Quick summary:

New survey (on our new app) is up & running - click here.

Last week inflation numbers came in hotter than expected (both CPI and PPI). Also, the ECB raised rates to an all-time-high on Thursday. But the reaction on equity markets was a short squeeze. Gap up and continue up.

The reversal came on Friday, a full day sell-off sending markets right to our predicted values.

Unfortunately, the price action from Thu killed our positions before we could profit from them.

FOMC is this week, on Wednesday. This will be the event driving markets for the rest of the month. On Thursday, paid subscribers will get a detailed analysis of the FOMC decision and our updated macro positioning:

The survey is live on our new app, jump right in:

A couple of changes up top, but the race is still very, very close. Keep up the good job everyone! Two weeks left before Q3 is done. Just enough time to pick up your prizes.

NOTE: For all those new to the whole thing, here is a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

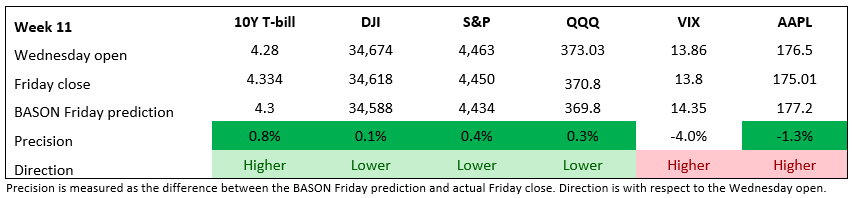

Last week’s performance

It was one of those weeks. Counterintuitive price action; in hindsight, explainable, but on the day, just weird.

What happened? First CPI came in hotter than expected on Wednesday (read our immediate take away on this), and markets traded sideways on the day. Ok, fine. But then on Thursday after PPI came in hotter than expected as well, and after ECB pushed reference interest rates to all-time-highs (4% - 4.5% - 4.75%), a sell-off was highly anticipated. And yet, markets opened gap up, and kept pushing up for the rest of the day.

Classic short squeeze. Short positions mostly got opened the day before, following a bad CPI print, meaning that fewer sellers were left in the market on Thursday. If you keep holding shorts, and not adding to them, the buyers will prevail and markets go up. This will soon pull in some holders of shorts to close them, thus sending markets further up. It wasn’t a big squeeze, but it was most certainly a squeeze.

And then on Friday, a massive sell-off, sending markets back below their Wed lows, and right about where we predicted they would end up this week.

It was too late unfortunately. We have to maintain our risk exposure to protect all downside to the portfolio. So as our max weekly drawdown was breached, we also had to close the shorts on Thursday, to prevent further damage. Caught up in the short squeeze, and only had the macro positions to benefit from the sell-off on Friday, to make up at least something on the way back. Total loss was 2%.

Notice the VIX prediction in particular. A proper sell-off would have sent it up by some margin - as it did on Friday when it finished up over 7%. But on Thursday it got compressed and hence it was difficult for it to climb back to our predicted level.

This week is FOMC week. The Fed most likely will pause for now. But the key is what they will signal for the future. The ECB said last week that this hike is their last one, hopefully sufficient enough to curb inflation. With the Fed, the odds are there is still some left in the tank. Even more importantly it’s about how the cuts are gonna be priced in for 2024. As usual, the monetary policy decisions affect the macro positioning of our portfolio, and we will provide an update on Thursday to our paid subscribers.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.