156%.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!