Quick summary:

The Q2 competition is up & running - click here.

Last week was the first significantly negative week for markets since the first week of January. Most of that drop happened in the final hours of Thursday. Why? No one knows for sure, as many narratives were given.

But the weekly price action was very turbulent; from drops on Tue, rally on Wed and Thu, a huge drop on Thu before close, and a bounce back on Fri. In weeks like that we typically lose money, but last week we came out flat at +0.2%.

This week, we’ll see if the negative price action continues, or we got another good buy the dip opportunity. A lot will hinge on CPI (Wed), and PPI (Thu). There’s also the FOMC minutes coming out on Wed afternoon, but these aren’t likely to be a big trigger. Inflation data will be key.

In Saturday’s paid post we will talk about earnings expectations and how this might shake up markets for the rest of April and May.

The competition

NOTE: Payments to winners from Q1 will go out this week.

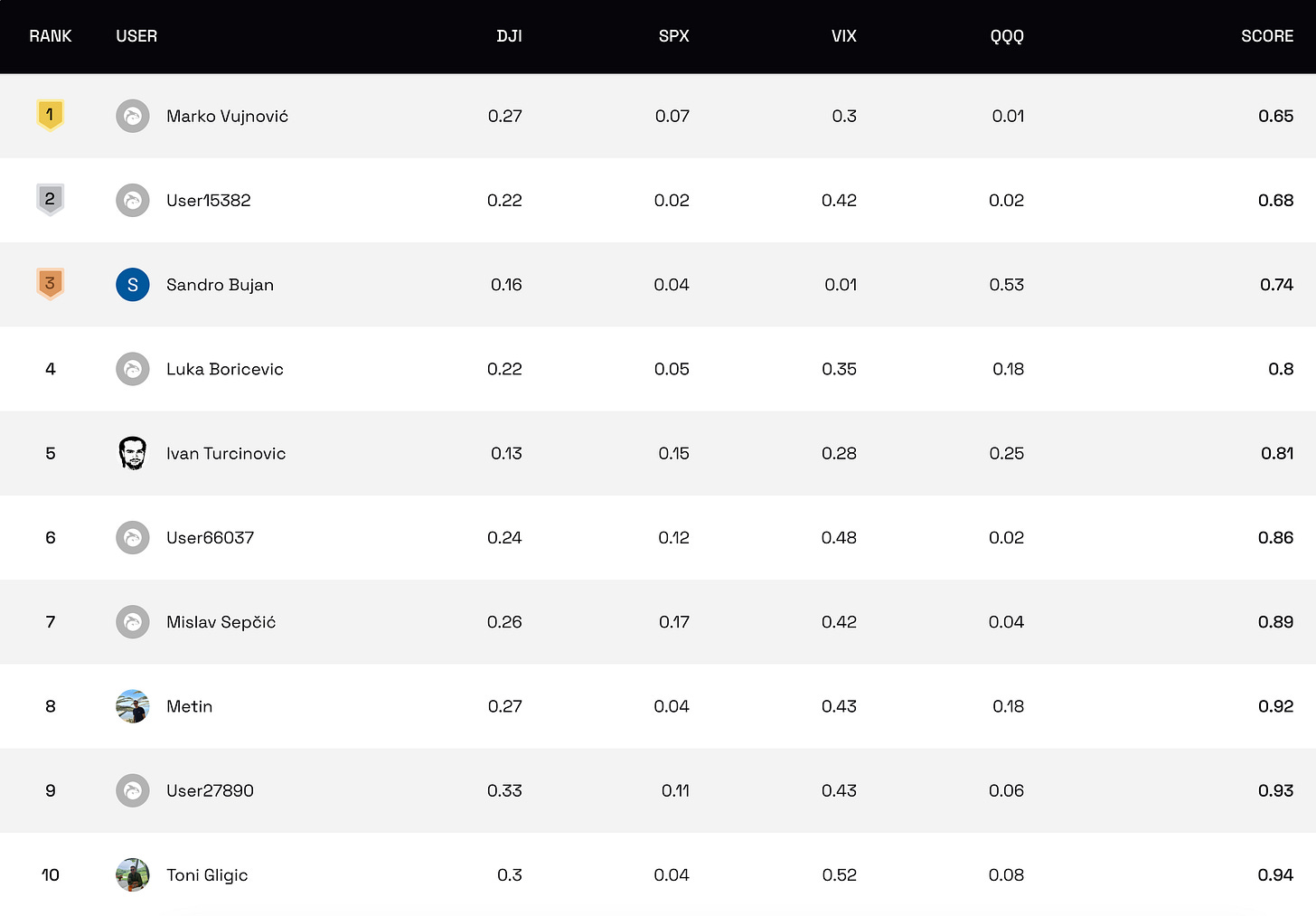

The new competition has started, and already we have seen some great performances last week. A lot of you started strong right out of the gate. Keep it going! For everyone else, still a good time to join in:

Keep in mind, consistency is key to staying in the top. And good predictions, obviously.

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Last week's headlines were dominated by a surprisingly strong jobs report released on Friday, April 5, 2024. The U.S. economy added an impressive 303,000 jobs in March, far outpacing the expected 200,000. This boost was most noticeable in healthcare, government, and construction sectors, signaling robust sectoral growth. The result was a slight decrease in the unemployment rate, moving from 3.9% to 3.8%.

The market reaction to the jobs report was a rally on Friday, even though the expectation was that we get a further leg of the sell-off from the day before. But obviously, the reaction was more likely to do with the Thursday price action rather than the news on Friday. So what did happen on Thursday to warrant a 2% sell-off in the middle of the day?

Hard to tell. There were several narratives being thrown out: the jobs report leaked and markets quickly priced in lower cuts in 2024 (wrote about that overt the weekend), there was a Fed speaker who basically said confirmed this on the day - that the Fed maybe doesn’t even cut (even though we heard Powell saying something else the week before, and two weeks prior at the presser), and there was also a narrative on geopolitical tensions between Iran and Israel (which pushed gold and oil up just as equities sold off).

Whatever it was, it broke the bullish trendline, setting up a higher probability for a correction. Doesn’t mean it will happen, but probabilities have shifted. It’s still a bull market out there, don’t forget.

We could very well get another buy the dip reaction this week, particularly if inflation numbers (both CPI and PPI) come in lower than expected.

These are the main events this week. CPI comes in on Wednesday, and the market already expects a pick up in annual inflation, to 3.5% (and 0.4% month-to-month). Anything coming in hotter will likely cause a negative reaction, as this is already high. Similar for PPI on Thursday. Then again, last time we got bad CPI and PPI, the markets shrugged it off easily.

Tell us what you think!

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.