Quick summary:

New survey is up & running - click here.

Last week’s performance was similar to the week before: a miss in direction, but very high precision on almost every indicator compensated for the directional miss

Also, the VIX directional play and the macro hedges did well

This week we have the Fed minutes on Wed, and the PCE inflation index on Fri

The 2023 Q1 competition is now open for its fourth week. Thank you all for joining us, and I hope you find the competition challenging and interesting. As you know, the competition has changed a bit (read about all the new features here) to give you all a greater chance of getting rewarded, both quarterly and at the end of each year by participating in our annual profits.

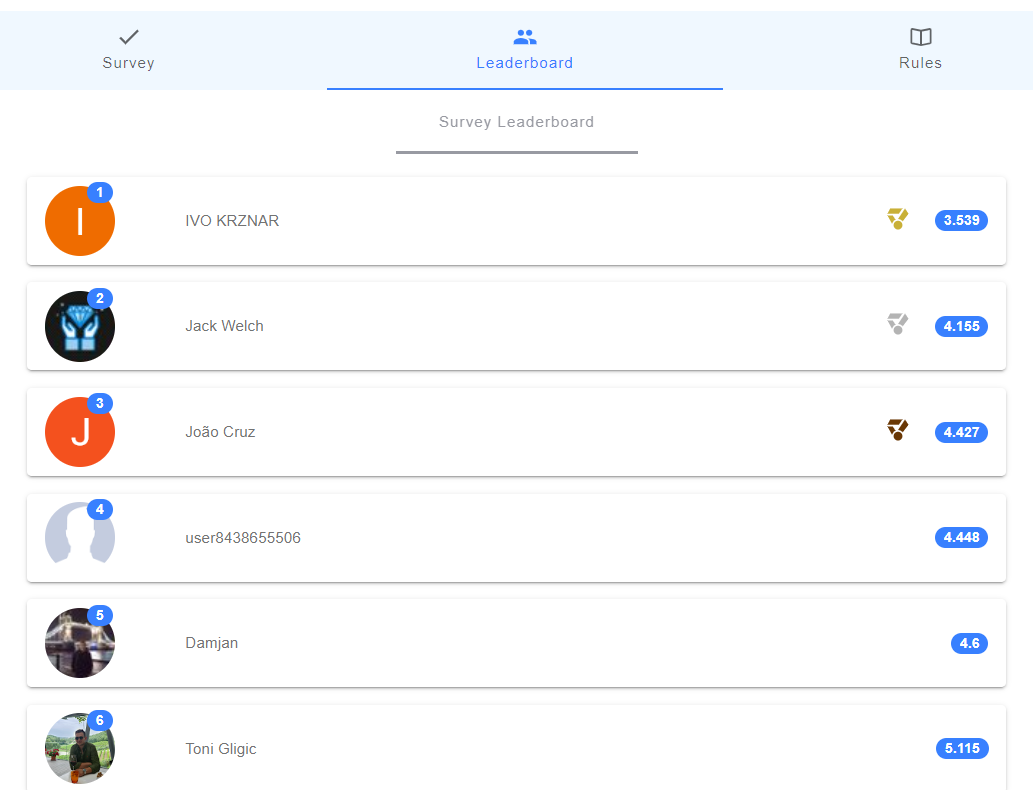

Things are shaping up on our leaderboard, some familiar names are back on top :)

Keep it up everyone and best of luck!

The survey is here:

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance

It was a week very similar to the one before. Good start on Wednesday, getting us very close to our target levels before the close (see table below), a gap down on Thursday, followed by a nice intraday rebound in our direction (again getting us close to our targets), only to finish with a hard sell-off in the final hour before close, which carried on till Friday open. The 4050 was the key SPX target last week as the options expiry on Friday was testing this lower boundary (watch this to see what I mean by that). It didn’t manage to pierce through, even though it touched it on several occasions during the day. In the final hours, the price went back up within our 2% confidence interval.

For us this meant another week where we missed direction, but had really good precision on almost every one of our indicators.

5 out of 6 came within the 2% confidence intervals we typically assign. Most importantly, the VIX prediction was both correct in direction and precision, allowing a decent return on this particular position.

The VIX prediction was a good signal coming into a major options expiry week, so it made sense to expect higher volatility towards Friday, which is what happened. In hindsight, this higher volatility was primarily a result of the sell-offs, so we couldn’t have been right both ways. No big gains, but no losses either.

This week we start with the release of Fed minutes from the last meeting on Wednesday afternoon, and then on Friday the Personal Consumption Expenditures (PCE) price index is released. This is the most closely watched indicator by the Fed, so do expect more volatility towards the end of the week.

…join the competition!

Participate in our survey competition regularly to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter!